Investors are Growing Cautious of the AI Hardware Market

“The next Nvidia isn’t going to come from the semiconductor side.”

Sign up to get cutting-edge insights and deep dives into innovation and technology trends impacting CIOs and IT leaders.

The AI market has largely been on the rise for the past few years, but investors may be getting more cautious about where the chips fall — literally.

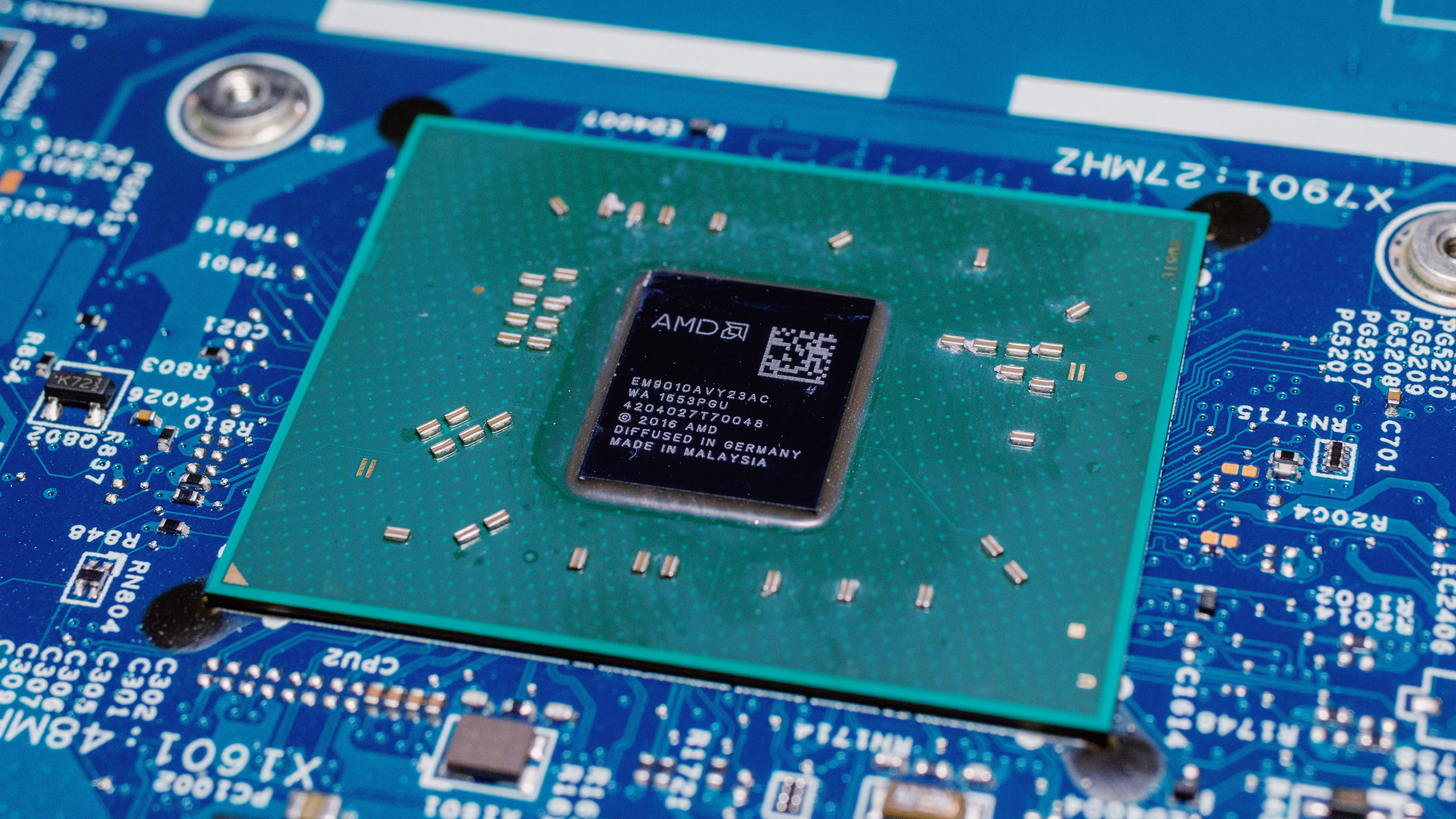

Chipmakers AMD and Arm saw their shares slide last week on disappointing earnings outlooks. Though AMD reported growth will be in the “strong” double digits, it wasn’t enough to impress investors. Arm, meanwhile, predicts that revenue will be $1.18 billion to $1.28 billion in the next quarter, coming in below Wall Street estimates.

Though AMD has struggled to shine with Nvidia’s performance soaking up the AI chip spotlight, Arm’s outlook could serve as a better “bellwether” for the industry at large, said Romeo Alvarez, director and research analyst at William O’Neil. The U.S.-China trade war and export ban could also “put a ceiling” on expectations, he said.

“Companies are definitely being more cautious,” said Alvarez. “Nvidia may even get caught in the crossfire … it’s reasonable to tone down your expectations.”

But broadly, these forecasts may signal a shift in the market similar to what took place in the early days of the internet: Investor interest is shifting from innovations in hardware to those in software, said Alvarez. Similar to Cisco being one of the “early winners” of the internet, AI hardware companies “allowed for the technology to become mainstream.”

And though hardware providers like Nvidia were the “clear winner” of the AI market’s early days, only so much more innovation can happen on the hardware side. Even large language models are “turning into a commodity,” said Alvarez.

So what kind of companies are the industry’s next big thing? That’d be those monetizing AI in a way that makes sense for enterprises, such as AI agent applications for departments like accounting, HR, cybersecurity and coding, Alvarez said.

- “If you can automate things with your platform, companies are going to be all over it — if you can do it faster and at a cheaper price,” Alvarez said.

- Firms like Palantir and Cloudflare — which both saw stock surges after recent earnings reports — could signal this shift.

“The next Nvidia isn’t going to come from the semiconductor side,” Alvarez noted. “It’s probably going to come from the software side, as companies figure out ways to develop applications. The AI cycle will continue, but the winners may change from the hardware side to the software side.”