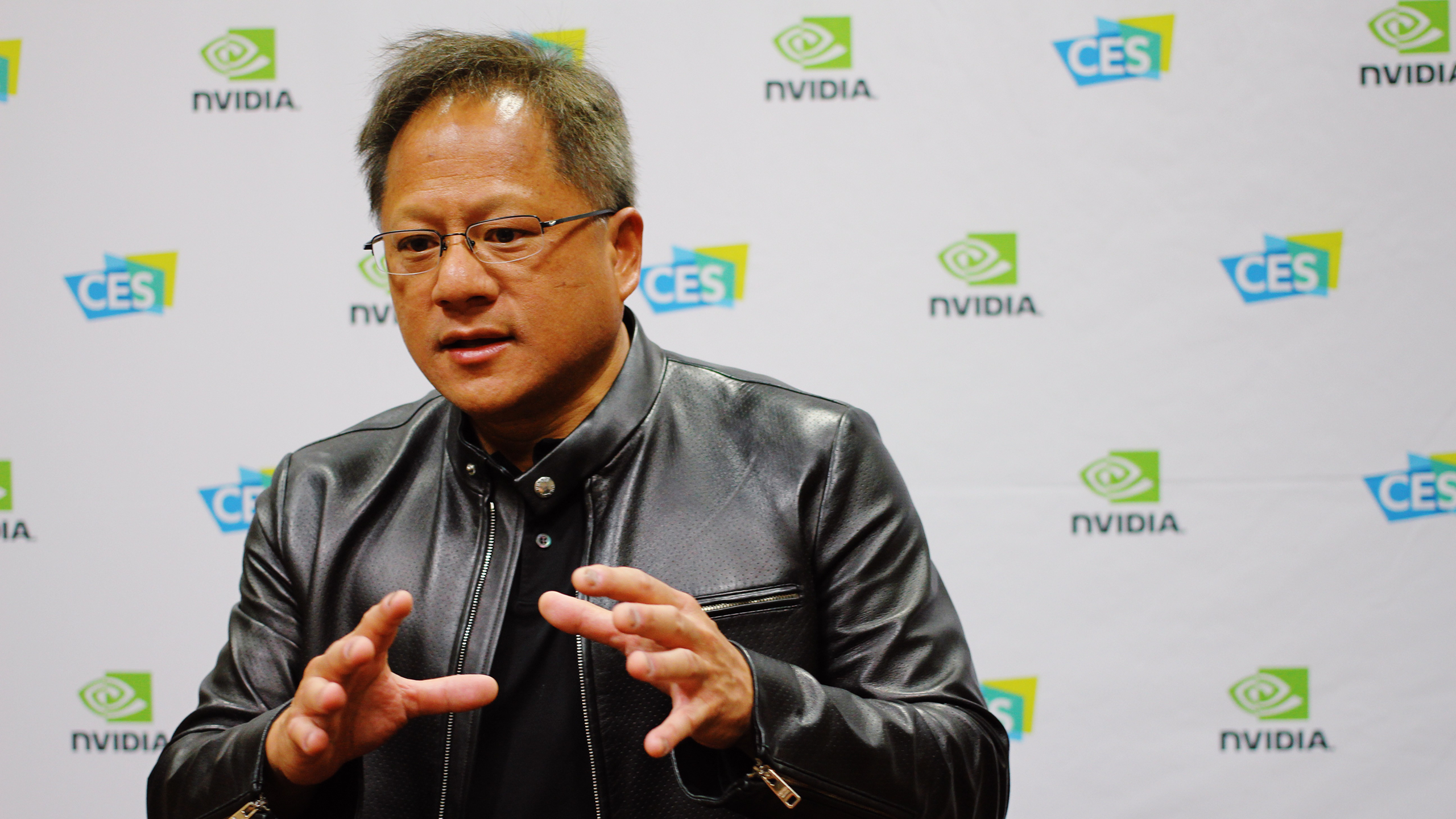

Nvidia’s Never-Ending Rally Has Hedge Funds Off to a Good 2024

The AI semiconductor giant’s stock tripled last year — and it’s jumped nearly 50% already in 2024.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

The formula’s been ridiculously simple: 1) pick the sector that everyone is crazy about; 2) pick the company in that sector building that industry’s picks and shovels; 3) buy that stock; 4) make gobs of money.

Now comes the tricky part, especially for hedge funds seeking maximum returns: saying when: Is there ever a good time to offload shares that have doubled, or even tripled, and still show no signs of heading lower?

Free Money

Nvidia’s stock has rode on the runaway hype train that is generative AI, but that doesn’t make the company’s run any less impressive — in 2023 alone, the stock more than tripled as the company’s reputation as AI chipmaker du jour became common knowledge throughout financial markets. Then, as if we all didn’t get the point, Nvidia’s stock has just… kept going — its rise has even accelerated in the new year, jumping 48% already and making it the third most valuable company in the world with a market cap of nearly $1.8 trillion.

As the Financial Times noted over the weekend, that’s been a boon for hedge funds that boosted their bets on the stock during the fourth quarter and let it ride:

- Boston-based Arrowstreet Capital built its Nvidia position to $2.1 billion by the end of 2023, according to regulatory filings. Assuming the fund held its entire stake, that’s meant an additional $1 billion in gains in 2024.

- Then there’s D1 Capital Partners, which sold more than 146,000 shares of Nvidia in last year’s Q4 — certainly good for an impressive profit, but also bringing the unenviable task of explaining to clients why it bailed on another 48% rise that other hedge funds “saw coming.”

Tale of the Tape: It’s not like Nvidia’s run has been all hype. The company also has brought the receipts: In its last earnings report, it blew past profit and revenue expectations, beating Wall Street’s top-line consensus estimate by nearly $2 billion. This brings us to the company’s Q4 report scheduled for this Wednesday. Any hint of a crack in demand for AI chips could finally derail the stock: but at this point, how sure can you be?