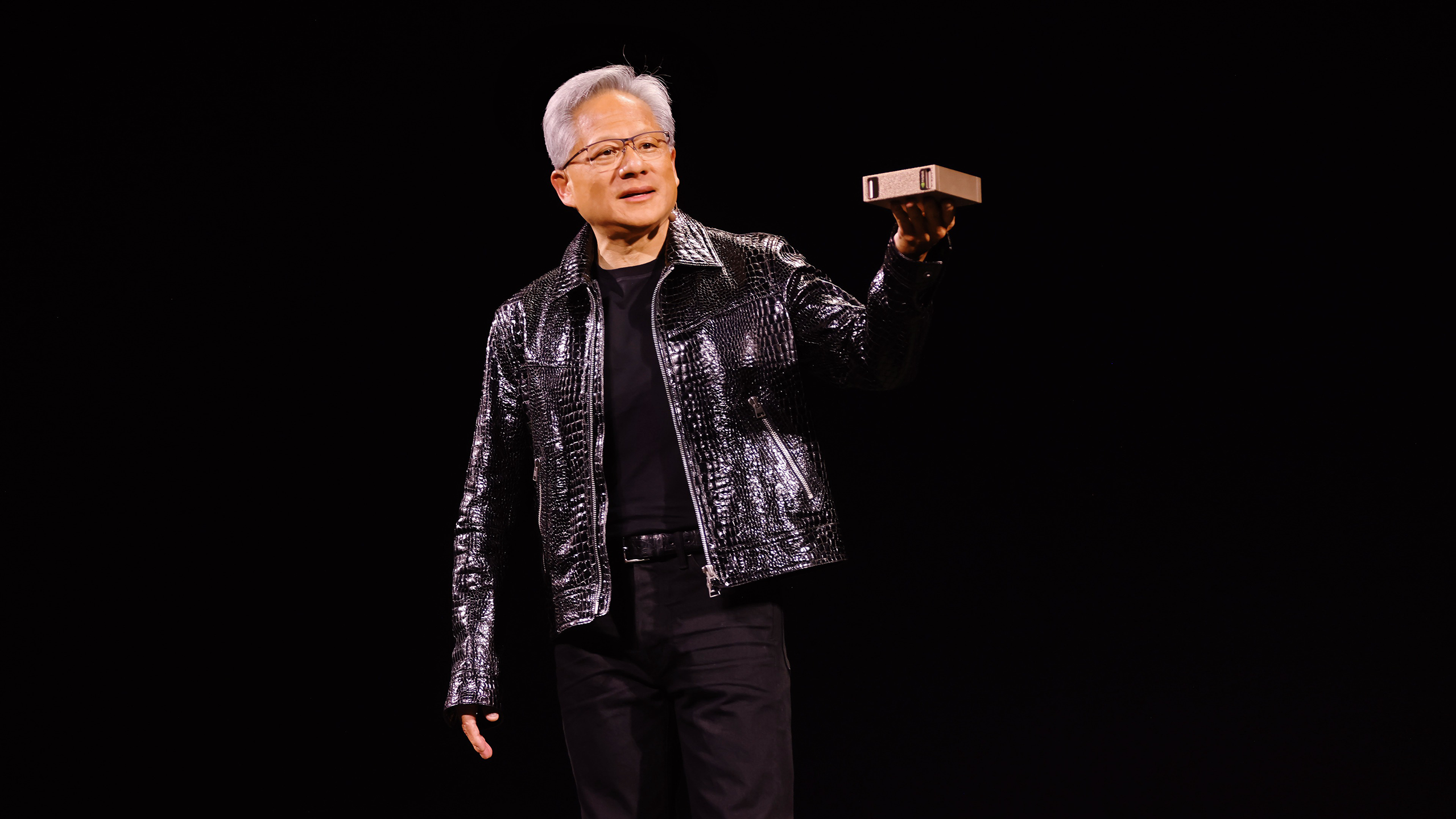

What Will it Take to Shake Nvidia’s Dominance?

Even after shaky moments like the advent of DeepSeek, Nvidia “just recoups that value within a couple of weeks.”

Sign up to get cutting-edge insights and deep dives into innovation and technology trends impacting CIOs and IT leaders.

Nvidia has long been the darling of the tech industry. Can it keep up its hot streak?

The chip giant beat analysts expectations on Wednesday after reporting a 78% surge in revenue for the fourth quarter, reaching $39.3 billion, and an 114% jump for the full fiscal year to $130.5 billion. Its quarterly data center revenue alone reached $35.6 billion, up 93% year over year.

Ido Caspi, research analyst at Global X ETFs, said he expects Nvidia’s growth to continue, though the rate of expansion may decelerate as the company’s rapid expansion continues and estimates adjust.

“Although revenue growth has decelerated, Nvidia’s 78% year-over-year increase remains impressive given its scale, underscoring strong demand for AI infrastructure,” said Caspi. “This robust performance should similarly alleviate investor concerns about potential slowdowns from emerging competitors like DeepSeek.”

Nvidia’s earnings add yet another quarter to its astronomical winning streak over the past few years. While a few instances, such as DeepSeek’s initial introduction to the market, have knocked its share price down, “it just recoups that value within a couple of weeks, and then it’s backed up to all-time highs again,” said Brian Jackson, principal research director at Info-Tech Research Group.

If the current trajectory of the AI market continues, it’s not likely that Nvidia will be dethroned from its position. With practically every big tech firm “contending to become the dominant player in this space,” said Jackson, “competition is good for spending and investment.”

The only thing that may get in the way is if adoption starts to lag, said Jackson. If the enterprises and users of these massive AI models start to question whether or not they’re getting enough bang for their buck, that could create a domino effect that impacts Nvidia as it would other tech giants.

“There is this line of discussion with AI in the enterprise space about, ‘will (AI) really deliver the return on investment that everybody is saying it will, and why haven’t we seen it yet?” said Jackson. “That could change things. But right now, all indicators show that it’s getting bigger and there’s going to be more building.”

Still, return on investment can be a tricky thing, said Jackson. Actually harnessing the usefulness of AI is about more than just giving your workforce access to productivity tools. It requires CIOs and other leaders to “rethink everything your business does,” Jackson said.

“It’s not an easy path, and it requires a lot of work, and so it’s no wonder why we haven’t seen every organization figure it out,” he added.