Morgan Stanley Faces SEC Questions Over Cash Sweeps

Morgan Stanley is the latest firm to disclose an SEC inquiry into its cash sweep program that pays paper-thin interest rates to clients.

Sign up for market insights, wealth management practice essentials and industry updates.

Morgan Stanley is in the cash-sweep hot seat — again.

The Wall Street investment bank is the latest brokerage to disclose an inquiry over its program of paying paper-thin interest rates to clients on cash. It’s a routine practice by some of the largest broker-dealers that involves shuffling clients’ uninvested assets into higher-yielding accounts. Some reports estimate firms earn profits 10 times what they pay to customers.

Last fall, rival Wells Fargo also disclosed an SEC investigation, and it faces a lawsuit over the practice. Ameriprise and LPL have also been swept up in legal disputes, too, that claim the brokerages did not act in their clients’ best interest. (The next big scoop is finding a broker that’s not getting sued over cash sweeps.)

Cash Me Outside

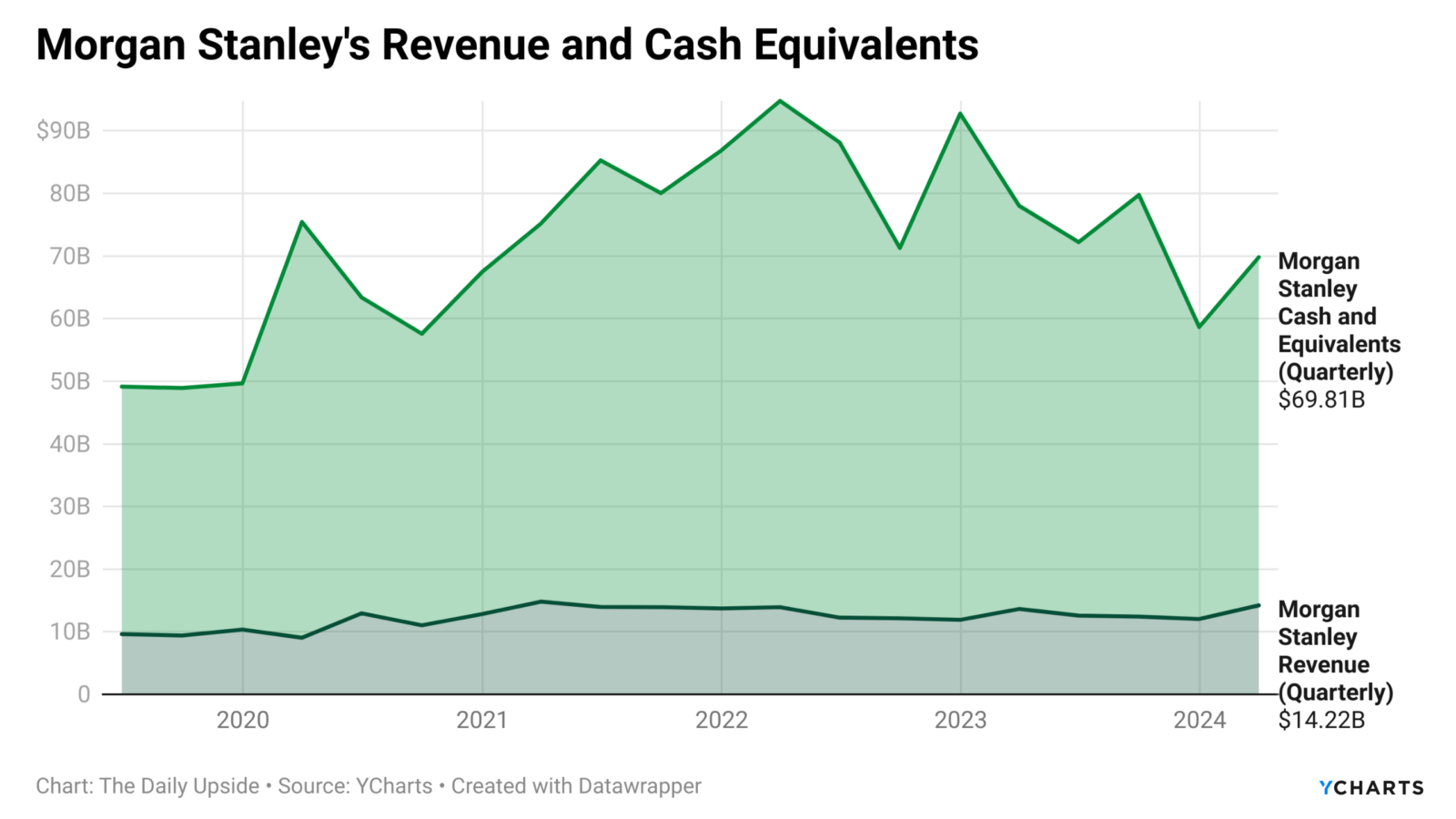

The Securities and Exchange Commission is now looking into Morgan Stanley’s cash-sweep program, which the investment bank calls its “net income interest.” That revenue grew exponentially to over $8 billion in 2023 alone, according to an unrelated lawsuit filed in June. It’s the second lawsuit the firm is facing over the practice.

To be fair, it’s a commonplace revenue stream that’s often disclosed to investors in the very fine print. Morgan Stanley also offers numerous cash alternatives that clients can choose to invest in. A single basis point interest rate on cash is also an industry standard, and matches rates by competitors like Merrill Lynch and JPMorgan. A basis point saved is a basis point earned, right?

Morgan Stanley declined to comment on the record.

Karma Is on the Menu. Wells Fargo said in its second-quarter earnings call that it would pay customers more on cash and take a likely $350 million hit in its wealth arm this year. Morgan Stanley followed suit, announcing it will now pay its clients 2% on cash, although it’s not clear whether the investigation impacted the decision.

On its most recent earnings call, the company announced a loss in revenue in its sweep accounts. Net interest income for the company topped $1.798 billion for the second quarter, down 17% from a year ago. Morgan Stanley CFO Sharon Yeshaya attributed the drop to “changing competitive dynamics.” The losses are expected to be offset by “repricing” the overall investment portfolio.