Morgan Stanley Clients Earned .01% on Cash. Now, They’re Suing

A class-action lawsuit filed by a former Morgan Stanley customer revolves around cash sweeps that earn additional income on uninvested cash.

Sign up for market insights, wealth management practice essentials and industry updates.

A penny saved may be a penny earned, but at top Wall Street brokerages, it’s more like a basis point.

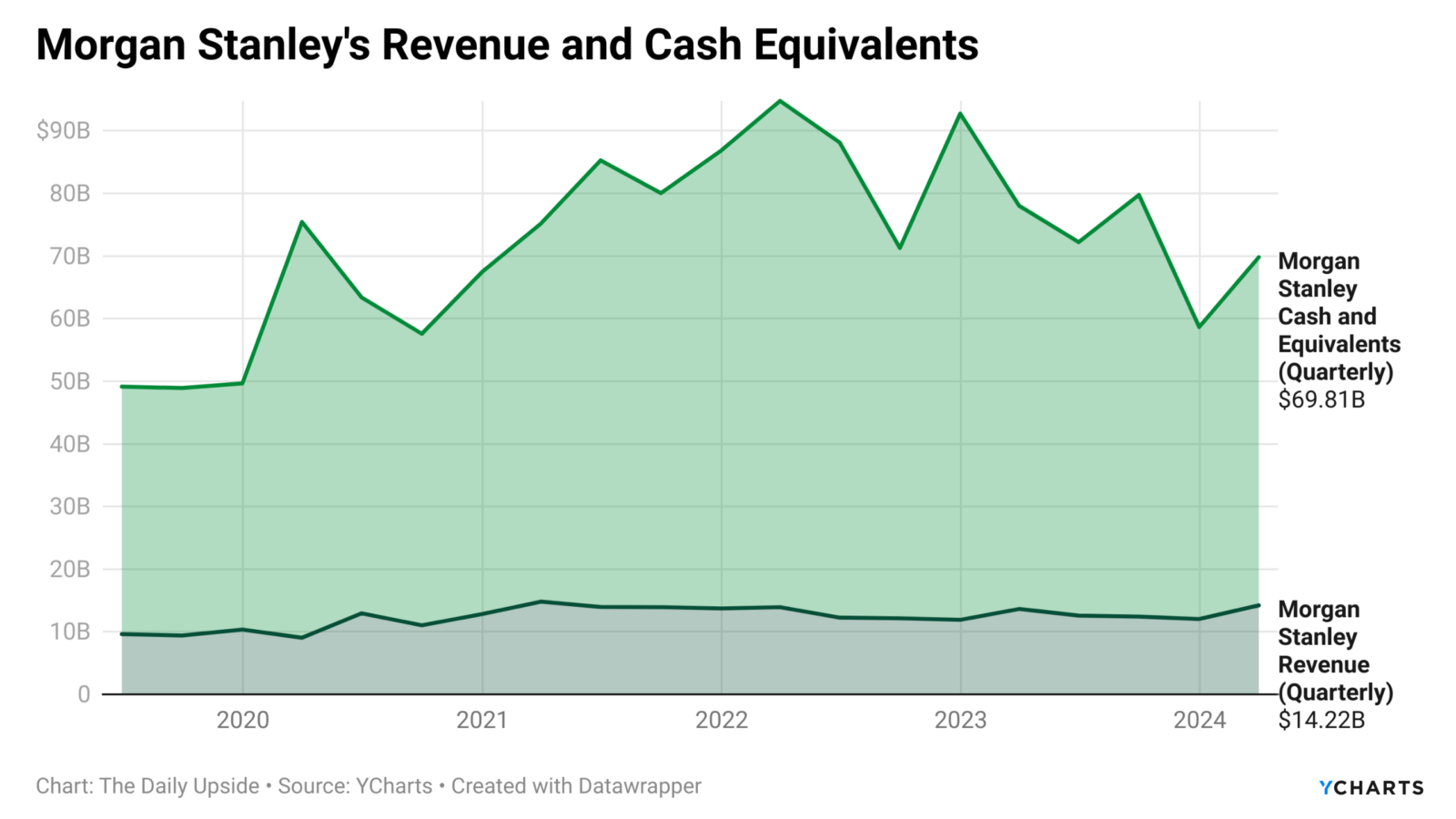

Morgan Stanley is the latest firm to be sued over the pencil-thin interest rates it pays its clients on assets held in cash. A class-action lawsuit filed by the estate of a deceased former customer revolves around the company’s use of cash sweeps — programs that generate additional income for banks using customers’ uninvested cash. It’s a commonplace practice that’s often disclosed to investors, but is gaining new attention as high-yield savings accounts offer interest rates topping 5%. With better-paying options elsewhere, the investing public is becoming more aware of what’s hidden in the fine print.

“This case concerns a simple ruse,” according to the complaint, filed June 14. The bank “devised a scheme” in which its advisers make significant profits on cash balances whereas the customer, who is owed a fiduciary duty, “literally loses money,” the lawsuit alleges.

The cash sweep program — what the bank calls its “net income interest” — grew exponentially to over $8 billion in 2023 alone, according to the complaint. With unprecedentedly high and sticky inflation, paying customers a single basis point on cash is simply a losing battle for savers.

Morgan Stanley declined to comment.

A Dollar Short

Everybody’s gotta make a buck, and cash sweeps are in no way illegal or even uncommon. In fact, they’re a legitimate practice for much of the banking industry, which is why savings accounts at the big banks generally offer peanuts by way of interest. Industry advocates say the sweeps help pay for other perks, like the free trades that are table stakes at almost every brokerage today.

Retail investors have piled into cash since the Federal Reserve began tightening the purse strings in 2022. Assets in money-market funds, that mimic cash holdings, rose to an all-time high this month as the Fed seems in no apparent rush to start cutting rates:

- US money-market funds had inflows of roughly $28 billion in the week of June 12, according to a weekly report from the Investment Company Institute.

- Assets ballooned to $6.12 trillion, topping a prior record high reached in April.

Cashing Out: To be fair, Morgan Stanley also offers numerous cash alternatives, which clients can choose to invest in. The cash sweep program, and the rates charged, are also disclosed to clients. The details can generally be found in the disclosures. (The fact that no one reads them — or even knows they exist — is another issue altogether.) A single basis point interest rate on cash is also an industry standard, and matches rates by competitors like Merrill Lynch and JPMorgan. What’s a basis point amongst friends?