Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Germany’s Adidas is one of the most successful athletic wear companies in the world, generating more than $20 billion in revenue a year. It also was founded by two brothers who were members of the Nazi party, a piece of history that Adidas doesn’t exactly advertise. When rapper Kanye West began spouting off antisemitic rhetoric in the fall of last year, the company had the choice to either cut ties with West or risk facing possibly devastating levels of investor and consumer backlash.

It chose the former, which meant canceling the production and sale of Yeezys, a popular footwear collab with West that in 2022 generated nearly $2 billion for Adidas. By October of last year, the company was left with more than $550 million in unsold Yeezys, and it only started selling the shoes again this summer — helping to mitigate a massive write-down — while reportedly donating some to charities that combat racism and antisemitism.

Changing World, Changing Consumer

Businesses realize that the instant availability of online information swirling amid social-justice campaigns like the MeToo movement have ushered in an age of public scrutiny like none other and they need to weigh potential profits against a potential PR disaster.

In a 2019 interview with Harvard Business Review, Bob Williams, a marketing expert who pairs celebrities with brands, said companies have drastically raised their vetting process for endorsements and partnerships in the past few decades. Morals clauses for celebrities in partnership contracts are now highly detailed, where they barely existed not long ago.

“Twenty years ago the level of worry was 1 on a 10-point scale. Today, it’s 8,” he said, noting that he marked the shift after Kobe Bryant’s arrest for sexual assault in 2003. “Until then A-list celebrities had an aura of invincibility. Afterward advertisers began looking differently at the endorsement genre.”

A Look at the Data

The evidence of risk seems to match the angst. In a study for the journal Management Science, marketing professors Stefan Hock and Sascha Raithel found that how companies choose to address celebrity scandals can affect stock prices and revenues:

- The study looked at a 29-year sample of 128 scandals and the 230 firms they affected. It included events like Barry Bonds’ steroid use, Justin Bieber’s DUI, and Christian Bale’s domestic assault charges.

- The research found that whether companies either cut ties or remained with their celebrity endorsers, saying something is infinitely better than doing nothing. Plus, if companies respond quickly enough, it can become a positive. Reacting slowly tends to signal uncertainty; it makes investors think company leaders don’t know what they’re doing.

- “The most surprising finding is that firms can even gain in value if their response is announced within 72 hours after the event became public. Over the four trading weeks following the negative publicity, these firms gain, on average, 2.10% in value.”

The rise of social media also has coincided with celebrity scandals becoming more frequent. Between 1988 and 2008, the research partners identified just 51 highly publicized scandals, but over the next nine years, they found 76.

No Longer No.1

Of course, negative publicity isn’t always prompted by a celebrity’s illegal or unethical behaviors, sometimes it’s a matter of partnering with someone who becomes an unforeseen lightning rod around political and cultural divides.

During the NCAA men’s basketball tournament this past spring, Anheuser-Busch InBev partnered with Dylan Mulvaney, a transgender Broadway actor and activist, to promote Bud Light, which had long held the title for America’s top-selling beer. In terms of scale, the campaign was rather limited: AB InBev sent Mulvaney a can of Bud Light with her face on it, and she posted a handful of videos on social media of her drinking the beer.

It’s unclear how much AB InBev paid Mulvaney, but the real cost came afterward:

- Some Bud Light lovers took issue with a trans person and advocate promoting their favorite beer. Some even began destroying cans of the American lager and posting the videos online. Ironically perhaps, celebrity country rapper Kid Rock posted a video of him shooting up multiple cases with a machine gun, prompting a boycott. However, fans have said Kid Rock still served Bud Light at his bar in Nashville, Tennessee long after the stunt.

- When outraged crowds targeted Mulvaney with hate speech, AB InBev remained largely silent. She said she felt the company didn’t have her back, and that whatever goodwill it meant to achieve with trans folks was now gone. Not only had the brewing behemoth upset its core market, but it also failed to tap a burgeoning one.

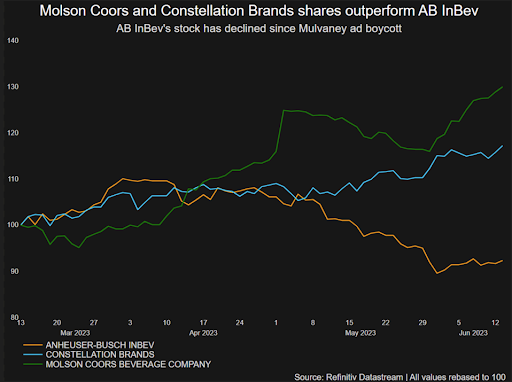

- Bud Light sales fell staggeringly hard and fast. By June, AB InBev’s stock had dropped 14% and the company lost $27 billion in market value. Its share price has recovered some, but the Bud Light boycott still lingers and just this week AB InBev laid off hundreds of its corporate US staff amid slumping sales.

Bud Light’s fall opened the way for Modelo, another beverage partially owned by AB InBev that had traditionally been marketed to Latinos, to become America’s new top-selling beer. Additionally, rivals Molson Coors and Constellation Brands saw their shares increase amid AB InBev’s fall.

One could almost understand Anheuser-Busch being blindsided, because the Mulvaney partnership wasn’t exactly blazing a new PR trail. In each of the last two years, the company received a perfect rating from the Human Rights Campaign, an LGBTQ advocacy group. And in 2016, the brewer ran a series of Bud Light ads featuring comedians Seth Rogen and Amy Schumer that addressed issues like gay marriage, pay gaps, and gender identity. Sales took a hit then, too, but the damage and fervor was nowhere near what came from Mulvaney saying, “Enjoy March Madness with Bud Light!”

In an interview with the St. Louis Post-Dispatch, Pier Yvette Alsup, who teaches inclusive marketing at Washington University, said appealing to younger and trans beer drinkers wasn’t a terrible concept. AB InBev had good intentions, but “I think the timing may not have been ideal. Reading the room, we as Americans are in a hyper political period.”

Sell Our Product

Despite the higher stakes, celebrity endorsements and partnerships don’t show any signs of slowing, with many stars still receiving massive payouts from businesses more than happy to dump cash at their feet.

Singer Selena Gomez landed a $30 million deal with Puma in 2017. Actor Charlize Theron made $55 million from an 11-year contract with fashion company Dior. And athletes Lebron James and Lionel Messi both have $1 billion lifetime sponsorships with Nike and Adidas, respectively. And should any of them do something consumers find repulsive, it seems a quick and sincere apology can buy a brand some goodwill until it finds its next celebrity.