JPMorgan Chase Patent Tackles Synthetic Data Bias

“Biases can significantly impact the equity of machine learning models and their decisions.”

Sign up to get cutting-edge insights and deep dives into innovation and technology trends impacting CIOs and IT leaders.

The devil is in the data when training a machine learning model.

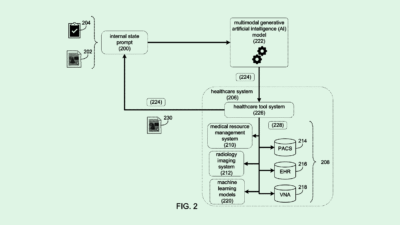

And banking giant JPMorgan Chase wants to make sure that its data stays as balanced as possible. The company is seeking to patent a system for “generating fair synthetic representative data,” from a larger set of real data for training a machine learning model.

Chase’s system aims to create synthetic data that mimics real data in statistical accuracy, demographic information and “demographic parity,” such that no group is unfairly favored in the dataset.

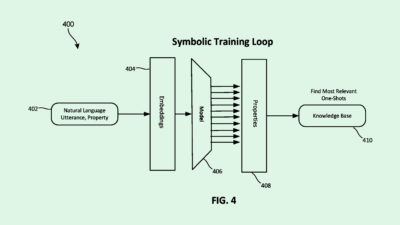

To do this, Chase’s system collects demographic information, features used in decision-making (such as income or education) and outcomes for each data point in a larger set, and uses those to make a synthetic dataset that mimics the original as closely as possible. The system then ensures demographic parity by assessing and adjusting the weights of the synthetic data.

“This proliferation of machine learning applications has highlighted the need to mitigate inherent biases in the data, as these biases can significantly impact the equity of machine learning models and their decisions,” Chase said in the filing.

Compared with many financial institutions, Chase has dived headfirst into AI. The company rolled out a generative AI assistant dubbed LLM Suite last year and deployed AI in its call centers. The company claimed in recent weeks that AI could help it reduce headcount by 10% in operations and account services.

Since data is the core of an AI model, a system such as the one Chase is developing helps financial institutions insulate models from bias. That’s particularly important for banking tasks like loan approvals, in which bias has historically harmed certain groups of would-be borrowers. Tech like this could help the company forge ahead with its AI goals, while mitigating some of the associated risk.