American Consumer Remains Resilient as Economic Growth Moderates

If economists are professionals who are paid to make incorrect guesses, as the old joke goes, then they’re certainly earning their keep.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

If economists are professionals who are paid to make incorrect guesses, as the old joke goes, then they’re certainly earning their keep.

On Thursday, the Commerce Department said the US economy grew 2.3% in the fourth quarter. Economists surveyed by FactSet expected 2.4% and those polled by Bloomberg 2.6%. So the punchline works — but, while the numbers came up short of estimates, there’s a story of resilience in the details.

Consume or Be Consumed

The US economy expanded 2.8% through all of 2024, the Commerce Department said, on par with the 2.9% in 2023. While that is a slight year-over-year tick down, 2024 marked the second year in a row that the economy defied gloomy prognostications including a few downbeat predictions from Wall Street.

And the fourth-quarter data released Thursday was a tribute to the unshakable resilience of the American consumer, whose outlays made up for a decline in business investment:

- Consumer spending grew 4.2% in the quarter, the fastest since the first quarter of 2023 and a half percentage point more than the 3.7% pace in the third quarter. Labor Department data released Thursday showed unemployment claims falling more than expected, another encouraging sign.

- Meanwhile, the 4.1% savings rate in the fourth quarter, while down from 4.3% in the third quarter, remained relatively high — the small decline suggests consumers dipped into their savings for purchases while remaining well capitalized. And the growth rate of household disposable income after taxes and inflation rose to 2.8% in the fourth quarter from 1.1% in the third quarter — this was the result of higher wage gains, meaning consumers had more to spend.

The main drag on growth in the fourth quarter was businesses investing less on new buildings and equipment, though one major factor — the seven-week labor stoppage at Boeing — is now over. Equipment spending contracted 7.8% in the fourth quarter — and investment in aircraft declined 69%. Despite Boeing’s propensity for bad news days, it’s not likely to go into near shutdown again.

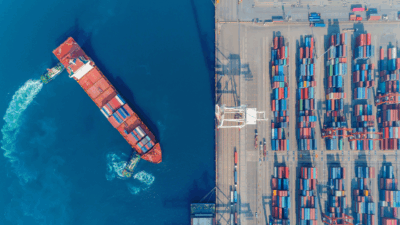

Put Your Feet Up: With the consumer price index — aka inflation — rising for two consecutive months and the abovementioned strength in the labor market — a potential contributing factor to inflation — and possible forthcoming tariffs on imported goods — aka another potential inflation factor — it’s hard to knock the Federal Reserve’s decision to leave interest rates untouched this week.