Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

The world’s second largest economy has run into a Great Wall.

China’s National Bureau of Statistics announced Monday that the country’s GDP grew a weaker-than-expected 4.9% in the third quarter of 2021, compared to the second quarter of 2020. That’s way down from the 7.9% growth in the three months ending in June. On a quarter-to-quarter basis, growth fell to a mere 0.2%, making for one of the weakest quarters in a decade.

Piling On

Last year, China was the only major economy to grow during the pandemic. This year, it’s been jumping one hurdle after another that’s slowed momentum: manufacturing is stalling due to the (seemingly) neverending global chip shortage and government caps on energy use have cut power to factories and households (oh, yeah, China has an electricity crunch, too).

The construction industry, which supports millions of jobs, is also in a steep slow down. Regulators are cracking down on developers too reliant on debt, and several firms are flirting with default. The numbers recall an old proverb that says “a fall into a ditch makes you wiser”:

- China’s industrial output in September failed to meet expectations: 3.1% growth over a year earlier was well below August’s 5.3%.

- While property investment has gone up 8.8% this year, new building construction starts are down 4.5% as a result of the real estate crackdown.

“The current international environment uncertainties are mounting, and the domestic economic recovery is still unstable and uneven,” Fu Linghui, a spokesman for the National Bureau of Statistics, said in a media release.

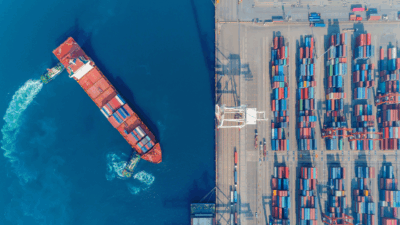

Long Term Goals: Another proverb says “patience is power.” Chinese authorities have said regulatory crackdowns are meant to steer the economy to sustainable growth from domestic consumption rather than exports. Good news on that front: retail sales, which have so far struggled during the pandemic, beat expectations to grow 4.4%.

What About Us?: “Ripple effects to the rest of the world could be significant,” warned Fidelity International’s Mo Ji, in a report, specifically flagging depressed resource demand. In other words, China’s short term pain could be everyone’s, well, short term pain.