Shrinking GDP Shows Tariffs’ Impact as Courts Scrutinize Their Legality

Keeping track of the Trump’s on-and-off tariff strategy was hard enough — and now the judicial system is having their turn at the switch.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Keeping track of the White House’s on-and-off tariff strategy has been hard enough — and now the judicial system is having its turn at the switch.

After judges on the US Court of International Trade decided unanimously Wednesday to nullify the vast majority of the administration’s “Liberation Day” tariffs, a federal appeals court on Thursday granted the White House’s request to temporarily pause the ruling. In other words: There’s a pause on the tariff pause, which means the tariffs are back on (for now at least). And as courts weigh their legality, hard economic data is starting to emerge, showing just how big an impact the maybe-not-even-legal tariffs have had so far.

Square One

So what’s the legal logic behind nullifying the tariffs? Essentially, the three-judge panel at the Court of International Trade sided with two sets of plaintiffs (one a coalition of states, the other a group backing small businesses) and ruled that the White House’s invocation of the International Emergency Economic Powers Act did not grant it authority to issue unilateral tariffs. And “if the challenged tariff orders are unlawful as to plaintiffs, they are unlawful as to all,” the panel of judges wrote. Ergo: Bye-bye, tariffs (except for those on steel, aluminum, and automobiles, which were imposed under different laws and are unaffected by the ruling).

The White House was given 10 days to “effectuate” the order but needed less than 24 hours to win a delay from a federal appeals court after saying it would seek “emergency relief” from the Supreme Court as soon as today if necessary.

Whether the tariffs ultimately stay or go — or the White House simply finds other means of imposing them — remains an open question. But what’s becoming clear is the damage they’ve inflicted on the American economy so far:

- New GDP figures from the US Bureau of Economic Analysis on Thursday showed that the American economy shrank 0.2% in the first three months of the year, slightly less than an original estimate of 0.3% but still marking the first contraction since Q1 2022.

- More sour news on Thursday: US corporate profits fell 2.9% in the first quarter, according to the bureau, their biggest drop since 2020 (though they remain above historical norms). Labor Department data released on Thursday also showed that 240,000 people filed for unemployment benefits last week, a larger-than-expected figure; continuing claims rose to 1.9 million, the most since 2021.

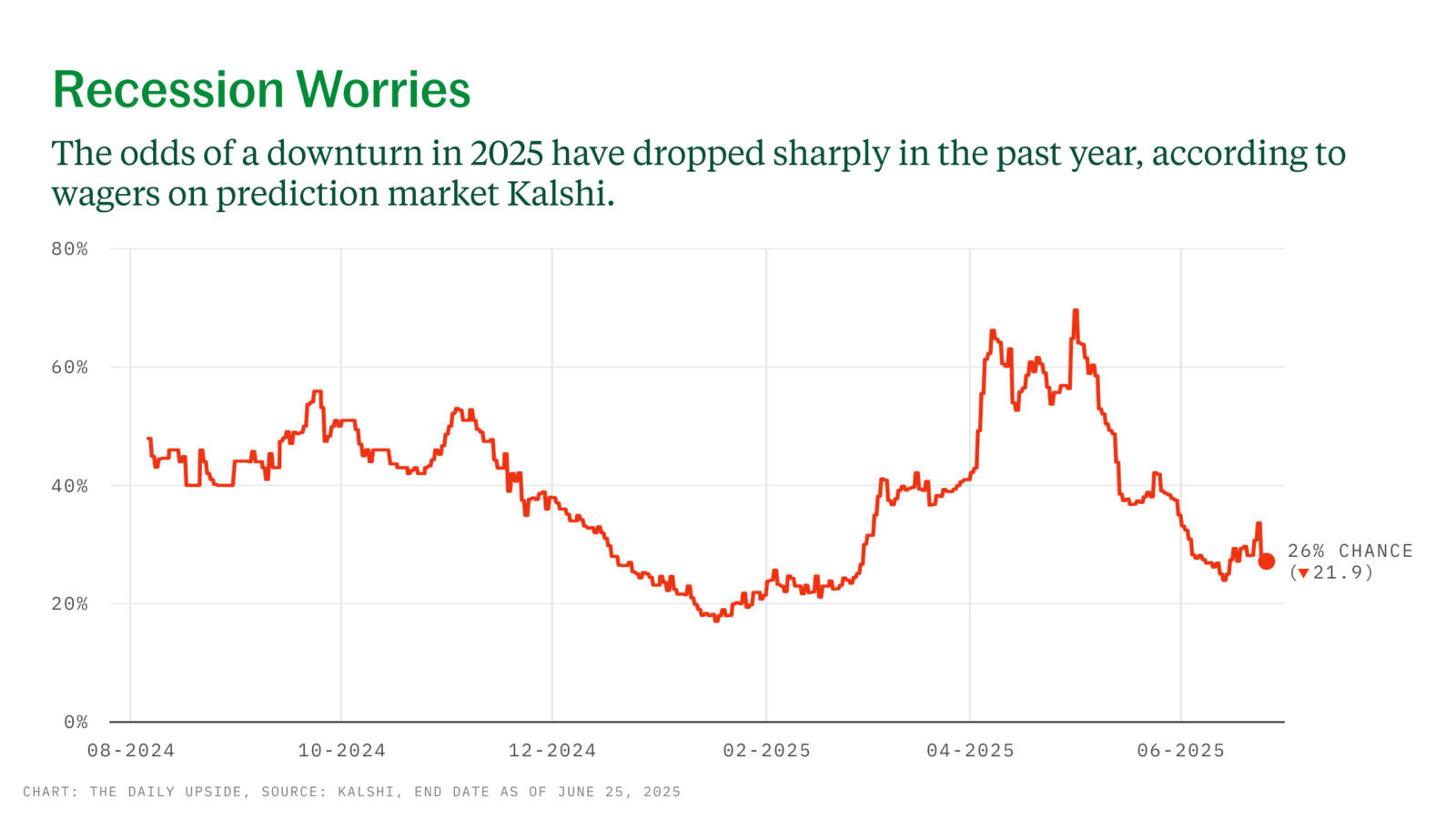

Alternate Routes: Whether or not the White House wins the legal dispute over tariffs, economists at Morgan Stanley and Goldman Sachs both told clients in notes on Thursday that the administration is likely to find some legal justification to keep levies at its preferred levels. To that end, The Wall Street Journal reported the administration is already weighing a plan B, which would involve using multiple provisions of the Trade Act of 1974 (and White House trade advisor Peter Navarro suggested they’re under consideration in a Bloomberg TV interview). Whether that means continued economic contraction is another question. The Fed isn’t ruling it out and predictions market Kalshi is quoting a 38% chance of a recession this year, though that’s down from nearly 70% odds at the start of the month.