Hooray? The US Economy May Finally Be Slowing

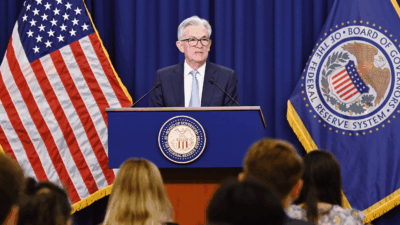

It has taken a while, but recent data suggests that the Federal Reserve’s rate hikes may finally be taming inflation.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

As Sophocles said, nothing truly succeeds without pain. We suspect he wouldn’t have put much faith in soft landings, either.

Nobody likes a tough job market or the high prices that consumers have seen for more than three years now, but it might be the lumps Americans have to take if inflation and high interest rates are ever going to ease.

Eat and Drink for Tomorrow We Die

The economy has remained rather strong in the face of interest rates that sit between 5.25% and 5.5% and stubborn — yet slowing — inflation. When the Fed adopted the mantra of “higher interest rates for longer,” consumers responded with a collective “yeah, whatever,” at least with their wallets.

One of the Fed’s favorite inflation gauges, the personal consumer expenditures index, rose 0.3% in April, precisely in line with forecasts but still hugging a 2.7% annual rate, which isn’t the 2% the Fed is looking for in the way of sustainable, low-inflation growth. The cost of healthcare, food, housing, and transportation — all essentials — are still weighing heavily on consumers, but plenty of them are still living a combination of “bougie broke” and “pandemic revenge spending,” going on expensive trips and spending frivolously when it might not make the most financial sense.

However, YOLO might be reaching its apex:

- In the past week, the Atlanta Fed’s GPDNow estimation for GDP growth in the second quarter fell to 1.8% from 2.7%, and a survey from McKinsey and Co. found that consumer sentiment is diminishing, with 45% of respondents taking a pessimistic view of the economy. One male Gen Xer said, “I don’t see that changing anytime soon, and I don’t see us in a position to buy a whole lot of extras at this point.”

- Some of that sentiment is tied to a frustrating job market. The April job openings and turnover summary from the Bureau of Labor Statistics found that hires and separations ticked up slightly, signaling workers have some confidence to move around, but the overall findings didn’t paint the most hopeful outlook. Job openings in April fell to 8.06 million — down by roughly 300,000 from March, a 19% decrease and the lowest since February 2021.

Everybody Takes a Beating Sometime: The surprising part isn’t that the economy is slowing, but rather that it’s taken so long to get to this point. This was the Fed’s goal when it started raising interest rates in March 2022: Make the cost of borrowing so expensive so that Americans ease their spending and inflation comes down. We’ve gone from expecting three rate cuts to maybe just one this year. It’s all part of the plan… potentially a really, really painful plan.