The Fed’s Preferred Inflation Gauge Just Ticked Back Up

The last mile is always the hardest. For the Federal Reserve, the last mile in its race to tame inflation just got even harder.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

The last mile is always the hardest. For the Federal Reserve, it just got even harder.

On Wednesday, new data released by the US Bureau of Economic Analysis showed that the personal consumption expenditures price index (PCE) — a.k.a., the preferred inflation gauge at the Fed — climbed 2.3% in October from a year earlier. That was in-line with expectations, but above the 2.1% rate seen in September, when the 2% finish line looked in sight. Now, with the possibility of inflationary tariffs on the horizon, the Fed also has to worry about a moving finish line.

It’s Getting Sticky

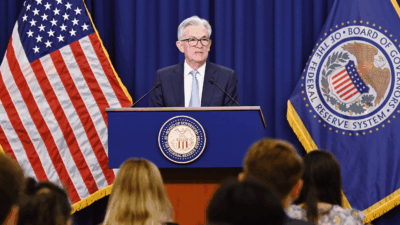

“Higher for Longer” quickly became the mantra of Fed officials when they embarked on one of the most aggressive rate-hiking campaigns in 40 years (to combat one of the nastiest spells of inflation in 40 years). That era came to an end — or appeared to come to an end — in September when the Fed issued a supersized 50 basis point rate cut, keeping pace with central banks around the world, followed by a 25 basis point rate cut in October.

But now comes the tricky part: PCE ticked back up. So did the “core” inflation index, which excludes volatile food and housing costs, rising to 2.8% in October. Mortgage rates have increased, uncoupled from the federal funds rate. The US consumer remains strong — spending increased 0.4% in October year-over-year, the Commerce Department said — even as shoppers are scavenging for deals and confidence has predictably flip-flopped along ideological lines after the presidential election. And of course, possibly soon: likely inflationary tariffs, a potential trade war, and the general unpredictability of the new administration.

That has investors pricing in a slightly different version of the future:

- Analysts and investors still heavily expect another quarter-point rate cut during the Fed’s December meeting; CME’s FedWatch tracker on Wednesday showed the odds of a cut to a 4.25% to 4.50% range at 70%.

- But after that, cuts will likely be far more gradual than previously expected. FedWatch on Wednesday indicated just a 16% chance of two more quarter-point cuts by May of next year, down from odds of 41% in October.

Minute Men: The odds shift likely was a response to Fed minutes from the November meeting released Tuesday, in which Fed members seem all in on the slow and steady approach. Still, Wednesday’s PCE data shows that “inflation progress has stalled,” Matthew Luzzetti, chief US economist at Deutsche Bank, told The New York Times. The Fed’s most likely response? Going from “higher for longer” to “slightly lower now but still high for longer.”