The Bank of England Makes Its First Rate Cut in Over Four Years

The Bank of England voted Thursday to cut its key rates for the first time in over four years by a razor-thin 5-4 margin.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

We’ll see if this makes the UK a cut above.

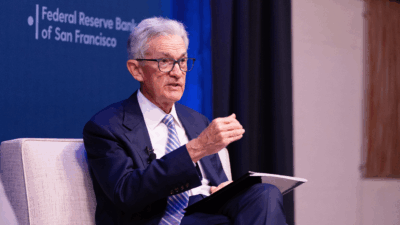

This week the Bank of Japan and the US Federal Reserve did precisely what markets expected them to do (raised interest rates and stood pat, respectively), and the Bank of England voted Thursday to cut its key rates for the first time in over four years by a razor-thin 5-4 margin.

Split Decision

Going into the week, markets were basically split on whether the BoE would take action. Policymakers had offered limited forward guidance, leaving the decision shrouded in Sherlockian mystery. The nail-biter result was even punctuated by the fact that the bank’s chief economist, Huw Pill, voted against it.

The BoE’s key rate, now cut to 5%, had been 5.25% — the highest since the 2008 financial crisis — since August 2023. But UK inflation, which peaked at a 41-year high of 11.1% in October 2022, has met the BoE’s 2% target for the last two months, which assuaged just enough of its policymaking panel. Other metrics have been mixed and, according to the BoE’s meeting notes, the dissenting voters raised the issue of the “greater risk of more enduring structural shifts” impacting employment rates and growth. But what’s done is done, and there were ripple effects almost immediately:

- Lower rates can weigh on banks’ interest margins and profitability, and UK and European bank stocks performed accordingly: NatWest fell 8%, HSBC 6%, and Lloyds 5.7%, while the main European banking sector index fell 4%.

- Bond markets in the UK, US, and Europe are pricing in a forthcoming season of cuts. US Treasury yields fell to the lowest level in six months on Thursday, German 10-year bonds (the eurozone benchmark) are on pace for their fourth straight weekly fall, and the interest rate-sensitive UK 2-year gilt fell to its lowest point in 15 months after the BoE decision.

Caution: BoE Gov. Andrew Bailey, who voted for the cut, was nevertheless cautious, stating policymakers “need to make sure inflation stays low and be careful not to cut interest rates too quickly or too much.” So, while bond traders are pricing in multiple rate cuts in the US and Europe in the remainder of this year, the UK could fall quiet by comparison. “They are not committing to anything,” Bank of America’s global head of foreign exchange strategy, Athanasios Vamvakidis, told Forbes. “They will go meeting by meeting, remaining data dependent.”