ETF Upside

Exclusive news and analysis of the rapidly evolving ETF landscape, built for advisors and capital allocators.

-

What F/m’s Latest ETF Filing Means for the Future of Tokenization

Photo by Planet Volumes via Unsplash -

NYSE to Build 24/7 Tokenized Securities Trading Platform

Photo by Alena Kravchenko via iStock -

Global X to Launch a Space Tech ETF

Photo by Alones Creative via iStock -

The Crypto ETF Trends Experts Are Watching in 2026

Photo by General Bytes via Unsplash -

Why This $357B Asset Manager Is Getting Back in the ETF Game

Photo via PARAMOUNT PICTURES / Album/Newscom -

Credit Card Rate Cap Undermines Bank ETFs After Year of Strong Growth

Photo by Getty Images via Unsplash -

Vanguard Splits Into Two Investment Teams

Photo by Alex Perez via Unsplash -

These ETFs Take a Page Out of Famed Investors’ Playbooks

Photo by Long Truong via Unsplash -

Where Crypto ETFs Stand in 2026

Photo by Getty Images via Unsplash -

J.P. Morgan Asset Management Votes with Its Feet on Proxy Advisors

Photo via Yen Meng Jiin/The Business Times/Newscom -

International Equity ETF Flows More than Doubled 2024 Totals

Photo by Getty Images via Unsplash -

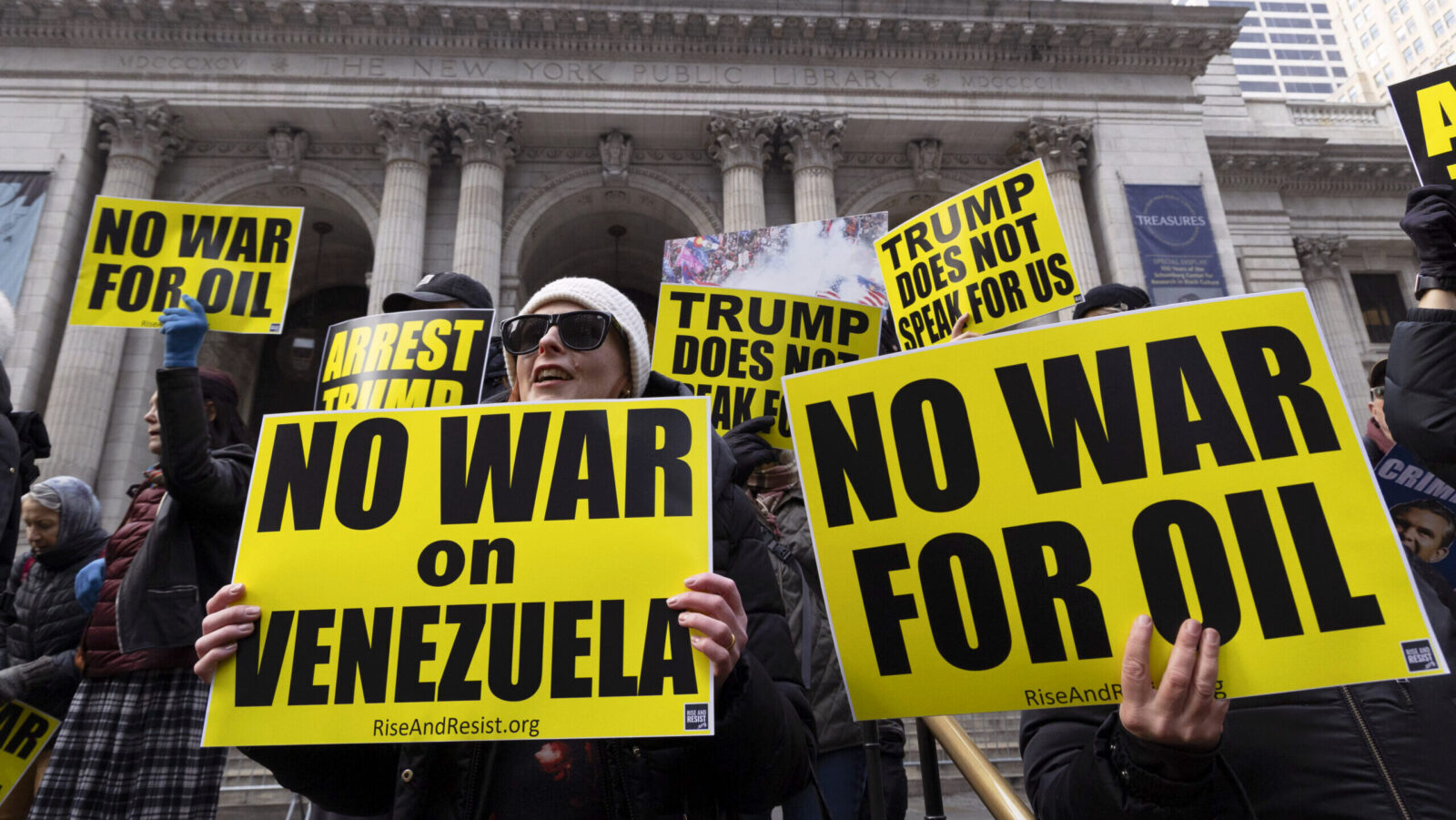

US Raid in Venezuela Compounds Uncertainty for ETF Investors

Photo via Gina M Randazzo/ZUMAPRESS/Newscom -

Morgan Stanley Wades Into Crowded Bitcoin Market

Photo via Richard B. Levine/Newscom -

Proposed ETF from VegaShares Bets on 4X Leveraged Funds

Photo by Jonathan Greenaway via Unsplash -

ESG Hits Record $799B in ETF Assets Globally

Photo by Anders J via Unsplash -

Why This ETF Can’t List on Major Exchanges

Photo by Getty Images via Unsplash