CIO Upside

Exclusive news and analysis of the rapidly evolving ETF landscape, built for advisors and capital allocators.

-

Calamos Launches First Autocallable ETF

Photo via Kris Tripplaar/Sipa USA/Newscom -

ETF Investors Lured to AI, Crypto, Fintech

Photo by Traxer via Unsplash -

An ETF for the Buy Now, Pay Later Market

Photo by Yunus Tuğ via Unsplash -

The Rise of the Buffer ETF

Photo by Fellipe Ditadi via Unsplash -

RFG’s Bluemonte Jumps Into ETFs

Photo by Getty Images via Unsplash -

Active Strategies Are Coming for Model Portfolios

Photo by Graham Mansfield via Unsplash -

Vanguard Changes Leadership on 44 Funds, Including World’s Largest

Photo via Rafael Henrique/SOPA Images/Si/Newscom -

Will AI Give the Free Markets ETF an Edge?

Photo by August Phlieger via Unsplash -

BlackRock Dumps 14 Funds, Many Being Sustainable Products

Photo via Richard B. Levine/Newscom -

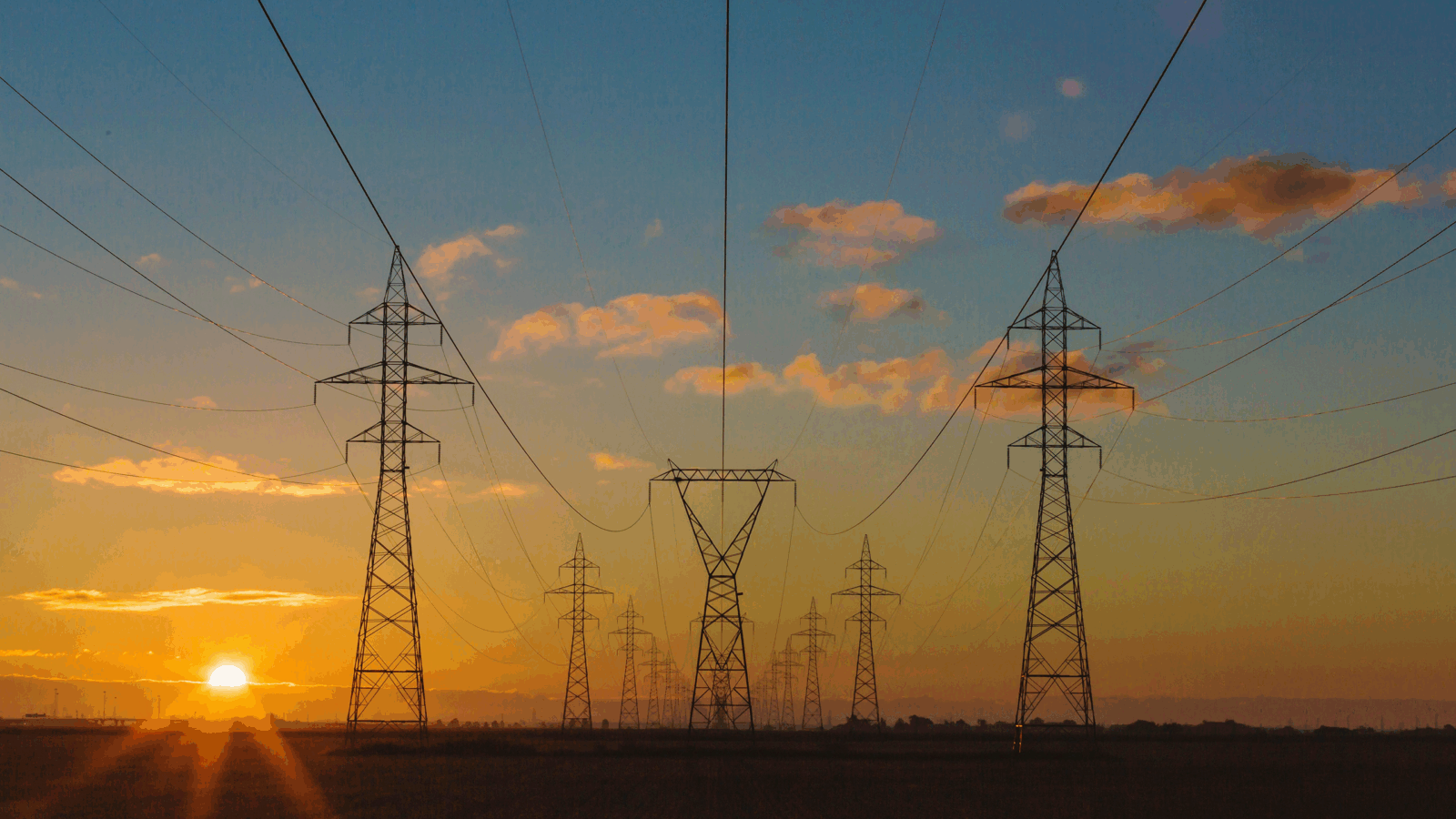

What the Israel-Iran Conflict Means for Sector ETFs

Photo by Matthew Henry via Unsplash -

Fidelity, Franklin Prep Solana ETFs with Staking

Photo by Alvaro Fernandez Echeverria via iStock -

Single-Stock ETF Market Swells With Firehose of New Products

Photo by Getty Images via Unsplash -

Invesco Hires Crypto Product Leader from JPMorgan

Photo via Mark Black/ZUMA Press/Newscom -

Schwab Keeps Industry’s ETF Fee Cuts Rolling

Photo by Hapabapa via iStock -

WisdomTree Branches Out to Private Credit

Photo via Samuel Rigelhaupt/Sipa USASamuel/Newscom -

Trump’s Truth Social Files for Bitcoin ETF

Photo via May James/ZUMAPRESS/Newscom