ETF Upside

Exclusive news and analysis of the rapidly evolving ETF landscape, built for advisors and capital allocators.

-

The Year ETFs Couldn’t Stop Breaking Records

Photo by Kevin Andre via Unsplash -

Advisors’ Favorite ETFs of 2025

Photo by Mayur Gala via Unsplash -

How AI Will Reshape Client Communications in 2026

Photo by Marvin Meyer via Unsplash -

Best-Performing ETFs of 2025 Were Digging for Silver and Gold

Photo by TomasSereda via iStock -

Crypto ETFs Pull in Assets Despite Poor Performance

Photo by Getty Images via Unsplash -

VanEck Ties Latest Funds to Positive Analyst Sentiment

Photo by Getty Images via Unsplash -

State Street’s Private-Credit ETFs Outperformed in 2025. Is That Enough to Interest Investors?

Photo by Terrillo Walls via Pexels -

American Century’s Avantis Crosses $100B AUM

Photo by Planet Volumes via Unsplash -

Here Are the Top ETFs Holding Oracle after Its Nosedive

Photo by Gregory Varnum via CC BY-SA 2.0 -

QQQ to Become an Open-End Fund

Photo by Annie Spratt via Unsplash -

New ETFs Aim to Help Investors Pay for Rising Healthcare Costs

Photo by Getty Images via Unsplash -

SPYM’s $100B Milestone Might Be the Last of Its Kind

Photo by JHVEPhoto via iStock -

Cannabis ETFs Stay High on Drug Rescheduling News

Photo by Natalia Blauth via Unsplash -

BlackRock Expands Its Bond-Ladder ETFs

Photo by Getty Images via Unsplash -

Why ETF Assets Are Growing Faster Than Experts Predicted

Photo by Casey Horner via Unsplash -

This New Bitcoin Futures ETF Could Be Pulling All-Nighters

Photo by Casey Horner via Unsplash -

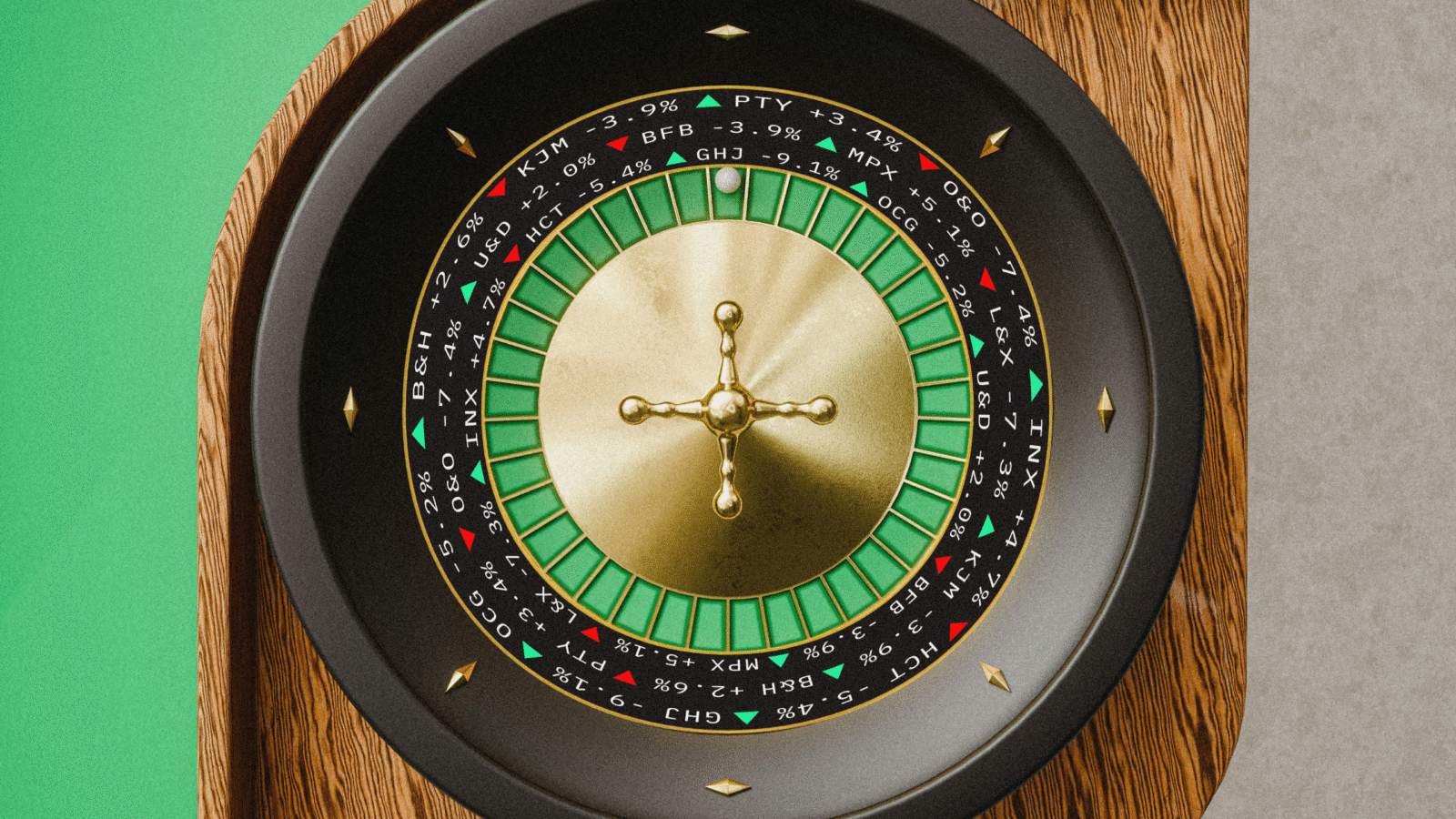

ETFs May Be Blurring the Line Between Gambling and Investing

Photo illustration by Connor Lin / The Daily Upside -

What Netflix’s Deal With Warner Bros. Highlights About Leveraged ETFs

Photo by Venti Views via Unsplash