Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Regional banks across the US want a regulatory buffer, but they might be getting a Buffet instead. As in the really rich guy from Omaha.

A bloc of midsize lenders has officially asked federal regulators to guarantee that all bank deposits will be insured by the FDIC for the next two years in the wake of the Silicon Valley Bank failure and the ongoing crisis of faith in smaller banks.

Get The Oracle on the phone

In a letter to federal officials, the Mid-Size Bank Coalition of America pleaded that extending the FDIC backstop to deposits larger than the $250,000 limit would be key in cauterizing the bleeding from smaller banks to larger ones in the wake of runs on SVB and Signature Bank. For regional lenders, the request is something of a hail mary as confidence in the system is already plumbing dangerous lows, and larger banks are already flexing their muscles as evidenced by last week’s $30 billion liquidity injection into First Republic Bank by US banking totems like JPMorgan Chase, Bank of America, and Morgan Stanley.

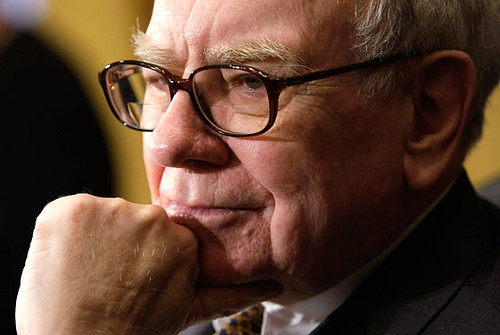

While the MBAC’s ask has support from a growing list of lawmakers, it appears that key Capitol Hill decision-makers are also turning to an old friend for help. According to reports, Berkshire Hathaway founder Warren Buffet has been engaged in talks with Washington throughout the SVB fallout and topics included the Oracle of Omaha infusing the banking sector with cash as he did with Goldman Sachs and BofA in the wake of the 2008 financial crisis.

Buffet and/or the FDIC might need to move quickly:

- The SPDR S&P Regional Banking ETF which tracks shares in smaller lenders has fallen by almost 25% since SVB imploded, squeezing those banks at a very inopportune time and fomenting fears of more failures.

- “It is imperative we restore confidence among depositors before another bank fails,” the MBCA implored in its letter.

Perhaps, a merger? While teamwork and a Batline to Omaha appear to be the plan for now, there is at least one signal that smaller lenders are willing to help each other out. According to Bloomberg, Signature Bank might have a buyer in New York Community Bank, which has kicked the tires and might announce a deal this week.