Stampeding Bull Market Will Keep Bears at Bay for Another Year, Investors Predict

The S&P 500 has climbed 35% since its April low and roughly 90% since the beginning of its bull run in 2022.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

That thing inflating before us like the Ghostbusters Stay Puft Marshmallow Man? Now, we know it’s not a bubble.

Nearly half of professional investors surveyed in Barron’s latest Big Money poll, published Thursday, said they were optimistic about the market’s potential over the next 12 months. It’s a major reversal from the pervasive pessimism that took hold earlier this year, and historically speaking, it looks pretty accurate, based on the length of past bull markets.

Moonwalking From The Edge

The arrival of “Liberation Day” tariffs, which would have amounted to the largest US tax increase in at least a few generations, had they been permanent, positively spooked investors when they landed in April. Just 28% of Big Money respondents reported market optimism in a poll published in early May, marking the lowest reading in the Barron’s survey since 1997.

The S&P 500, however, has climbed 35% since its April low, as trade-war treaties provided more clarity, consumer spending remained robust, and the AI hype train chugged along. Despite bubble talk, just 19% of investors told Barron’s they’re bearish about market conditions, down from 32% in the spring, while 34% say they are neutral and 47% report optimism.

Optimism aside, survey respondents gave curious onlookers plenty to chew on:

- About 67% say they disapprove of the White House’s tariff regime, while 57% approve of the Federal Reserve’s handling of interest rates, down from 70% in the spring. Some 63% see inflation climbing to 3% overall in 2025, while a plurality (31%) see GDP growing 2% this year, and another plurality (25%) see growth narrowing to just 1.5% next year.

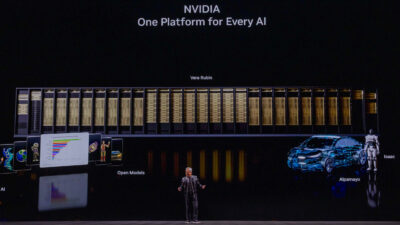

- Tesla was cited as the most overvalued stock by 21% of survey respondents, who were also somewhat mixed on Nvidia: 13% of respondents called the semiconductor king the market’s most overvalued stock, while 5% called it their “favorite” stock. Meanwhile, a little over half (56%) say they are professionally beating the S&P 500, while 58% say they are personally beating the index.

History Lesson: While bubble fears are real, there’s plenty of reason to believe the market has room to run, especially as the “Other 493” members of the S&P 500 close the earnings growth gap with the market-leading Magnificent Seven. This particular bull run turned three years old earlier this month, with the S&P 500 rising roughly 90% in that span. The 14 bull markets since 1932 saw an average gain of 170%, and lasted about five years, Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, recently told Reuters. Optimistic survey respondents may well be just good students of history.