Midday Market Brief: Wait and See

Stocks are mostly stuck in neutral as investors await two key pieces of data on Wednesday.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

With the corporate news cycle easing into the sparse summer season, economic data will have to pull more of the weight to push the market significantly higher.

Stocks were down slightly on Tuesday, with the S&P 500 off 0.3%.

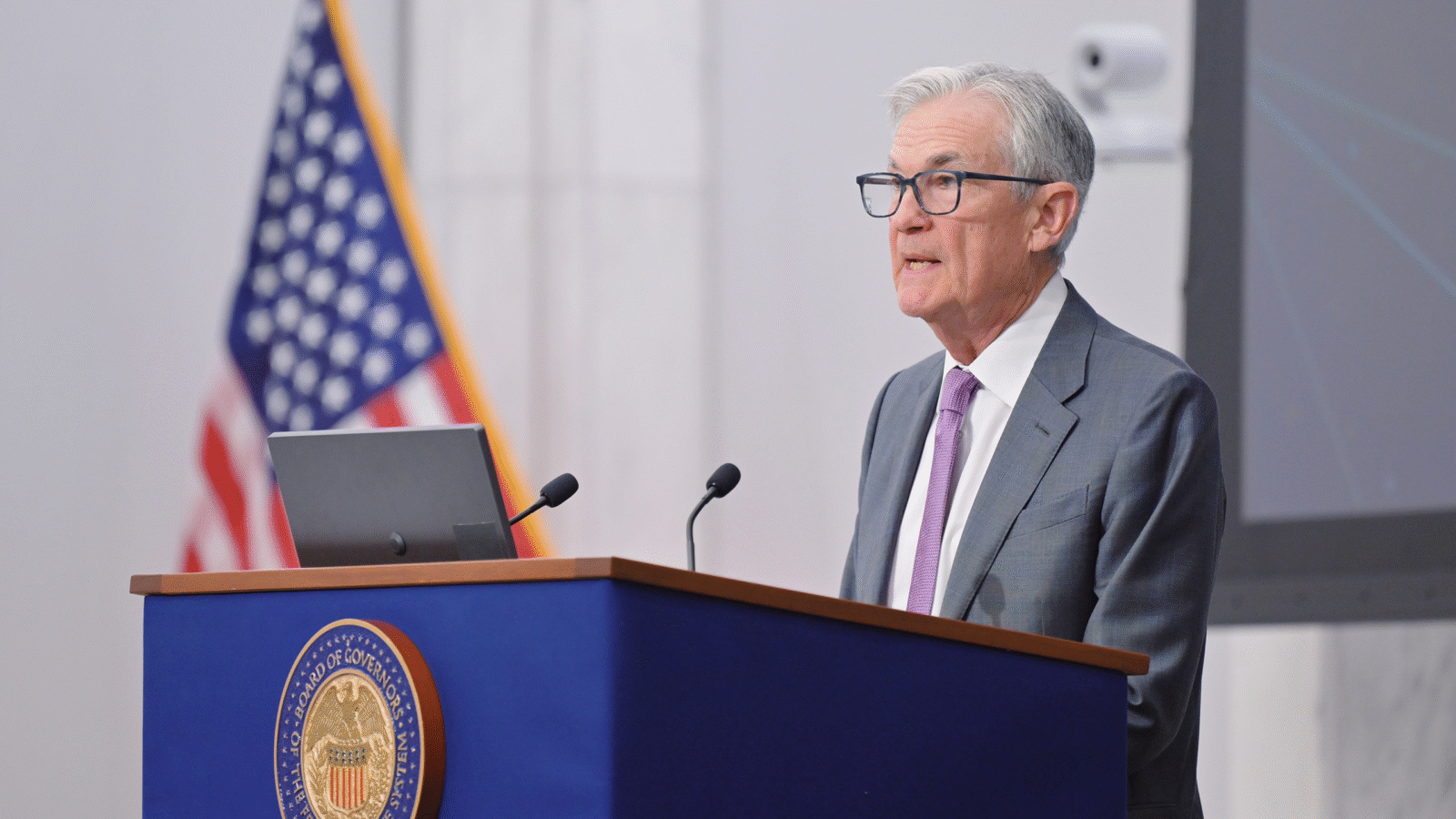

The sideways action — much like Monday’s — comes as investors kick rocks around before two key releases on Wednesday: the consumer price index for May and the Federal Reserve’s “dot plot,” both of which could offer a clue about if and when interest-rate cuts will come.

Movers & Shakers

These are the stocks making news on Tuesday:

- Apple stock was 5.8% higher a day after the company’s developers conference. Investors seem hopeful that the company’s unveiled AI plans will spark purchases for iPhone upgrades.

- General Motors rose 1.2% on news that the company will boost its dividend by 33% and plans to institute a $6 billion stock repurchase program.

- Fifth Third Bancorp was down 1.5% after the company trimmed its full-year revenue guidance and said it was raising its allowance for credit losses.

- Affirm shares jumped 4.9% on news that the company’s payment platform would be available to Apple Pay users in the US later this year.