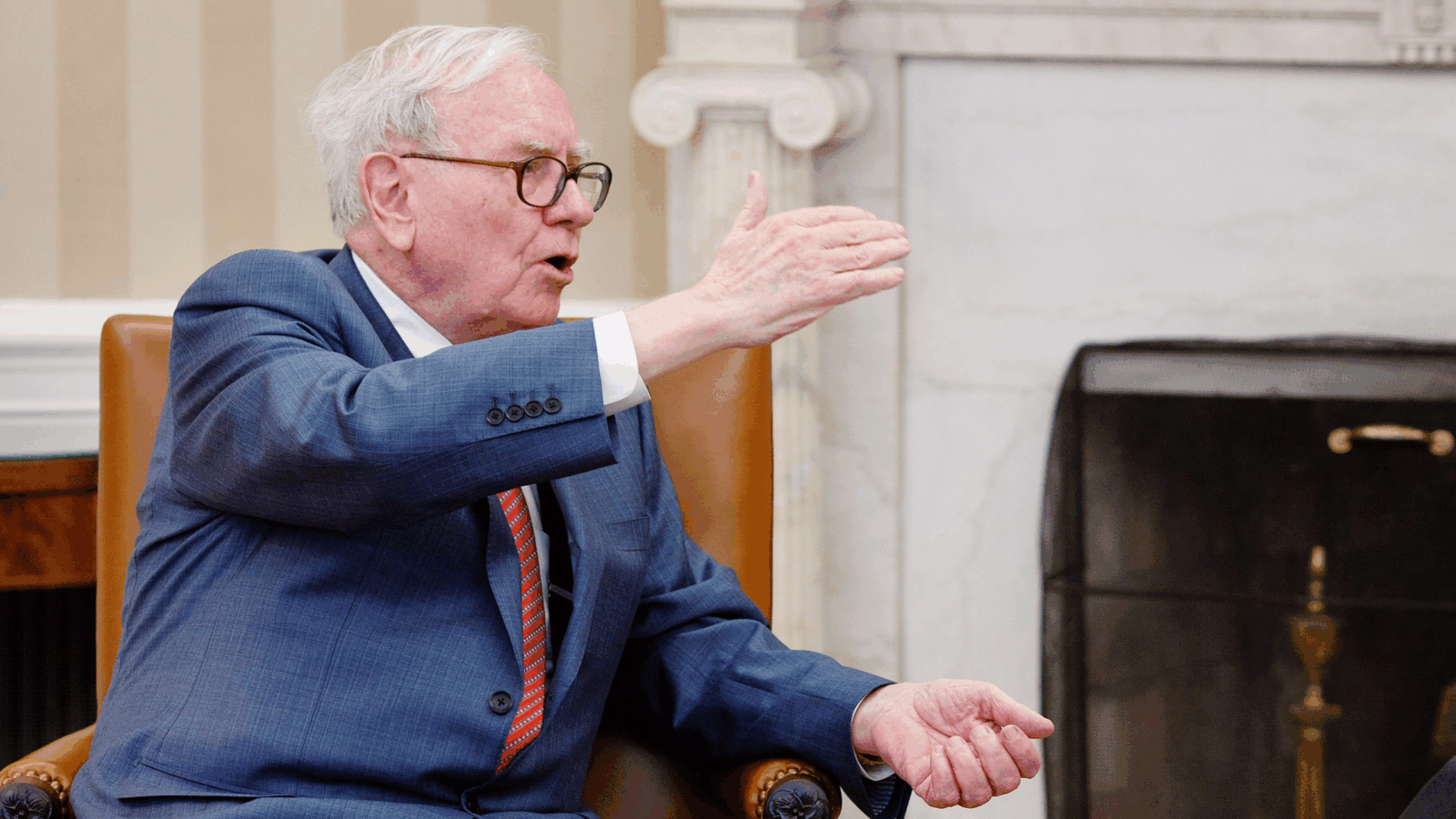

Warren Buffett Splashes Water on Any Great Investing Expectations

The Oracle of Omaha warned investors to not expect “eye-popping” performance in the coming years.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

The Oracle of Omaha has seen the future. It’s meh.

In his latest letter to shareholders, Warren Buffett — the 93-year-old founder and CEO of the investing conglomerate — said there’s “no possibility of eye-popping performance” in the coming years. We all might as well enjoy some Cherry Coke until something interesting comes along.

Not Much Going On

Berkshire has made plenty of deals to acquire or pump money into companies that supercharged the firm’s performance — Geico, Dairy Queen, insurance company Alleghany. At the start of 2022, it poured more than $50 billion into stocks. But those days look to be in the past for now.

“There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others,” Buffett said in his letter. “Outside the US, there are essentially no candidates that are meaningful options for capital deployment at Berkshire.”

The company will pursue anything that looks unique and lucrative but right now, not many businesses seem to excite Buffett — Berkshire Hathaway’s record cash pile of $168 billion can attest to that:

- When nothing on the market looks attractive, Berkshire dumps what it can and turns inward. The firm bought $2.2 billion of its own stock in the fourth quarter of 2023, totaling more than $9 billion for the whole year. It also sold $24 billion of equities last year.

- Berkshire Hathaway is also known for its conservative approach to trading. In his letter, Buffett took a crack at Wall Street speculators and day trading apps that encourage people to move their money around without much thought.

“Markets now exhibit far more casino-like behavior than they did when I was young,” he said. “The casino now resides in many homes and daily tempts the occupants.”

Building an Empire: Buffett also took time to commemorate his friend and business partner, Charles Munger, who died last year at the age of 99. “In the physical world, great buildings are linked to their architect while those who had poured the concrete or installed the windows are soon forgotten,” he said. “Berkshire has become a great company. Though I have long been in charge of the construction crew, Charlie should forever be credited with being the architect.”