Finance

-

How Clients Can Invest in NFL Teams

Photo by Myron Mott via Unsplash

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

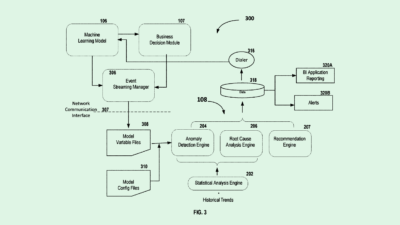

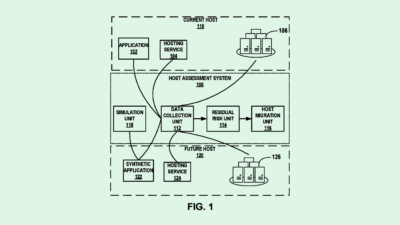

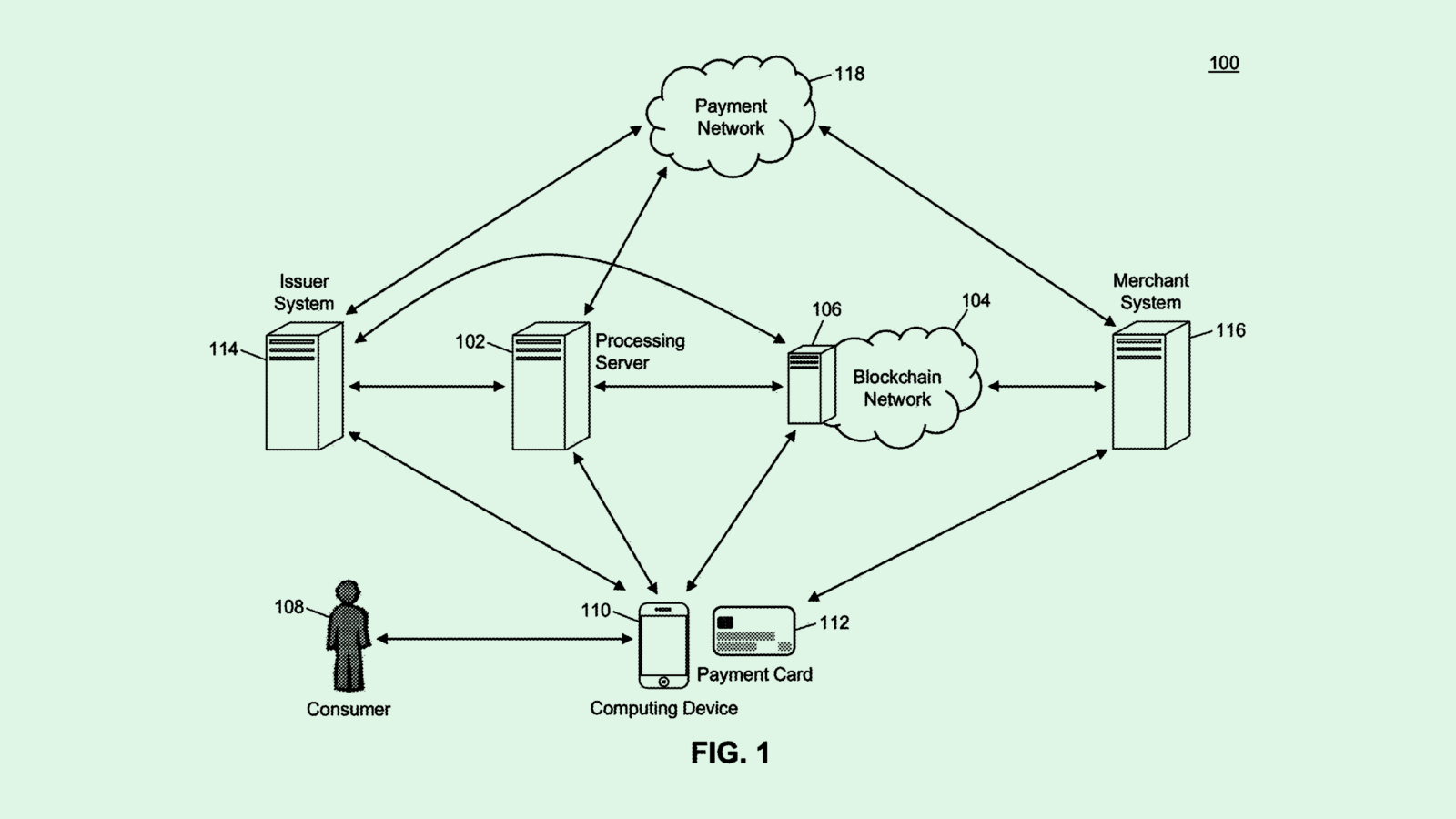

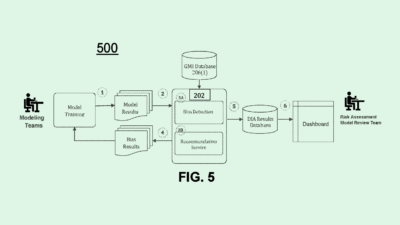

Mastercard Continues Crypto Crusade with Seamless Transaction Patents

Photo of Mastercard’s Trustless Transaction Patent via the U.S. Patent and Trademark Office