The Comeuppance of (Another) Crypto Kingpin

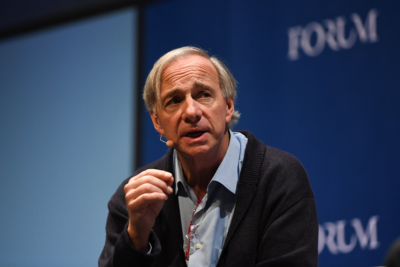

Binance agrees to pay one of the biggest corporate fines in U.S. history. Changpeng Zhao is the founder and chief executive officer of Binance, the largest cryptocurrency exchange in the world.

Sign up to unveil the relationship between Wall Street and Washington.

Binance agrees to pay one of the biggest corporate fines in U.S. history.

There cannot be very much brightening up the days of the convicted fraudster and ex-crypto billionaire Sam Bankman-Fried, who is awaiting sentencing in March from prison, where reports tell us he is subsisting on a diet of bread, water and peanut butter.

Except maybe the comeuppance this week of one of his biggest frenemies and competitors, Changpeng Zhao, the founder and chief executive officer of Binance, the largest cryptocurrency exchange in the world.

Zhao, also known as “CZ,” pleaded guilty Tuesday to money-laundering violations, agreed to step down as chief executive of Binance, and will pay $200 million in fines (chump change for him, as he is a billionaire).

In what U.S. authorities called the biggest corporate resolution ever, involving a number of government agencies, Binance will pay more than $4 billion in fines and other penalties after admitting to engaging in unlicensed money transmitting, sanctions violations and money laundering.

As widely reported, crypto’s propensity for operating from tax shelters and dabbling in financial shenanigans continues to beleaguer the industry.

“Binance became the world’s largest cryptocurrency exchange in part because of the crimes it committed,” U.S. Attorney General Merrick Garland said in a statement. “Now it is paying one of the largest corporate penalties in U.S. history.”

In a separate action, the U.S. Securities and Exchange accused Zhao and Binance in June of “commingling billions of dollars of investor assets” and shifting them to another entity that Zhao owned. (As is well known on Wall Street, customer funds can’t ever be mixed with a company’s own funds and doing so can result in a prison sentence, as was the case with Bankman-Fried.)

Born in Jiangsu province, China, Zhao was reared and educated from adolescence in Canada, gaining citizenship there before launching Binance in 2017. He is now worth an estimated $23 billion.

In the book, “Going Infinite,” by Michael Lewis, Bankman-Fried painted Zhao as a crypto industry leader who was willing to play fast and loose with the rules, describing how Binance frequently engaged in wash trading (which is a form of market manipulation and is illegal on exchanges in the U.S.) “He should be a great character,” Bankman-Fried said, “but he’s not.”

Bankman-Fried, in addition to being convicted on fraud charges, was also convicted of money-laundering earlier this month, potentially facing up to 110 years in prison.

As of Wednesday, Zhao was released from prison on a $175 million bond, agreeing to return to the U.S. for a February sentencing. As part of the charges against him, he pleaded guilty to a violation of the Bank Secrecy Act, which carries an 18-month sentence.

Considering he and Binance are now set up in Dubai – and the United Arab Emirates has no extradition treaty with the U.S. – it looks like this story may have some more twists and turns to it before it’s over.

The views expressed in this op-ed are solely those of the author and do not necessarily reflect the opinions or policies of The Daily Upside, its editors, or any affiliated entities. Any information provided herein is for informational purposes only and should not be construed as professional advice. Readers are encouraged to seek independent advice or conduct their own research to form their own opinions.