‘If You’re So Smart, Why Aren’t You Rich?’

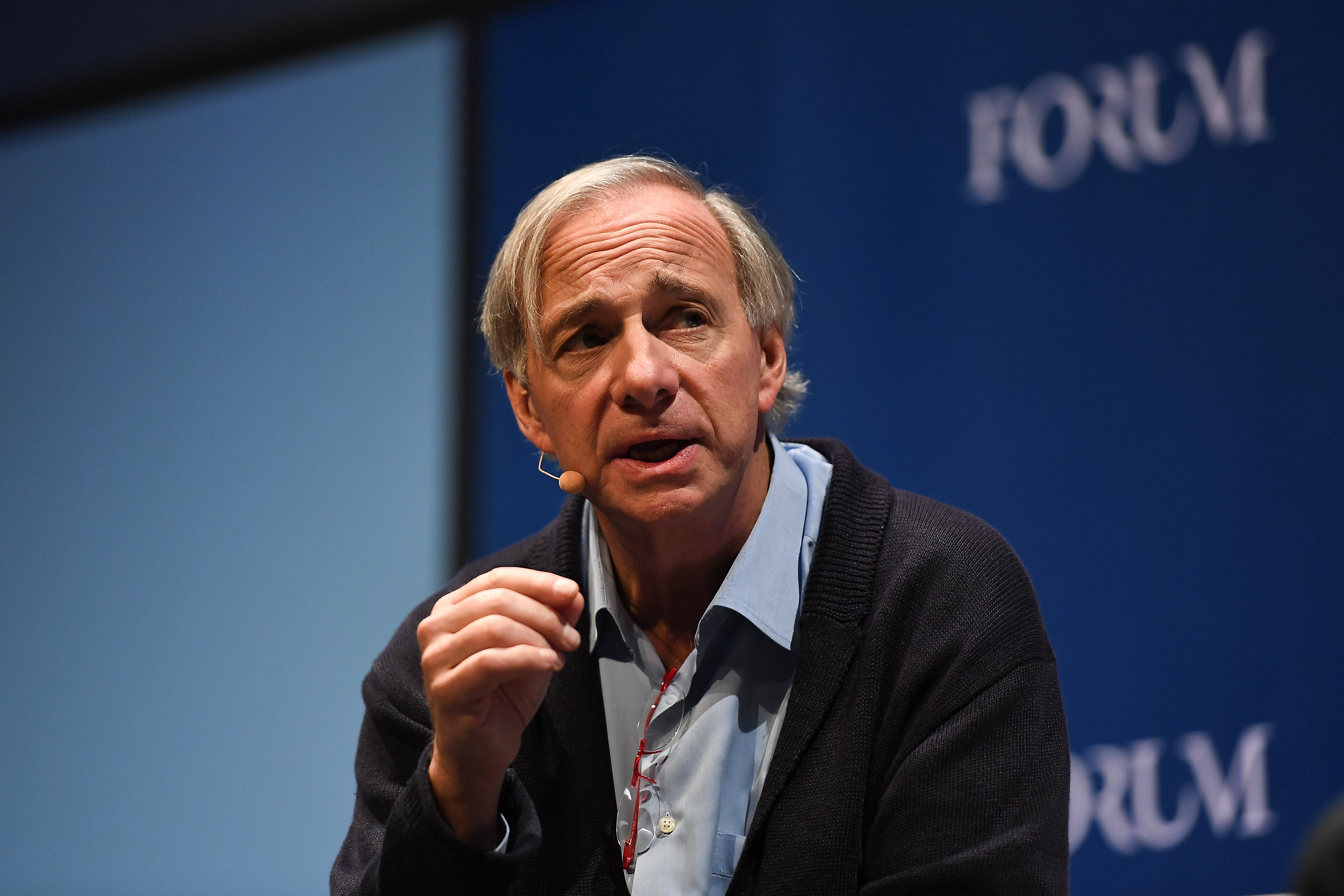

It sounds like something a gunslinging, billionaire hedge fund manager might say. And it is. Ray Dalio, founder of the highly secretive, $100 billion hedge fund Bridgewater Associates, is still in damage-control mode following the release of a book…

Sign up to unveil the relationship between Wall Street and Washington.

It sounds like something a gunslinging, billionaire hedge fund manager might say. And it is.

It is safe to say Ray Dalio, founder of the highly secretive, $100 billion hedge fund Bridgewater Associates, is still in damage-control mode following the release of a book about him earlier this month that, in the words of The New York Times, tells in excruciating detail what it’s like to work for Dalio in his “manipulative professional hellscape.”

What makes it a hellscape? According to “The Fund: Ray Dalio, Bridgewater Associates and the Unraveling of a Wall Street Legend” by Rob Copeland, one of the things Dalio likes to do is lord his billions over his minions. When confronted by an employee at a town hall discussion, Dalio booms, “If you’re so smart, why aren’t you rich?”

Of course, very few people know exactly why Dalio himself is so rich, as how the fund makes its billions is kept a closely guarded secret.

What is revealed in the book is Dalio’s enduring fascination with the regimes of Russia and China – and the ability of both countries to rule with an iron fist – inspiring him to impose a draconian system of his own on employees in 2015.

Specifically, the book explains how Dalio sought to model his fund off a Chinese system, creating a surveillance regime within his own Westport, Conn., firm, where employees rated one another at the company on whether they were acting in line with the way Dalio himself might have acted across various situations.

The system included auditors and “overseers” selected personally by Dalio who would barge into meetings, scrutinize department heads and report back to him whatever was happening.

Perhaps most disturbing aspect of this system is that employees were recorded for years – with those records available for review at all times – and colleagues would rate each other, with those ratings accessible to all.

The book also chronicles how Dalio desperately sought to meet Russian President Vladimir Putin, reportedly succeeding around 2018, with some of his employees demanding to know whether it had happened – and Dalio dodging the question.

Without directly referring to the book, Dalio posted a statement on LinkedIn, warning that the news was becoming more like a soap opera and perceptions based on “gossip” were “threatening to our well-being.”

What is the truth about Dalio? One fellow hedge fund manager sent a note to Power Corridor just before this went to press stating that he suspects Dalio’s secretiveness is not a sign of great success, but of something to hide, noting that his fund “does not execute trades on the exchanges in the size necessary to match their returns.”

The views expressed in this op-ed are solely those of the author and do not necessarily reflect the opinions or policies of The Daily Upside, its editors, or any affiliated entities. Any information provided herein is for informational purposes only and should not be construed as professional advice. Readers are encouraged to seek independent advice or conduct their own research to form their own opinions.