Forget Burgers, Chicken, and Coffee. Chipotle is in a League of Its Own.

Chipotle is the only food chain among the top 20 best-performing stocks on the S&P 500 this year. So what’s the secret to its success?

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

We know guac costs extra, and we don’t care.

Since going public in 2006, the California-based Chipotle Mexican Grill has seen its share price skyrocket 7,500%, and by market close Friday, it was the only food chain among the top 20 best-performing stocks on the S&P 500 this year.

One Double Meat Burrito, Please

Chipotle fans don’t mind paying a little extra. That doesn’t seem to be the case at other food outlets, including the one Ray Kroc built. In the first quarter, McDonald’s and its 42,000 global locations generated more than $6 billion in parent company revenue. However, same-store sales fell short of Wall Street’s expectations. Menu prices in the US — which have increased 100% in the past decade, according to FinanceBuzz — have begun to scare away low-income Americans.

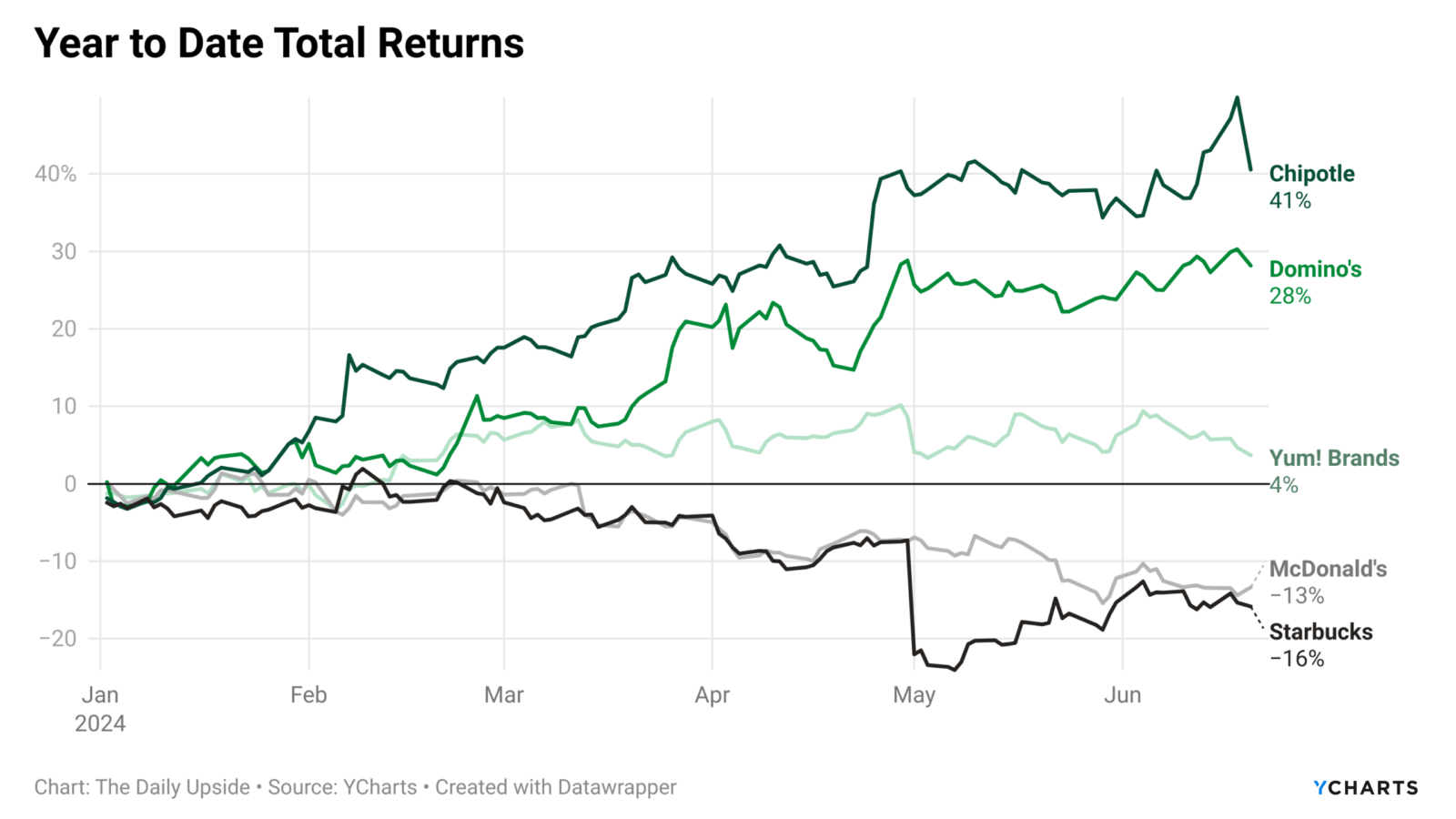

Now the burger giant is looking to win those customers back with a new $5 value meal and “Free Fries Fridays.” Burger King, Wendy’s, and Starbucks have also jumped on the budget-friendly bandwagon with their own deals. McDonald’s and Starbucks are actually some of the worst S&P performers this year, seeing their share prices drop roughly 13% and 16%, respectively.

And yet, business is better than ever at Chipotle, even though order prices start closer to $10 (and that’s without chips and queso blanco) and portion sizes have allegedly gotten smaller, according to outraged customers:

- Chipotle’s stock is up roughly 45% this year and is trading at $3,200 per share. However, that figure will get clipped this week as the company rolls out its 50-for-1 stock split, one of the largest in New York Stock Exchange history.

- According to Numerator, Chipotle customers are 34% more likely to be high-income earners making more than $125,000 a year — and that’s key to its business model. In its SEC filings, the company says one of its main goals is to persuade customers to pay higher prices for its “responsibly raised” meat and hormone-free dairy products.

And a Side of Cheesy Bread: The build-your-own burrito player does have one peer. Domino’s — whose share price has risen 26% YTD — isn’t too far behind Chipotle on the S&P’s top performers. Its success is thanks in part to increased marketing on Uber Eats, a revamped loyalty program, and offering consistent deals and discounts before such things were trendy. Haters don’t consider it real pizza, but that’s real money people are spending for their pie.