Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

As tantalizing as the potential of nuclear energy may be, the cost of building reactors has been monumental. But a new generation of plants, called small modular reactors (SMRs), are being touted as a way to break the dire economic cycle that has plagued the industry for decades.

Promises, Promises

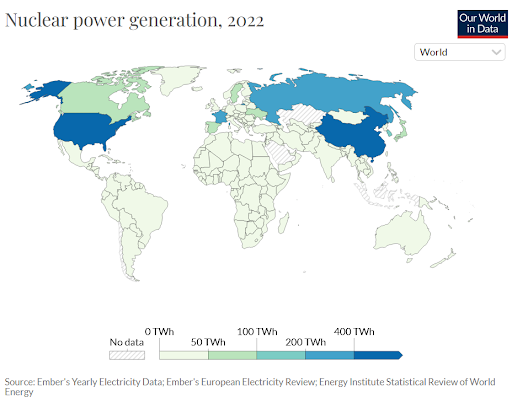

The first big wave of nuclear power plant construction followed the 1970s oil crisis. A sudden realization that wars in other parts of the world could spike the price of fossil fuels (sounds weirdly familiar to all us pandemic survivors) drove Western nations to invest in nuclear plants. Over the following decades, however, most of those countries lost their zeal for nuclear power, Stephen Thomas, energy policy expert and emeritus professor at the University of Greenwich, told The Daily Upside.

“The only country that actually followed through with it was France, they built 56 reactors in 15, 20 years,” said Thomas. “The others just sort of faded away, partly because the alternatives got cheaper, partly because electricity demand wasn’t growing at the rate everybody assumed,” he said.

In the 2000s, President George W. Bush promised a nuclear power “renaissance.” A new generation of reactors were vaunted, and projects to build them abounded. “The claim for this was that you could build reactors in four years, and they would cost $1,000 per kilowatt of capacity,” Thomas said.

Things didn’t quite turn out that way, though. “The reactors that have been built in Europe and North America since 2000, none has taken less than ten years [to build],” Thomas said, adding the cost per kilowatt now clocks in at around $10,000 per kilowatt of capacity.

One of the few plants to actually materialize from Bush’s optimism is Georgia’s Vogtle facility. Its first of two reactors was completed less than a month ago after taking a decade to build, and the cost for the entire project has more than doubled to $30 billion.

How Did Nuclear Get So Expensive? As even the most ardent libertarian would probably agree, making nuclear power safe is pretty crucial. Thomas said a handful of events over the past few decades have brought major regulatory change:

- Three famous 20th century incidents at Browns Ferry, Three Mile Island, and Chernobyl gave serious and, in Chernobyl’s case, tragic examples of weaknesses in contemporary plant designs.

- In 2001, 9/11 prompted new regulations to ensure plants were prepared for a similar attack.

Regulation is likely to intensify due to the war in Ukraine, as Ukrainian and Russian forces have battled around the Zaporizhzhia nuclear plant. “The assumption up until then was: if there was a war, both sides would studiously avoid any site of a nuclear power plant,” Thomas said.

An Atom of Hope?

Some governments are now placing their hopes on the new generation of SMRs that promise better economies of scale than their predecessors. They are touted as easier to standardize and build, which should make them cheaper.

Dr. Eugenie Dugoua, an environmental economist at the London School of Economics, told The Daily Upside that many SMR designs have yet to be put to the test, so it’s hard to assess their economic promises.

“We’re not even yet at the stage of demonstration,” she said. “It’s really this full scale demonstration that allows you to get actual costs […] how costly it is to build itself, how costly it is to operate, how much waste is generated.”

Crucially, she added, SMRs have the potential to shake up how nuclear plants are financed, as lower costs mean private investors will be able to chip in more. “You reduce exposure to massive risks,” she said, adding that the public sector will remain an important part of the financial model. “If the public sector disappears, the industry will collapse.”

Move Fast and For the Love of God Don’t Break Anything: The hype around SMRs means the nuclear industry suddenly has a wave of trendy new startups, all jostling to prove their designs are worth funding. ChatGPT founder and tech billionaire du jour Sam Altman has a fission startup called Oklo with a stated ambition to build “microreactors” that run off the waste produced by their big brothers.

Thomas is deeply skeptical of the hype surrounding new SMR designs’ ability to achieve economies of scale where larger plants failed. “On paper, these new designs look very attractive. And people think, ‘well, I could make that work.’ And it looks like gross arrogance to me,” he said. “If others have been trying for 50 years, and not made it work, no matter how attractive it looks on paper, maybe there’s a good reason. Maybe you shouldn’t give it another go.”

Dugoua was less damning. “When you’re trying to solve a problem, being able to pull from different organizations, different people, different skill sets, it’s good. You want to increase the spread of ideas.” She added that a host of startups makes it easier for private investors to chip in.

She cautioned that far-sighted investors might glimpse something of a chicken-egg problem, as the current batch of groovy new reactor designs will eventually have to be whittled down. “We cannot have 60 different designs globally. If you have that, it means we won’t have the scale economies that we’re so excited about,” she said.

“The industry will have to consolidate and choose which technologies are the winner,” she said. So for an investor getting in on the ground floor now, not knowing which design will emerge victorious means they’re taking a huge risk. Of course, we won’t know which design is the winner until it gets investment.

Is It All Worth It?

According to Thomas, the history of nuclear energy’s costs ballooning holds a lesson: focus elsewhere. “If you’re putting money, time, and effort into nuclear, that’s money, time, and effort that’s not available for other options that will work,” he said. As an example, he said offshore wind energy is “coming down in price, quick to build, seems to happen on time.”

Dugoua, however, doesn’t see it as a zero-sum game. “There’s still a question mark as to what extent you can have electric grids that are 100% renewable,” Dugoua said, “Yes, you can get to 90% renewables, but you will still need to have 10% of electricity that needs to be generated by a resource that is dispatchable.”

“We need to remember that it’s not just about the cost of generating a megawatt hour,” she said. “There are additional qualities of particular generation sources that are important, like being able to dispatch in the middle of the night whenever you want.” Dugoua said that instead of focusing on SMR research, investment could be funneled towards carbon-capture technologies (also largely unproven at scale) or battery storage.

Renovation Time: As well as plugging the gap (hopefully) left behind by the phasing out of fossil fuels, new nuclear power plants might also be necessary to replace the plants that sprang up in the wake of the ’70s oil crisis, Dugoua said. “Something like 60% of all the nuclear plants around the world today are 30 years old or older,” she said, and while it’s possible to extend their lifeline by around 15 years, sooner rather than later those plants will have to be decommissioned.

“[There are] several hundreds of gigawatts of nuclear capacity that are about to retire in the next 10 to 15 years. And this thing’s going to have to be replaced with some kind of generation,” she said.

With SMRs still something of an unknown quantity, it’s tough to predict exactly where the future of nuclear power will go — but if anyone’s looking for a private investor with a wealth of experience, we know a certain plant owner who’ll stop at nothing to keep nuclear competitive with renewable energy sources.