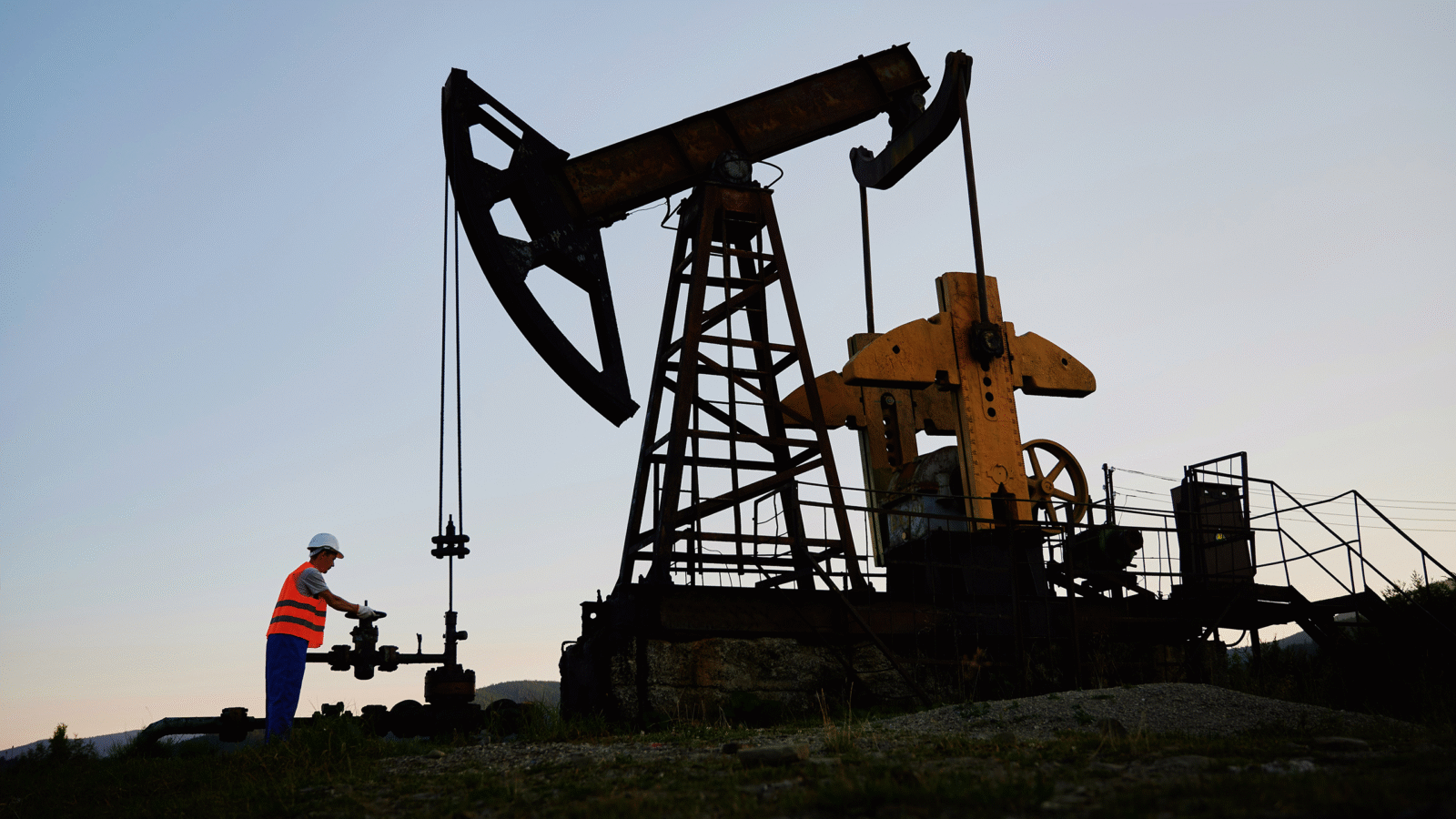

ConocoPhillips Acquires Marathon Oil in $22 Billion Deal

The deal provides increased operations both outside of and within the highly desirably Permian Basin oil fields of Western Texas.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Unlike oil itself, which separates over time, the oil industry is coming together.

On Wednesday, ConocoPhillips agreed to acquire rival Marathon Oil in an all-stock deal with an enterprise value of $22.5 billion, including $5.4 billion in debt. It’s just the latest in a long wave of mergers and acquisitions in the oil industry.

M&A FOMO

In the past year, the oil industry has experienced massive consolidation. But while major players like Exxon, Chevron, and Diamondback Energy completed a shopping spree totaling more than $150 billion in acquisitions, ConocoPhillips has largely been left out to dry. According to sources who spoke with The Wall Street Journal, the oil firm swung and missed on a handful of acquisition targets in recent months, including Endeavor, which eventually sold to Diamondback, and CrownRock, which sold to Occidental.

But now ConocoPhillips has landed a decent-sized fish — one that brings it increased operations both outside of and within the highly desirable Permian Basin oil fields of Western Texas:

- In addition to shale production in the Permian Basin, Marathon will offer ConocoPhillips increased access to the Bakken oilfield in North Dakota, Texas’s Eagle Ford, as well as offshore assets in Equatorial Guinea.

- ConocoPhillips says the acquisition will add total resources equivalent to 2 billion barrels to its inventory; in the first quarter, Marathon says it produced an average of 326,000 barrels per day.

Balancing Act: ConocoPhillips has been public about its desire to expand. In a CNBC interview in March, CEO Ryan Lance said “Our industry needs to consolidate. There’s too many players. Scale matters, diversity matters in the business.” Unfortunately for Lance, not everyone agrees. Though the industry mostly avoided antitrust scrutiny in its recent M&A binge, the tides may be beginning to turn. The FTC took a hard look at Exxon’s acquisition of Pioneer, signaling further interest in the industry’s consolidation.