Oil Giants Need Gas More than Oil Right Now

Last week the Big Oil companies weighed in with their earnings reports, and it was mostly a pretty sorry assembly.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Right now Shell must be feeling like the world is its fossilized oyster.

Last week the Big Oil companies weighed in with their earnings reports, and it was mostly a pretty sorry assembly. Exxon, Chevron, and BP all took a dent thanks to falling oil prices, but one energy giant stood head-and-shoulders above the rest. Shell comfortably exceeded Wall Street’s expectations thanks to its liquified natural gas (LNG) business.

Gas It Up

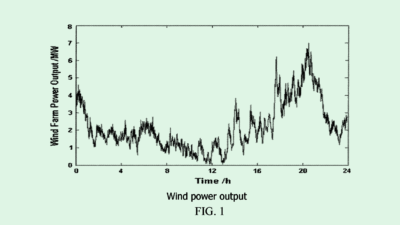

The price of a barrel of Brent crude oil has been coming down since April of this year, with a few peaks and troughs. Although prices have occasionally jumped up in response to conflict in the Middle East, they are sinking overall because of falling demand, especially in China. Some of oil’s biggest cheerleaders, namely the Organization of Petroleum Exporting Countries (OPEC) and the energy giants themselves, tried to talk up oil demand in the second half of the year, but now they seem pretty resigned to their fate. OPEC gave up on trying to drive prices higher in September. That said, OPEC is still maintaining a pretty brave face — today it offered a demand forecast for the rest of the year that’s much higher than other forecasters’ predictions.

This spells big trouble for the oil giants, as demand is not likely to zip back up anytime soon. “2025 looks very problematic for high prices with supply almost certainly outpacing demand by 500,000 to 1 million barrels a day,” Tom Kloza, global head of energy analysis with the Oil Price Information Service, told the AP last month. But for Shell, there’s a silver lining:

- Shell’s chemicals and products division — which encompasses its oil refining — suffered just like the rest of the industry, with adjusted earnings falling from $1.1 billion in the second quarter to $463 million in the third quarter.

- Its integrated gas earnings, on the other hand, grew from $2.7 billion to $2.9 billion, and provided a nice cushion against ailing oil prices.

Hot Air: Right now, LNG’s price is riding high on demand from Asia and continued uncertainty over Russian gas exports — plus, European gas prices are at their highest point this year because of a production outage at Norway’s key energy company Equinor. But the International Energy Agency predicts that gas, like oil, is going to hit its demand peak sometime before 2030, so it can’t afford to get too puffed up.