Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Bob Iger was supposed to be retired now, chanting “Meeska Mooska Mickey Mouse” and riding into the sunset while Disney, his old company, sailed toward its streaming future. Instead, Disney has struggled to bridge the gap from its terrestrial media past to the fractured digital future.

Iger’s replacement as Disney’s CEO, Bob Chapek, lasted less than two years before various Disney stakeholders begged Iger to return. But Iger’s second turn is less a victory lap than a referendum on everything that came before — a recognition that he didn’t entirely pull off his mission to future-proof the 100-year-old institution.

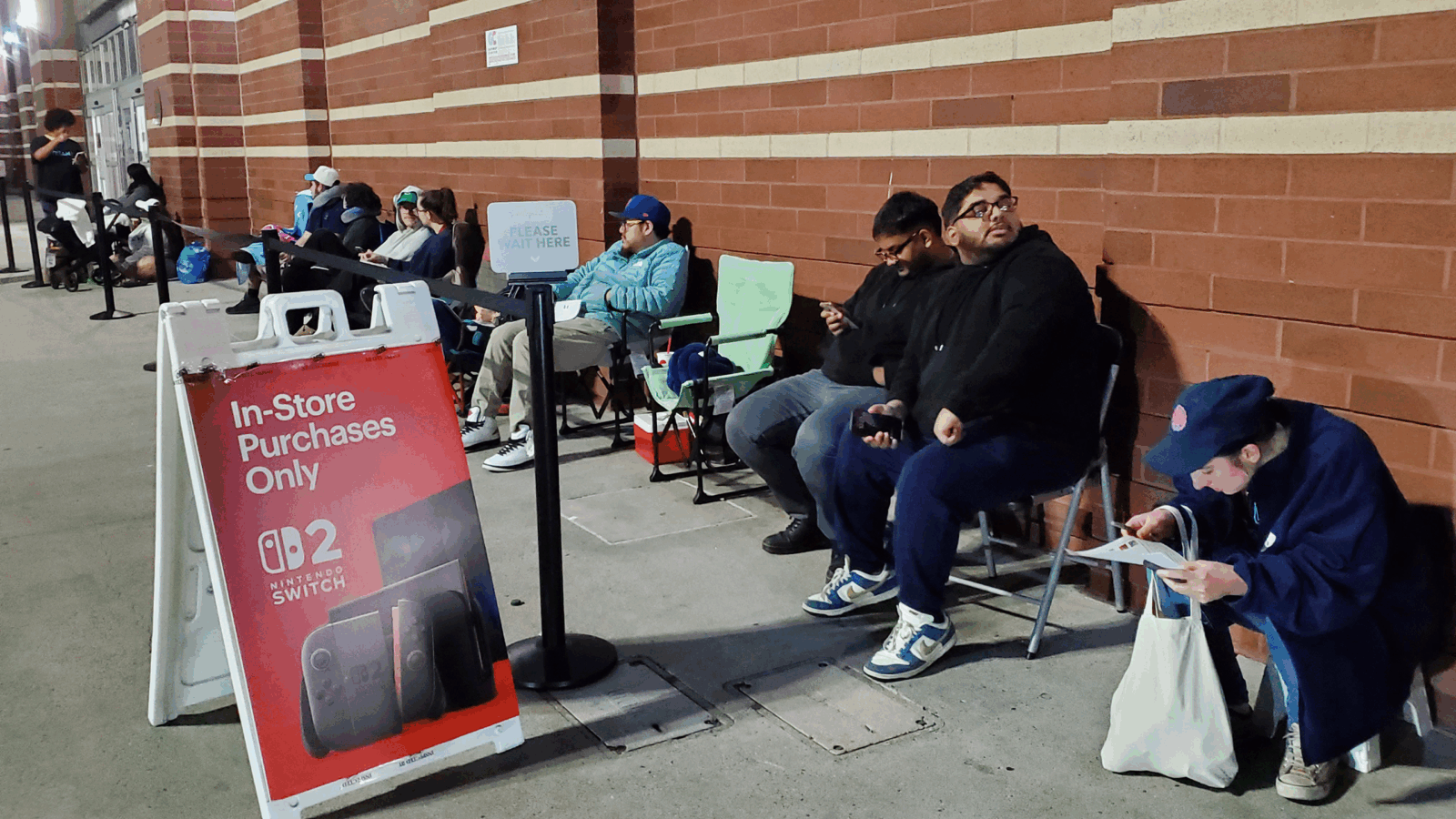

The game has completely changed. As Bloomberg reporter Lucas Shaw recently noted: “People spend more time (and money) on video games than they do on movies, and they spend more time watching YouTube than any other TV network.”

Unwillingly and perhaps unwittingly, Disney exited the 20th century media and entertainment economy and stumbled into the 21st century attention economy.

Even that understates Iger’s laundry list of problems: a historic dual-talent strike, a core TV business shrinking faster than anyone imagined, a string of box-office busts, an uncertain streaming future, a $40 billion debt load from yesteryear’s M&A spending spree, and a mediocre summer at the company’s theme parks.

Can Iger fix the mess he helped to create? Or is this the beginning of a slow sunsetting of the once-mighty Magic Kingdom?

Bob, Disrupted: In 2013, Disney generated more than $13 billion in profit. By 2022, that number fell to $6.5 billion.

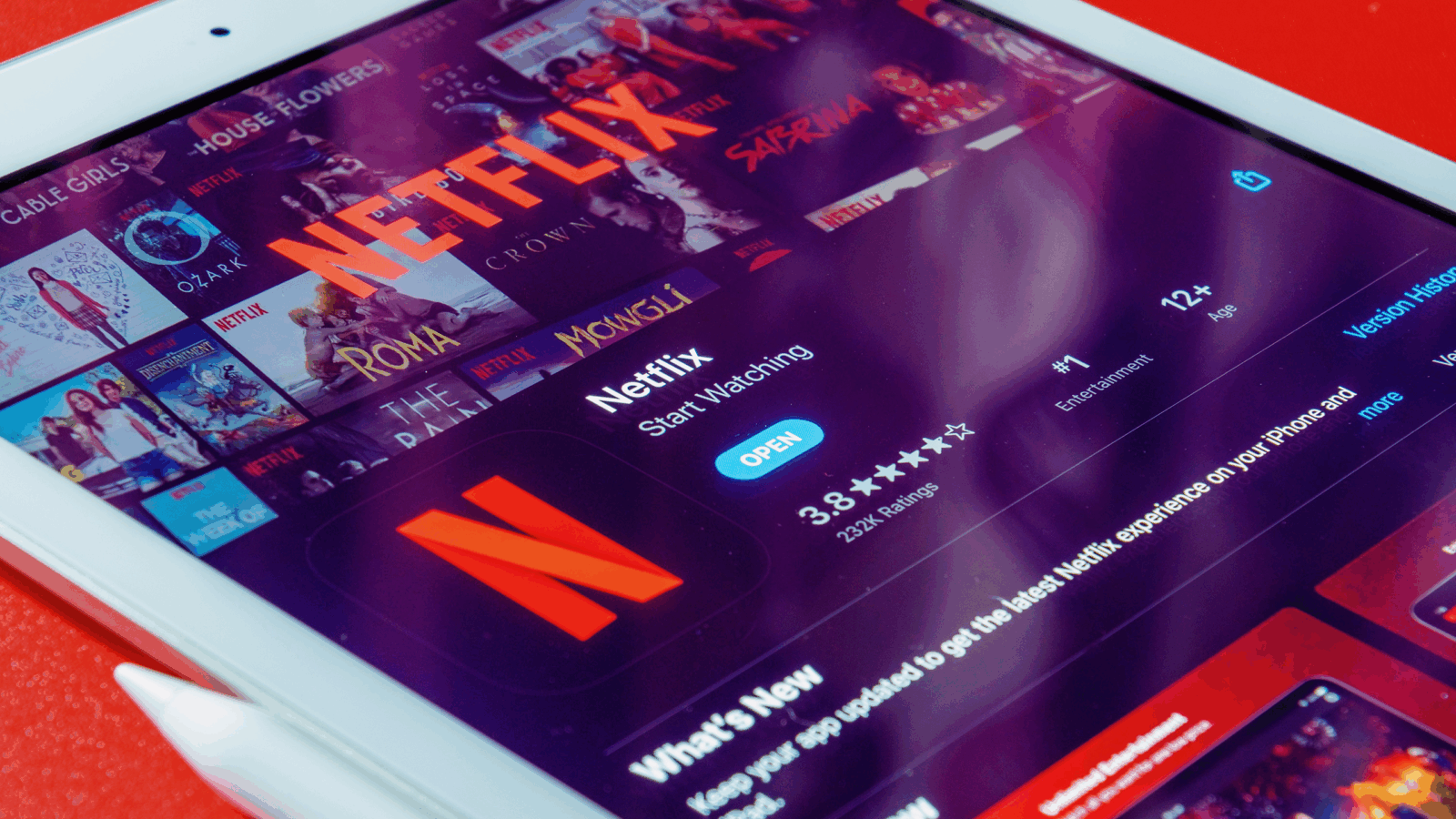

In the same timespan, Netflix went from a high-growth but unprofitable streaming upstart to slow-growth, highly-profitable enterprise.

The flip-flop of business fortunes dovetailed with the newfound bullishness for Netflix by former skeptical analysts like Wedbush Securities’ Michael Pachter.

“When I downgraded Netflix in 2011, I said that they were burning cash, they were in a window that didn’t make sense, and it only works if they obtain the cooperation of all the media companies creating content,” Pachter told The Daily Upside. “I thought that the media companies would figure out that it doesn’t make sense to let Netflix sell their content at such a low price, rather than retaining the content, withholding it from Netflix, and distributing the content in much higher value distribution channels.”

That’s exactly what happened. Disney walked directly into the Netflix trap:

- In 2012, Disney signed an exclusive licensing deal with Netflix to have the service be the streaming home for all Disney’s theatrical releases due later that decade — delivering a treasure trove of the popular Marvel, Star Wars, and Pixar franchises. Just as importantly, Disney also shuttered its own fledgling on-demand distribution platform.

- To be fair, Iger wasn’t the worst offender. CBS licensed entire TV seasons to Netflix the day after they finished airing. Both Fox and NBCUniversal made hay on a similar strategy — remember endless Netflix binges of The Office? — while the latter’s parent company, Comcast, began integrating Netflix directly into its home-cable systems.

“Netflix got to critical mass because everybody gave them everything they asked for at a reasonable price,” Pachter said.

Just a reminder: In the late 2000s, Disney joined Fox and NBCUniversal to jointly own and operate Hulu — a sort of collective hedge against digital that also created a streaming home for past and future content. So much for that. (Today, Disney owns a 67% stake in Hulu, and has long mulled purchasing the remaining 33% from NBC-parent Comcast).

For the legacy players, the easy licensing fees were simply balance sheet gravy on top of their incredibly lucrative traditional linear TV businesses. Until they weren’t.

Bundle Fumble: The cable TV bundle essentially created a paradise of corporate socialism — when a customer subscribed to a cable plan, mostly to watch Disney’s ESPN, they still paid affiliate carriage fees to Disney’s competitors, whether or not they watched TNT or AMC or TBS. One new cable subscriber was everyone’s win. But when they started to “cut the cord” for Netflix, everyone lost.

By the latter 2010s, cord-cutting became an undeniable trend headed straight to the core revenue stream of legacy media:

- In 2013, roughly 100 million US households were pay TV subscribers. By 2019, it was only 83 million, according to estimates from Wall Street analyst firm MoffettNathanson — a dropoff that seemed to be accelerating.

- Global Netflix subscribers, in the same time span, leapt from 35 million to 151 million.

By this time, Iger understood the game: Wall Street loves growth, and it hates shrinking businesses. The answer: Cut out Netflix, dive into streaming, and levy revenues from the declining-yet-still-lucrative linear TV business to bridge the past and the future.

The company launched its Disney+ streaming service in November 2019, with some 10 million fans subscribing on its first day. And at just $6.99 a month, it undercut Netflix’s $12.99 standard tier at the time. Iger handed over the reins to Chapek in 2020, and officially exited the company by the end of 2021 after a brief stint as executive chairman.

Mission hardly accomplished.

Return of the Bob: By the time Iger was wooed back to his old post in November 2022, a few things were clear:

- Wall Street no longer loved growth at all costs, at least for streamers. In April 2022, Netflix reported that it lost subscribers for the first time — while still barely sniffing profitability — sparking a Street-wide streaming mea culpa.

- Maintaining a sustainable streaming service is expensive. And unlike Netflix, Disney couldn’t lean on easy content licensing from third parties; all its competitors were busy building their own streamers.

- Meanwhile, the legacy pay TV business was dying faster than anyone expected, and its short-term future as a buoy to support the streaming business was seriously in doubt.

Disney found itself caught in the middle of the two models, occasionally employing a carrot-and-stick-all-at-once approach to lure pay-TV subscribers in an effort to maintain growth — such as yanking the ever-popular Dancing with the Stars from ABC to stream instead on Disney+.

“This is not necessarily even Disney-specific, but the constant decision which media companies have been facing is between how much do we commit to building out the streaming offering without cannibalizing the underlying legacy core TV business,” Jamie Lumley, analyst at Third Bridge, told TDU. “Because if it’s done too fast, as you’ve highlighted, this could seriously erode that business and not allow it to create the runway to really get those streaming businesses up and offline.“

In its most recent quarter, the company reported a shocking 35% decrease in linear TV net income.

In a starker example, Iger has said its ESPN cash cow will eventually bypass the cable bundle and be offered as a direct-to-consumer product. But those fat cable carriage fees, often the highest-fee channel in basic cable plans, have long buoyed the company. A too-quick move to DTC could see cable companies negotiating to significantly slash ESPN carriage fees — or offer bundles without it all together.

Payout: Iger said recently that Disney’s overall DTC business will achieve profitability in about a year. Other Disney executives believe that to be ambitious, according to a report from The Wall Street Journal. Lumley agrees: “It’s probably not a 12-month question, but more maybe an 18-to-24-month question.”

But Wall Street is focused on profitability, and that’s where Netflix is now, while Disney+ toils away, revealing another of Iger’s big mistakes:

- Netflix posted $1.49 billion in net income in its latest quarter, with 238 million global subscribers paying anywhere between $19.99 a month and $6.99 a month, with ads.

- “Netflix achieved scale. It didn’t matter if they weren’t producing as much content. Because those incremental subscribers are throwing $15 a month, and the incremental cost to serve them is probably $2 of tech spend. So they’re making literally $12 incremental profit per subscriber,” according to Pacther.

- Disney’s highest Disney+ tier remains just $10.99, and its lowest, with ads, $7.99.

“We certainly have felt some challenges of [Disney+’s subscription price] starting off relatively low, and then being a bit anchored to that price point,” Lumley said. “Because even if they double it, they’re below, for example, Netflix’s premium tier. And doubling prices is an eye-grabbing headline, which could then stir up a public response and not necessarily see the desired effects of being able to continue to hold on to that base and have that sort of growth. So pricing is a big question.”

So What’s Next: Iger’s early future-proofing move was to acquire as much popular IP as possible — including multi-billion acquisitions last decade of Star Wars and Indiana Jones owner Lucasfilm, Marvel Entertainment, and the $71 billion acquisition of 21st Century Fox, bringing The Simpsons, the X-Men, and various other franchises into the fold.

But an over-reliance on the IP well may already be leading to underperformance. Marvel films were once near-guarantees for billion dollar box offices, but recent installments, most notably Ant-Man and the Wasp: Quantamania, have fallen far below usual expectations. The franchises’ big summer Disney+ streaming series, Secret Invasion, was an outright bomb. The latest Indiana Jones offering reportedly cost $350 million — and has barely made that much money back. Even old in-house properties haven’t delivered: This year’s The Little Mermaid redux struggled to hit a reported break-even point, and massively underperformed other recent live-action remakes of 1980s and 1990s classics.

“There does seem to be a degree of saturation in the market,” Lumley said. “If we just look at recent Marvel releases, while they still overall have done fairly well versus the market, they’re not the same degree of success that was seen five, six years ago.”

Meanwhile, Hollywood’s labor strike stands threaten next summer’s box office. (Deadpool 3, slated for next May, is currently on production hiatus.) Ironically, the standoff likely could’ve been avoided if studios hadn’t lunged headfirst into the streaming age with such indifference to how it would affect actor and writer residuals — the one contract item each guild has historically cared about more than anything else.

To reduce Disney’s debt, Iger, the former great acquirer, has said Disney intends to get leaner. Nearly everything is for sale, including ABC, which could grab $8 billion, according to some estimates, while the company is exploring “strategic partnerships” for ESPN — a recognition that the company is weary of increasingly expensive rights for live sports.

Of course, Disney pioneered the media conglomerate pinwheel strategy where box office and TV viewership were essentially tools to sell toys and drive interest in theme parks. But even that isn’t going well either:

- Foot traffic at Disney’s US parks fell 23% in the last quarter, according to UBS’ Evidence Lab, a startling acceleration from a 5% drop from the quarter before.

- Meanwhile, Disney recently shuttered the $1,200-per-person-per-night supposedly super-immersive Star Wars: Galactic Starcruiser hotel in Florida, just 18 months after it opened, due to low demand.

Selling Sunset: Iger still plans to retire — eventually. He just signed a contract extension through 2026, though he also just brought in former top deputies Kevin Mayer and Tom Staggs to advise him through the next few years. Both were once considered succession candidates, though they each left to form a Blackstone-backed media startup once it was clear they’d been passed over.

Disney reports its latest quarterly earnings this coming week, perhaps the most critical report in any time in recent company history. As Succession’s Logan Roy once knew, tech is coming, tech is here, and only one major legacy media company is likely to survive — if any do at all. How Iger and company operate in the next few years may just decide if that’s Disney after all.