The New York Times Adds The Athletic, Loses Ben Smith To A New Venture

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

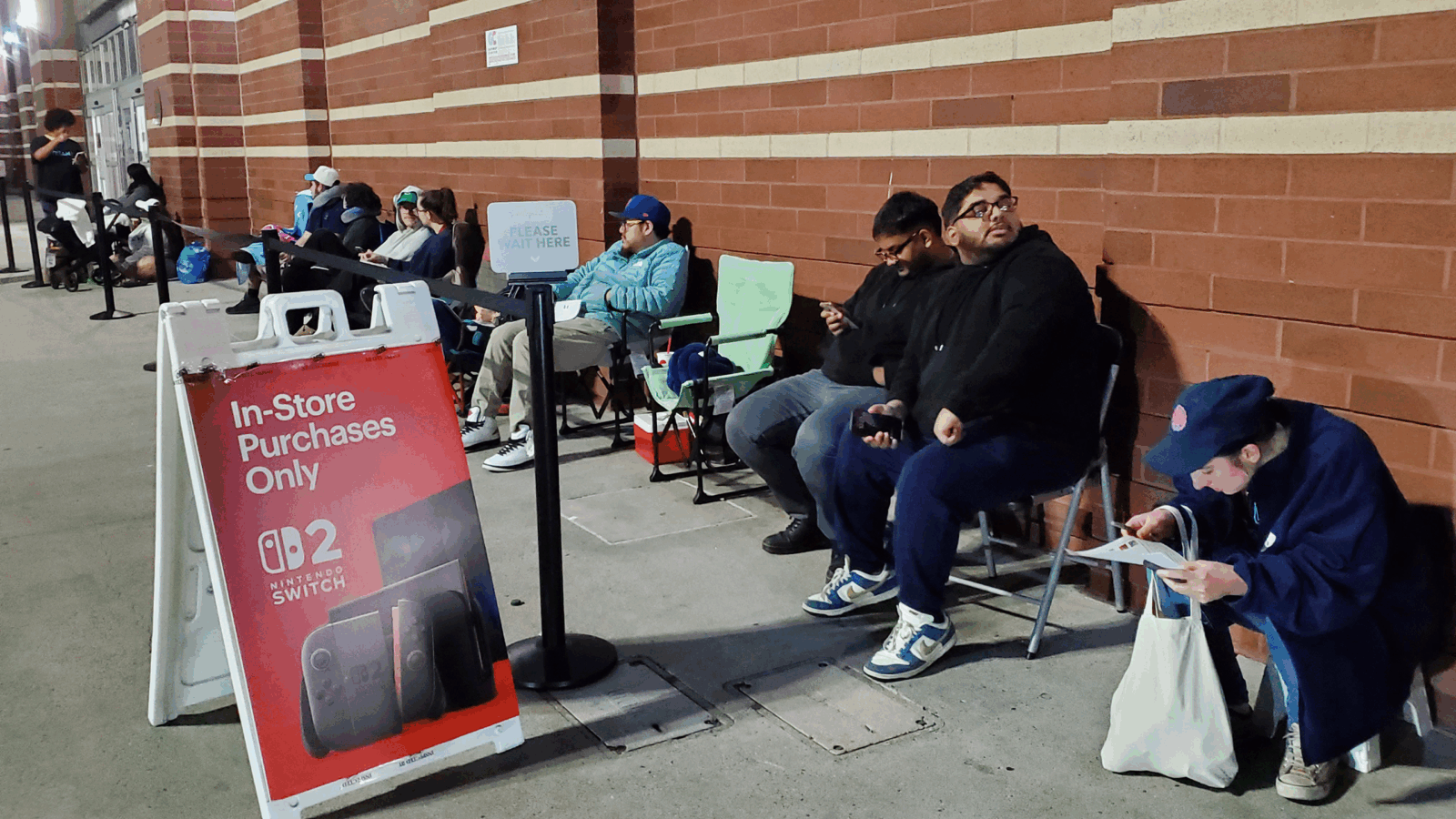

You’ve probably seen the ads: for just $1 a month, you can have The Athletic for an entire year. Apparently, the powers-that-be at The New York Times called that bet and raised it by $550 million. On Thursday, news broke that the paper of record is acquiring the subscription-based sports media startup.

But as the Grey Lady snaps up a competitor, one of its own is leaving to launch another. Media columnist and newsroom star Ben Smith is leaving the paper to launch a new news enterprise with Bloomberg Media CEO Justin Smith (of no familial relation).

Don’t Bury The Lede-Off Hitter

In 2017, Alex Mather, co-founder of The Athletic, told the New York Times his company’s goal was to service local markets with high-quality beat writers and “bleed out” its crusty old media competitors. Now, he’s joining the 170-year old New York Times.

With the acquisition, the New York Times is taking ownership of a venture that’s massively expanded since its 2016 launch:

- In November, The Athletic had roughly 1.2 million subscribers, according to TechCrunch, (in comparison, the New York Times reported 8.3 million in November), and employed a staff of roughly 600.

- Between 2019 and 2020, The Information reported The Athletic operated at a loss, spending roughly $100 million to generate $73 million in revenue— though the company projected profitability by 2023.

Mr. & Mr. Smith: In a farewell interview with The Times, Ben Smith, who previously served as BuzzFeed News’ editor-in-chief, said his yet-to-be-named new venture aims to fill a void of “200 million people who are college-educated, who read in English, but who no one is really treating like an audience”— perhaps a not-so-subtle dig at his now-former employer.

His partner, Justin Smith, meanwhile, claimed there hasn’t been a significant new entrant in the global news business in 40 years, according to a memo seen by Axios. As it stands, he will be self-funding the project, which aims to launch by the end of 2022, as the duo looks for long-term investors.