Will Delaware Overhaul Shareholder Rights Laws?

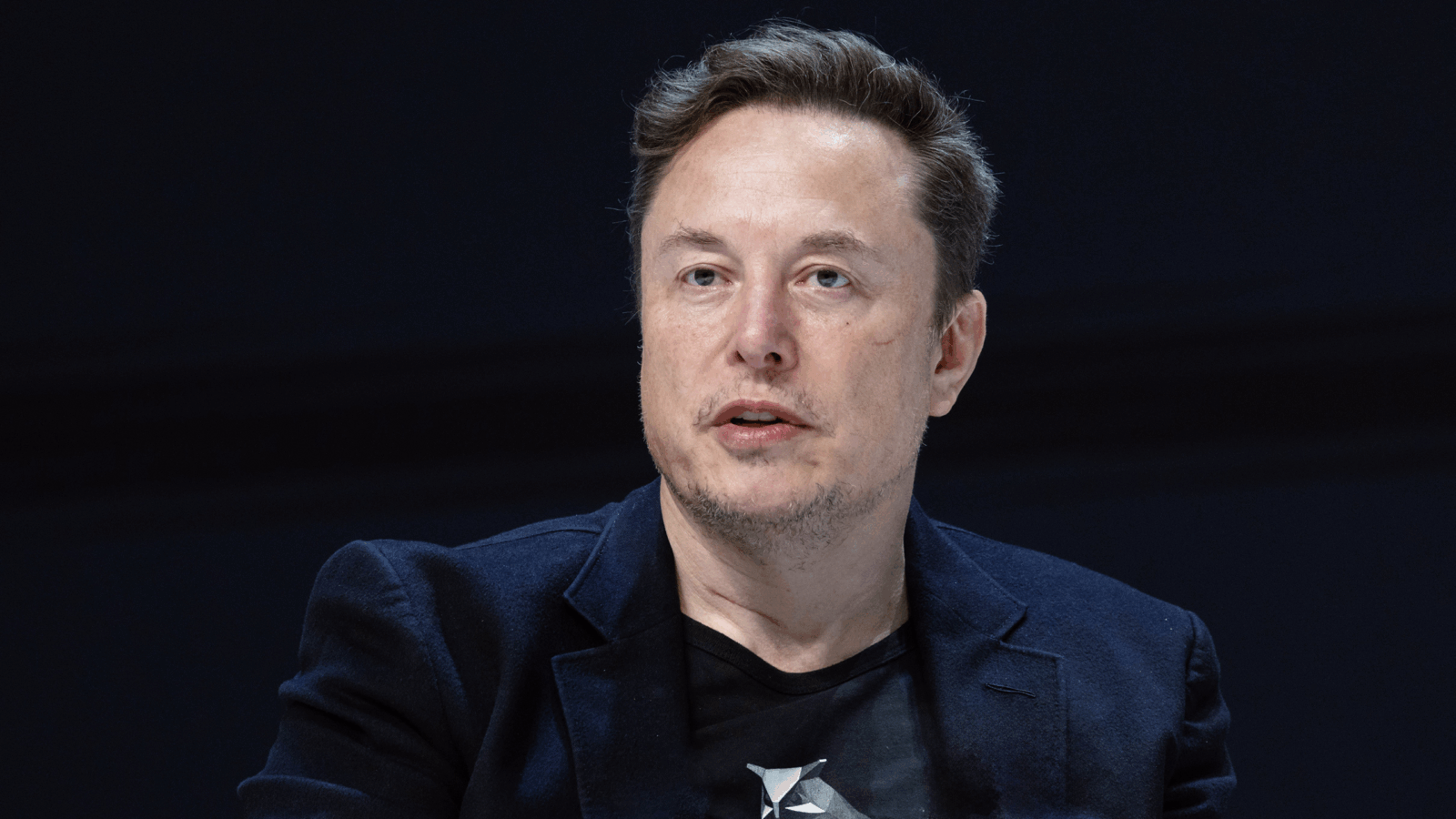

Hey look, Elon Musk is at the center of a controversy that has nothing to do with DOGE, the Hatch Act, or exploding rockets.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Hey look, Elon Musk is at the center of a controversy that has nothing to do with DOGE, the Hatch Act, or exploding rockets.

We’re talking about his ongoing push to reclaim a $56 billion pay package that was nullified by the Delaware Court of Chancery last year. The case has since prompted the introduction of legislation in the state — Senate Bill 21, or SB 21 — that could alter the balance of power between shareholders in Delaware, the legal home to many of America’s largest corporations. On Wednesday, lawmakers met for hearings over the bill.

Crossing the Delaware

At the heart of the matter is one question: What is a controlling shareholder? Flashback to over a year ago, when a Delaware judge ruled that Musk, despite owning roughly just 13% of Tesla shares, held enough sway over the company to be considered the de facto controlling shareholder — and thus had undue influence over negotiations for his massive pay package. It was the most high profile in a string of similar rulings that critics say were overly deferential to noncontrolling shareholders.

That, in turn, led to a series of Dexits (or corporate exits from Delaware) or threats of Dexits. Which in turn prompted some state lawmakers, concerned over the potential loss of a major source of state revenue, to introduce SB 21, which codifies the definition of a controlling shareholder and would likely soothe the concerns of powerful shareholders such as Musk.

It has, predictably, drawn ardent supporters and ardent critics:

- On Tuesday, a group of 21 influential corporate law firms co-signed a letter urging passage of the bill, saying it marks “an important step in maintaining Delaware’s status as the jurisdiction of choice for sophisticated clients,” and noting that over its “long history… Delaware has repeatedly adjusted its approach in order to modernize and respond to market developments.

- On the other side: more lawyers. One group of lawyers who bring shareholders’ cases against companies claims the bill would “take rights away from stockholders to eliminate accountability for billionaire executives.”

Course Correction: So would the bill help Musk if it is even passed? Probably, experts say. In fact, Boston College law professor Brian Quinn in a recent blog post wrote the entire point of SB 21 “appears to be about dictating an outcome” in Musk’s ongoing appeal, given that it leaves room for judges to adjust in accordance to the new law in any pending case. Either way, it’ll be the last time Tesla fights in the state; the company has since moved its legal home to Texas.