housing market

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

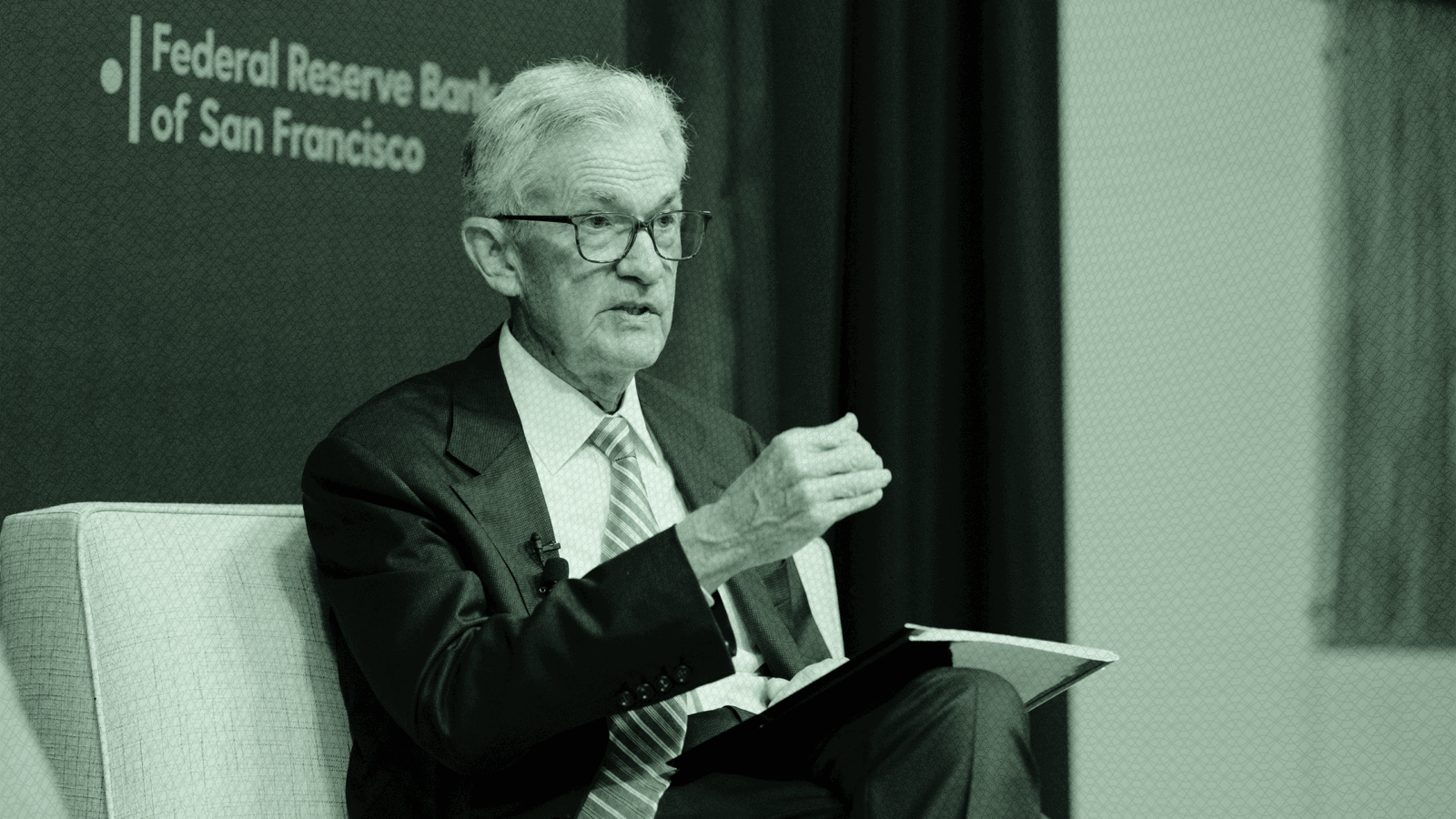

What Does the Fed’s Rate Cut Mean for Clients?

Jerome Powell, Chair of the Federal Reserve. Photo by Federal Reserve Board of Governors via PDM 1.0.

-

Housing Will Drag the Most on US Growth in H2 2025 Slowdown, Says Goldman

Photo via imageBROKER/Thomas De Wever/Newscom