tax

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

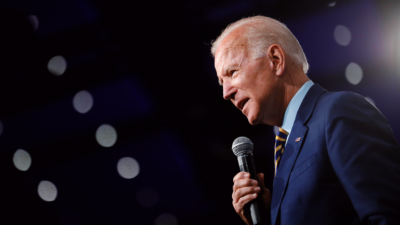

Advisors Are Watching These Tax Law Changes in 2026

Photo illustration by Connor Lin / The Daily Upside, Photos by Pixpine Mockups and Anthony Behar/Sipa USA/Newscom