Chipmakers Reaffirm Winner Status in the AI Economy

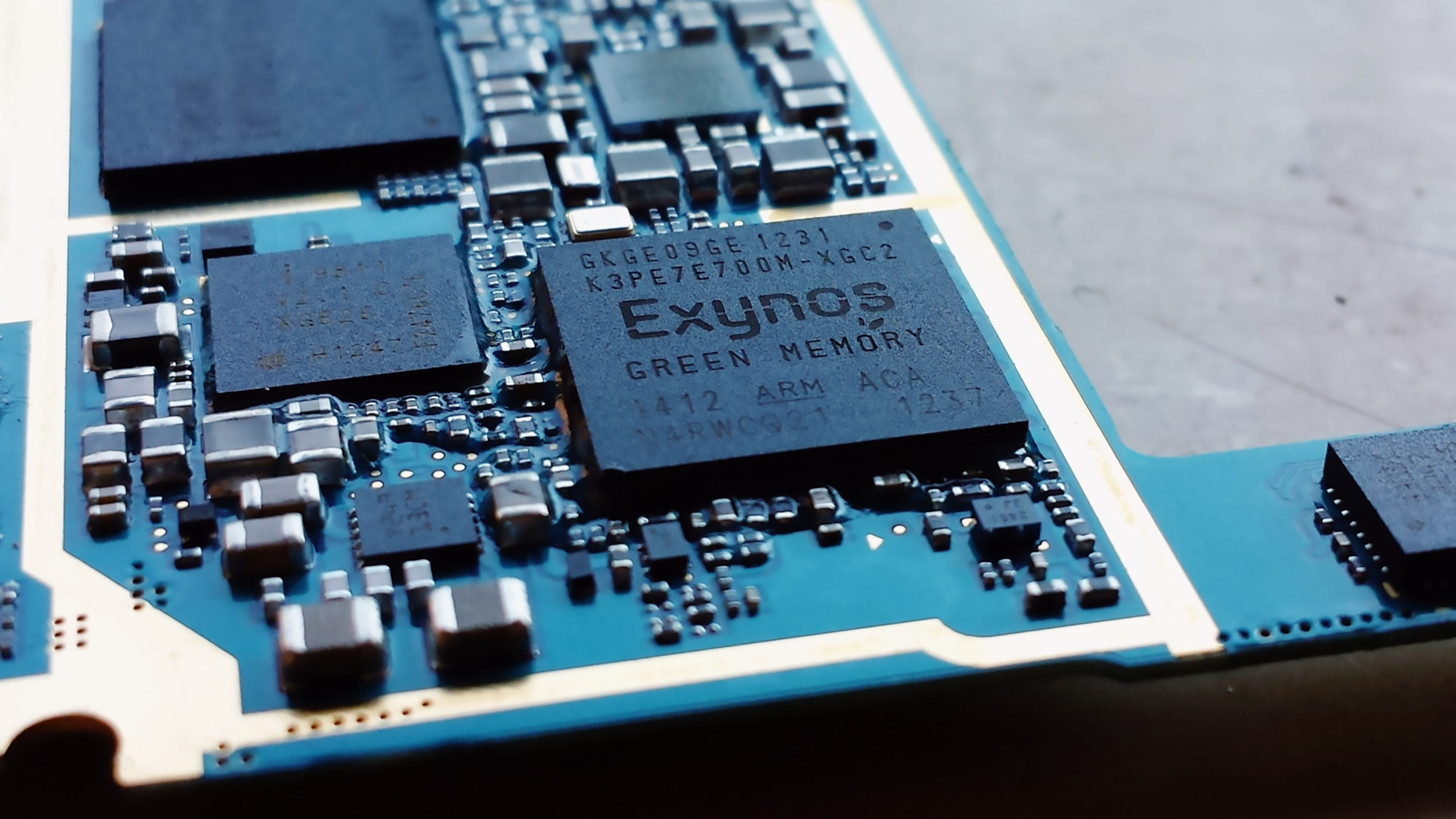

Investors are showing a lot of love to the computer chip supply chain. Nvidia, Samsung, and TSMC are all clawing back gains this week.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

As Big Tech struggles to show how it’s ever going to make money from AI, the technology has been a winning chip for the semiconductor industry.

Despite the shareholder backlash to Silicon Valley’s defiantly all-in approach to costly artificial intelligence initiatives, investors are showing a lot of love to the computer chip supply chain. Nvidia, Samsung, and TSMC are all clawing back significant gains this week.

Chip and Putt

The typical Big Tech hyperscalers — you know, Microsoft, Meta, Google, Apple, and Amazon — are officially in the “prove it” phase of the AI adoption cycle. So far, they haven’t. Microsoft kicked off the week Tuesday with its fourth-quarter earnings report, announcing a 15% year-over-year revenue increase that beat expectations. And yet, Wall Street remained unimpressed. On Wednesday, shares dipped over 1%, extending a roughly 9% decrease over the past month, as the firm’s Azure cloud business disappointed and the company said demand for AI services was outstripping its computing power. Meanwhile, Microsoft’s capital expenditures in the latest quarter hit $19 billion, up nearly 80% from a year prior — it said nearly all that went toward cloud and AI spending. Microsoft sees only one way out: spend more.

Same with the others. In its earnings call Wednesday, Meta too reaffirmed its commitment to AI spending. And analysts at CFRA said they expect Amazon to “ramp up” investment on AI infrastructure this year.

That’s music to the ears of semiconductor companies, which will continue to thrive so long as Big Tech doesn’t deviate:

- Nvidia, which had fallen around 24% since a June peak, rebounded 13% on Wednesday following Microsoft’s earnings call. Meanwhile, Samsung climbed 3.5%, TSMC over 7%, AMD 4.5%, and Arm 8%.

- The rising tide lifted just about every player in the semiconductor sea: 24 of the 25 companies in the VanEck Semiconductor ETF posted gains on Wednesday, with most increasing over 2%.

New Rules: Big Tech’s doubling down on AI wasn’t the only good news for the chip industry Wednesday. Reuters also reported that the US government is planning a new rule that would stop some foreign countries from shipping chip-making equipment to Chinese companies — though the rule will include carveouts on shipments from key allied countries like Japan, the Netherlands, and South Korea. That’s huge news for Tokyo Electron and the Netherlands-based ASML, which saw share-price bumps of 15% and nearly 9%, respectively.