Dan Ives: Trillions in AI Spending Are Just the Start of ‘Fourth Industrial Revolution’

Dan Ives has traveled more than 3 million miles over 25 years, touring data centers, and meeting CEOs and CIOs where AI is being built.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

For closely watched analyst Dan Ives, artificial intelligence is not a moment of irrational exuberance — it is the structural backbone of a new economic order. He calls it the “fourth industrial revolution,” not as a provocative soundbite, but as a literal description of a transformation that is reshaping industries, labor and capital for decades.

His conviction doesn’t come from models or dashboards. It comes from old-school, face-to-face meetings. Over the past 25 years, Ives has logged more than 3 million miles, enough to make the clouds feel like a second home, while touring data centers and meeting CEOs and CIOs at the heart of the tech world. “You can’t see demand from a spreadsheet,” Ives told The Daily Upside in a long-ranging interview. To be sure, Ives documents his travels across X and LinkedIn, typically wearing the signature colorful suits that have become a recognizable part of his public persona.

‘A 1996 Moment, Not 1999’

“More money will be spent in the next two years than the last 10 combined,” he says. “We still believe it’s the second, third inning in this AI revolution.”

That view is widely shared across the investment world. Cathie Wood of ARK put it simply recently: “This AI story has just begun. We are in the first inning.” According to Gartner, total global AI spending — including infrastructure, software, chips, services, and more — will probably reach about $2 trillion in 2026.

Ives is unequivocal: The AI boom is not a bubble. Comparisons to the dot-com era, he argues, miss the mark. This isn’t capital chasing vague promises — it’s capital funding infrastructure. Cloud migration, sovereign AI build-outs, semiconductor capacity and enterprise software overhauls aren’t speculative ideas; they’re tangible shifts already underway. The spending is real, the deployments are happening, and adoption is still in its early phases.

“This is a 1996 moment, not 1999,” Ives says. Market sentiment may swing, but the structural trajectory, in his view, is firmly intact.

Billionaire investor Michael Burry of “The Big Short” is taking the other side of the spectrum, placing bets against AI names like Nvidia and Palantir worth about $10 million.

‘Fourth-Derivative’ Players

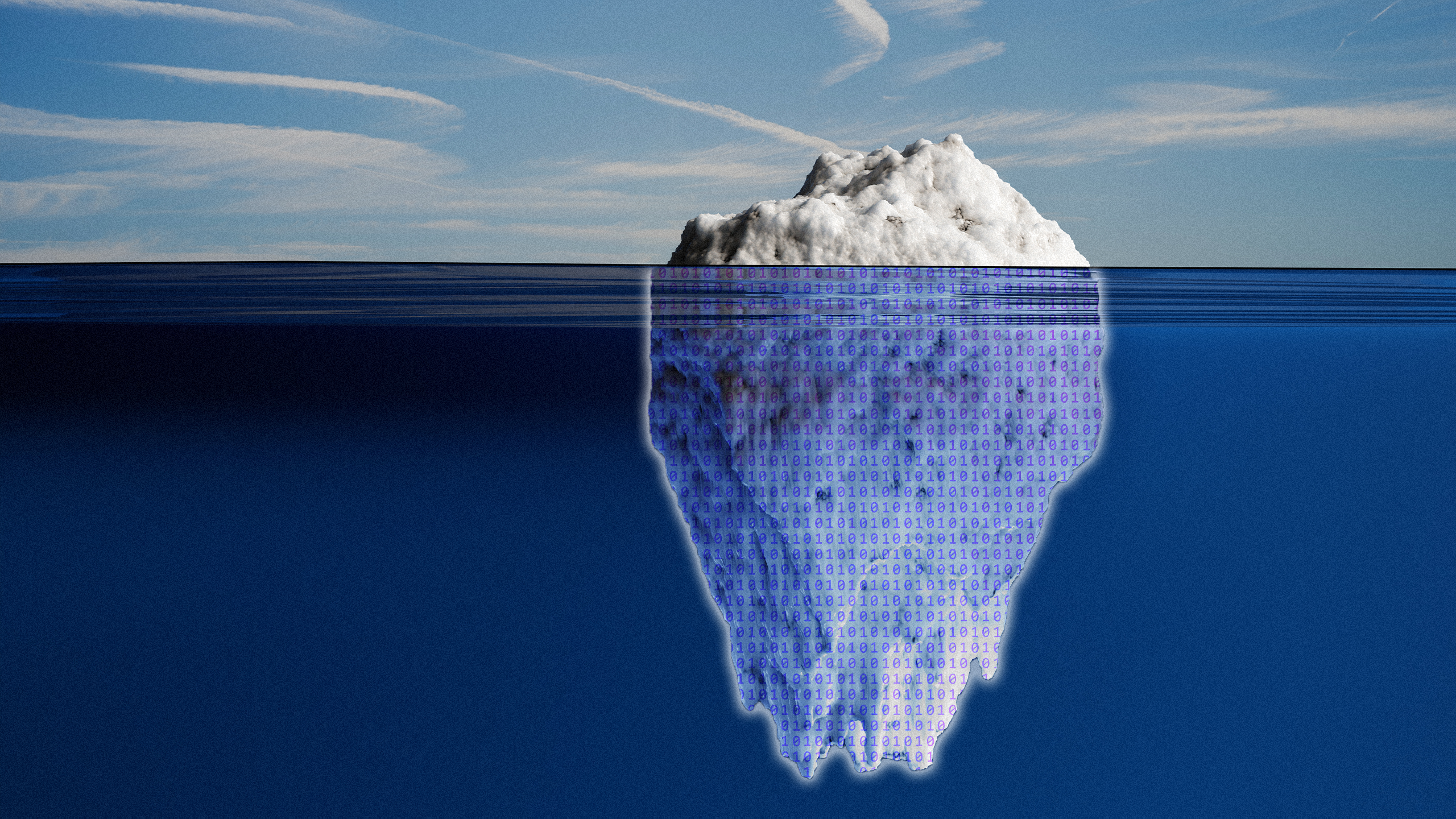

While a lot of ink is dedicated to headline Big Tech winners such as NVIDIA, Microsoft, Amazon, Google and Palantir, Ives is equally attentive to the layers beneath.

Cybersecurity firms like CrowdStrike, Zscaler and Palo Alto are structural winners in a world where AI accelerates both attacks and defenses, Ives says. Data-center infrastructure, cooling and power, provided by companies like Vertiv and Akamai, are quietly essential. And enterprise software transformations, often invisible to casual observers, will ultimately underpin much of the AI economy.

It is in these overlooked layers that Ives sees the real opportunity for alpha.

As AI builds the new economy for enterprises and consumers, first-order beneficiaries like NVIDIA, Microsoft and Palantir are “core names” in 2026. But “second-, third-, and fourth-derivative” players, especially in cybersecurity, are critical as AI adoption scales, creating opportunities for companies like CrowdStrike to capture massive structural upside, he says.

Ives’s perspective also extends well beyond infrastructure and cybersecurity. His track record is built on early, contrarian calls on Tesla, Apple and Nvidia, companies that ultimately reshaped entire industries. Nvidia’s GPU dominance now defines the AI compute era; Tesla’s work in autonomy and robotics aligns with his long-term view of integrated systems; and Palantir’s long-awaited enterprise pivot confirmed his knack for recognizing transformative opportunities in overlooked corners of the market.

Sovereign Initiatives & Semiconductors

AI adoption is accelerating faster than any prior technology cycle.

Ives projects that enterprise and government AI investment over the next two years will exceed the cumulative spending of the past decade, reflecting real infrastructure build-out rather than hype.

The Kobeissi Letter wrote that 63% of recent US economic growth is attributable to AI-related spending. “Without AI spending, the economy is running FAR weaker than it seems,” it adds.

Indeed, sovereign AI strategies are reshaping the global landscape. Both the US and China are investing heavily in computers, advanced semiconductors and AI-driven industries. This competition highlights the strategic role of infrastructure leaders like Nvidia and national-scale software platforms such as Palantir, increasingly embedded in government and defense operations.

Recent developments illustrate these stakes. On December 8, President Trump announced that Nvidia would be allowed to ship H200 AI chips – its second-best AI chips – to “approved customers” in China, with 25% of sales directed to the US government to protect national security. The move underscores AI hardware’s role as both an economic and strategic asset.

Foundational hardware remains critical too. Semiconductor supply chains — anchored by TSMC, ASML and Intel — form the backbone of AI growth. Ives notes these firms are as strategically important as the software they support, as accelerating AI compute demand continues to strain manufacturing capacity.

Guard Duty

On December 1, Wedbush maintained its Outperform rating on CrowdStrike Holdings with a 12-month price target of $600, versus a trading price of $509.16 and a market cap of $127.8 billion.

CrowdStrike, regarded as the gold standard of AI-driven cybersecurity, remains on Ives’ AI 30 List and Wedbush’s Best Ideas List, bolstered by its agentic security strategy, including innovations like AgentWorks, which leverages the Charlotte AI framework.

With an estimated $150 billion in AI-addressable assets, enterprises increasingly need agentic security operation centers to counter AI-enabled threats, making CrowdStrike a critical player in securing the AI economy.

M&A integrations of Onum and Pangea, the expansion of Falcon Flex, and milestones like FedRAMP High Authorization for Charlotte AI position CrowdStrike to capture a growing share of an underpenetrated public sector market and international opportunities.

‘The Messi of AI’

When Palantir went public at roughly $10 per share, many investors dismissed it as a government-dependent contractor. Ives saw a company quietly evolving, winning enterprise footholds and executing a strategic pivot that Wall Street had yet to recognize.

That conviction crystallized on July 28, 2023, when he initiated Wedbush coverage with an Outperform rating and a $25 price target; the stock had closed the night before at $16.15 — implying more than 50% upside. As Palantir’s AI capabilities matured, Ives raised his targets and famously called the company the “Messi of AI,” a reference to soccer great Lionel Messi.

Today, Palantir trades around $180, a stunning validation of Ives’s thesis and one of the clearest examples of spotting generational winners before the market recalibrates.

“Palantir has been so out of favor over the years,” Ives says. “But it was recognizing what (Alex) Karp and Palantir were doing. Just to see that play out and the stock go from $10 to where it is today … That has been the most rewarding one.”