Behind Sam Altman’s ‘Code Red’ Response to OpenAI Competitors’ Gains

In memo this week, Altman promised the release of a new reasoning model next week that bests Google’s Gemini.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

“I expect the vibes out there to be rough for a bit.” So said Sam Altman in a memo to staff last month. And the vibe shift has indeed been fast and furious.

OpenAI’s leader declared a “code red” to staff in a new memo, first reported by The Information, as the world’s most valuable startup comes under siege from a wave of emergent AI rivals.

The Replacements

Altman’s memo went out just as Google launched its impressive new Gemini 3. The Alphabet subsidiary said its new chatbot bested ChatGPT and Anthropic’s Claude in a series of key tests, and Altman conceded the release could “create some temporary economic headwinds” for OpenAI. Take it from one convert, Salesforce CEO Marc Benioff, who last month tweeted: “I’ve used ChatGPT every day for 3 years. Just spent 2 hours on Gemini 3. I’m not going back.”

ChatGPT still maintains a massive, 800 million-strong and growing weekly user base and is backed by OpenAI’s world-class research. In this week’s memo, Altman promised the release of a new reasoning model next week that bests Gemini. Still, the Google chatbot’s user numbers are soaring, up to 650 million in October from 450 million in July. The search giant has the built-in advantage of offering Gemini through integration with its other products. Calling it a “critical moment,” Altman will focus on improving ChatGPT at the expense of other projects including health, shopping, and personal assistant AI agents. A quick look at the financials makes clear why shoring up the company’s core product is imperative:

- Anthropic, whose Claude has won business customers for its powerful coding capabilities, forecasts it will break even in 2028, according to documents obtained last month by The Wall Street Journal. OpenAI, meanwhile, expects $74 billion in operating losses that year, equal to 75% of revenue, and doesn’t foresee a profit until 2030.

- With $1.4 trillion in computing commitments through 2033, OpenAI needs continued growth to keep up with its expected cash burn. HSBC analysts determined that, even if its revenue reaches $200 billion by 2030 (up from some $20 billion this year), the company will need to bridge a $207 billion shortfall with debt, equity fundraising or expedited revenue growth.

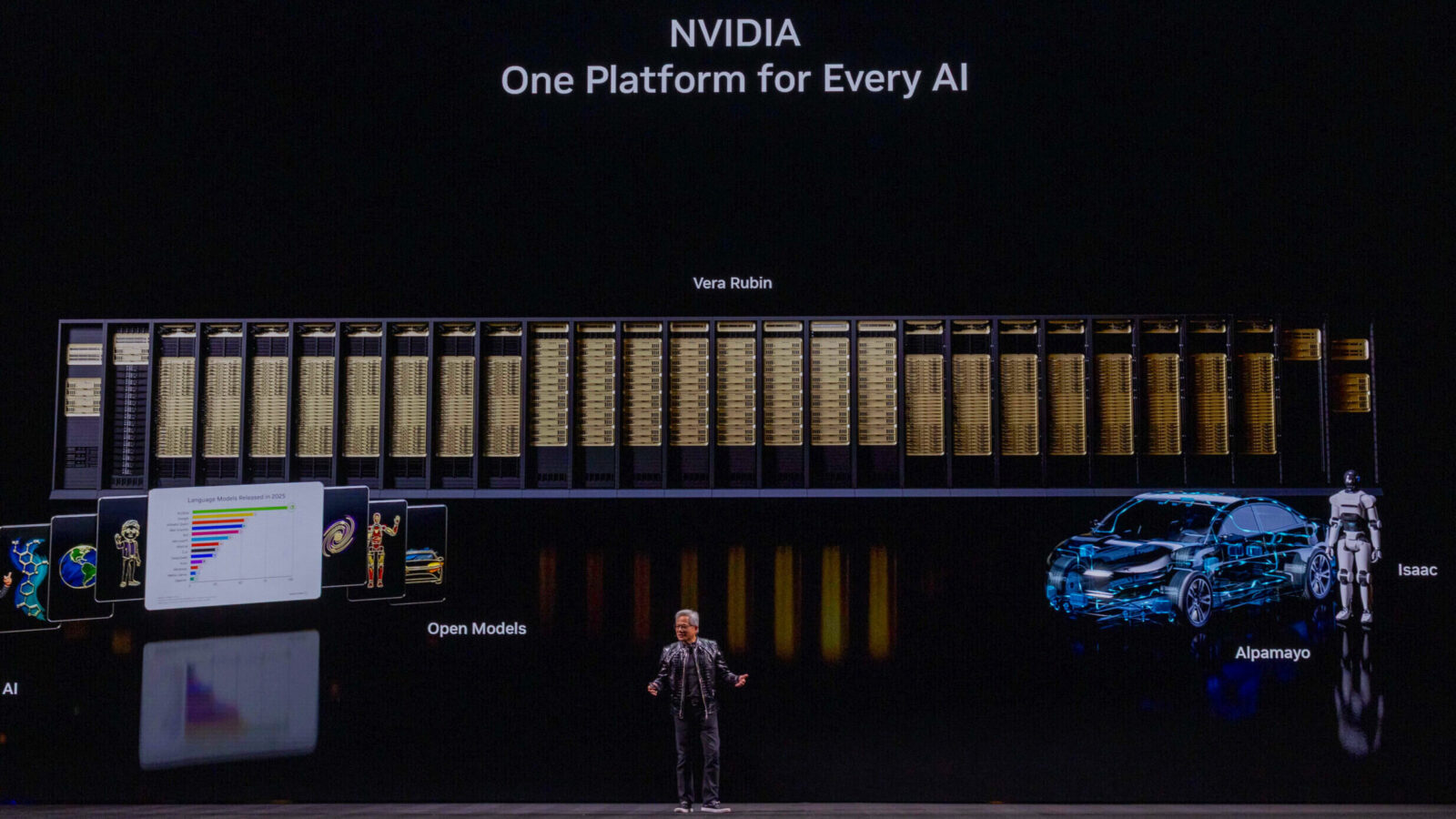

It’s All Connected: Google’s AI advances are delivering headaches all around. The search giant trains Gemini on its own Tensor Processing Units (TPUs), rather than semiconductor giant Nvidia’s graphics processing units (GPUs) that are popular with rivals. While Nvidia’s chips are more versatile, the purpose-built AI TPUs come cheaper and use less power, and Google’s AI rise has led to some jitters among investors. Nvidia is down roughly 1.2% since Gemini 3 was released on November 18, while Broadcom — which helped develop Google’s chips — is up 11.5%.