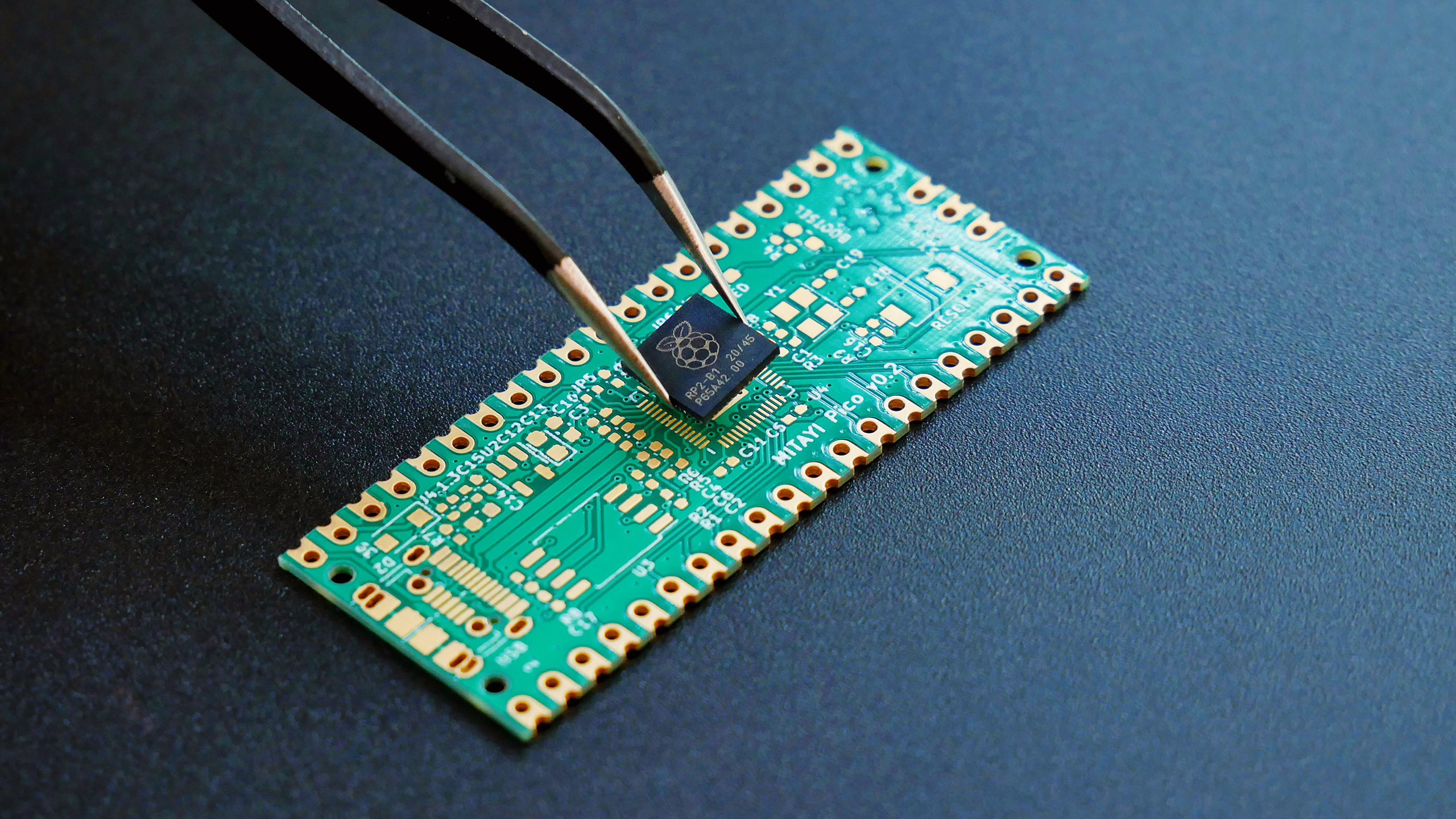

Mexico is Quietly Becoming an AI-Hardware Manufacturing Hub

With AI on the mind, US tech heavyweights are are urging Taiwan-based contract manufacturers to move production facilities to Mexico.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Will AI be to Mexico what the iPhone was to China?

As US industry strategically uncouples from China, several tech heavyweights in the AI hardware game are urging Taiwan-based contract manufacturers to move production facilities to Mexico, a comfortable 7,700 miles from Beijing, according to a Wall Street Journal report this weekend.

It’s Fun to Stay at the USMCA

The last time major advancements in consumer technology spurred a manufacturing boom, when the iPhone debuted in 2007, much of the production process ended up centralized in China. This time around, with the rush of AI requiring all new specialized hardware, US tech players are attempting to re-draw the battle lines — especially amid increasingly protectionist policies. They have a new policy ace up their sleeve: the US-Mexico-Canada Agreement (USMCA), a free trade deal signed in 2020 that makes relocating manufacturing to Mexico much more attractive.

North American countries “hope to replace products imported from Asia as much as possible,” James Huang, chairman of the Taiwan External Trade Development Council, told the WSJ. “Based on this consensus, Mexico is poised to become the most important manufacturing base for the USMCA.”

As the dawn of the AI era begins, the impact of the USMCA is already being felt:

- Hewlett Packard Enterprise and Dell, two major server manufacturers, have already asked certain suppliers to relocate some cloud computing production to Mexico, sources told the WSJ. Taiwan-based Foxconn, the world’s largest tech contract manufacturer, already has Mexico-based facilities producing AI servers for Nvidia, Google, and Amazon, sources also told the WSJ.

- In fact, Foxconn says it has invested $690 million in Mexico in the past four years, and Taiwanese officials now estimate there are more than 70,000 people in Mexico employed by around 300 Taiwanese firms. Last year, two-way trade between the two countries topped $15 billion, according to the Mexican government.

Last year, Mexico-made products accounted for more than 15% of US imports, besting China’s nearly 14% for the top spot. In 2015, China accounted for 21.5% of such imports.

Not So Fast: The shifts in business relationships have not gone unnoticed in Beijing, whose President Xi Jinping has launched a major charm offensive. This weekend, he hosted over a dozen high-profile US business leaders to persuade them to continue investing in the country. We looked, but no one posted anything on TikTok.