With AI Bases Loaded, Nvidia Bats a Quarterly Earnings Home Run

Nvidia faced “the tough task of meeting high earnings expectations and high skepticism around AI capex,” per analysts at Bank of America.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

You can stop holding your breath now.

Nvidia, batting clean-up this earnings season, reported its quarterly earnings on Wednesday just as bubble jitters were manifesting in a four-day losing streak for the S&P 500. Investors who had feared anything short of a home run were instead delighted by an out-of-the-park dinger. A record $57 billion in revenue blew past Wall Street’s expectations, profits soared, and the chipmaker even raised its guidance for the fourth quarter.

The Earnings Call to End All Earnings Calls

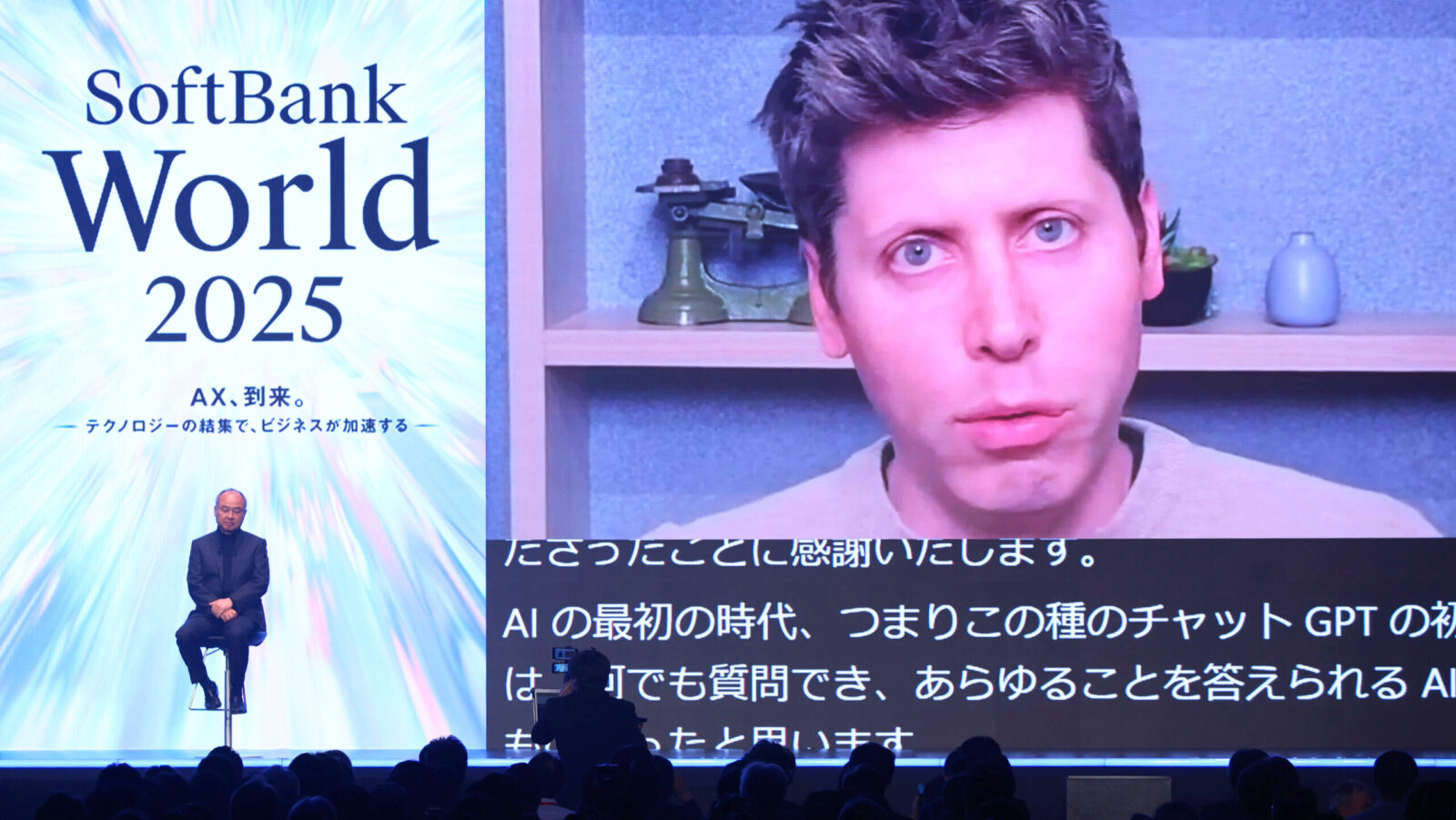

While the party is still in full swing, for now, all eyes were on the largest company in the world for a reason. While each of the five major tech hyperscalers has already reported beats this earnings season, massive capital expenditures in the present, with more planned for the future, were beginning to spook investors. Meanwhile, big names had started to bow out of Nvidia. SoftBank sold off its stake in October (though it swore the move “had nothing to do with Nvidia itself”), as did Peter Thiel’s hedge fund, while Michael “Big Short” Burry drew attention for his own short position on the semiconductor king.

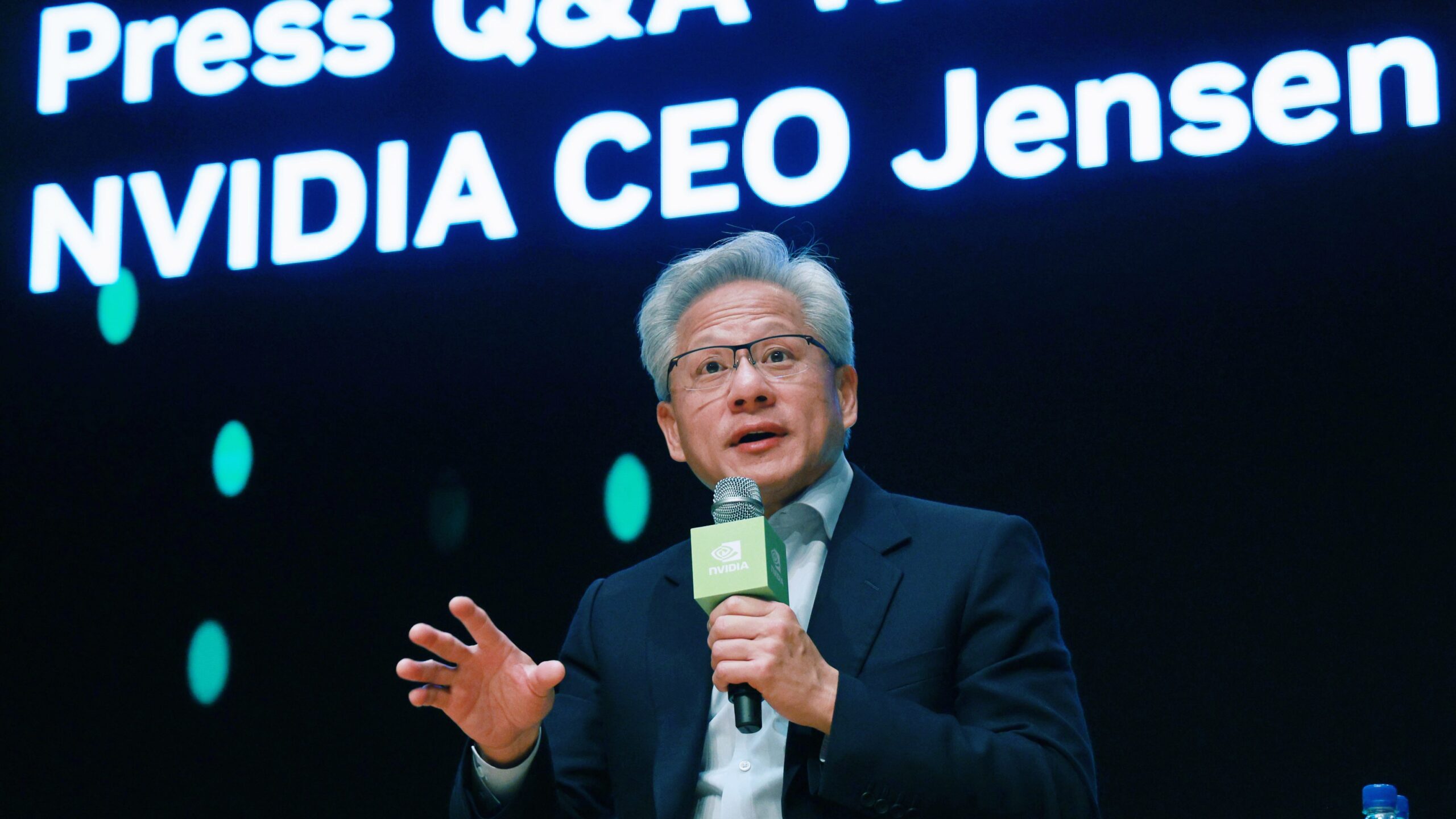

In all, that meant Nvidia entered its call on Wednesday facing “the tough task of meeting high earnings expectations and high skepticism around AI capex,” according to analysts at Bank of America. In a call with analysts following the earnings report, CEO Jensen Huang said that many of Nvidia’s biggest customers (i.e., hyperscalers) are already making money off of their AI investments. Nvidia itself has been among the biggest beneficiaries:

- Sales were up 62% from a year ago, while the company said revenue in the current quarter is expected to climb as high as $65 billion, about $3 billion more than analysts had expected.

- Net income for the previous quarter jumped to nearly $32 billion, also besting expectations, while Nvidia’s gross margin reached 73.4%; executives said that will climb to 75% in the current quarter after dipping earlier this year amid the costly rollout of its high-end Blackwell chips. “Blackwell sales are off the charts, and cloud GPUs are sold out,” Huang said in a statement.

Soothe Yourselves: Nvidia climbed more than 5% in after-hours trading on Wednesday. “Every investor has been waiting for an air pocket in demand, but supply looks like it is continuing to be the problem as the former continues to be off the charts, specifically in Blackwell and cloud GPUs,” David Wagner, head of equity and portfolio manager at Aptus Capital Advisors, wrote in a note seen by The Daily Upside. In a call with analysts, Huang stressed that deals with AI firms like Anthropic and OpenAI, which have sparked concerns of circular financing, ensure that Nvidia tech remains at the heart of the industry. “We run them all,” Huang said, referring to major AI models.