Major Investors Are Getting Sick of Apple’s AI Cloak and Dagger

Two big shareholders are supporting a proposal that calls on the tech titan to disclose its future plans for generative AI.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Apple likes to keep developing products under lock and key, but some investors want the company to bust a hole in the vault and share what it’s thinking about that crazy little thing called generative AI.

Two major Apple investors, Norges Bank Investment Management and LGIM, said they’re backing a proposal at the company’s annual shareholder meeting on Tuesday to force it to disclose more information about risks associated with its AI endeavors. Apple is telling shareholders to reject the motion, saying it would lay bare its highly guarded strategy, per the Financial Times.

The Not-So-Secret Walled Garden

Apple hasn’t pitched into the generative AI boom with the same extroverted fervor as its Silicon Valley peers, but that might change after a Bloomberg report on Tuesday that it’s ditching plans to build an electric car to focus more on generative AI projects. Just what those might be is anyone’s guess. Rival Google has already started touting AI features embedded in its messaging system for Android phones. If Apple wants to hold onto that blue text-bubble caché, it needs to exit stealth mode soon.

Apple’s investors have generally gone along with the company being as mysterious as possible about product launches as part of its secret sauce — but when it comes to AI, that approach just makes people anxious:

- LGIM said in a blog post that the shareholder proposition, called Resolution 7, mandates that Apple produce a “transparency report on the company’s use of AI in its business operations” as well as “disclose any ethical guidelines that the company has adopted regarding the company’s use of AI technology.”

- LGIM didn’t give any specific examples of AI-associated risks, but said that “data privacy and security, regulatory compliance and workforce transitions” were top of mind, and added that it sees “societal trust in AI as a material risk.”

LGIM added that it brought the issue to Apple directly, but the company hadn’t committed to any kind of increased transparency. “Apple is among several companies that have outsized influence on the integration of AI into our economy,” LGIM wrote.

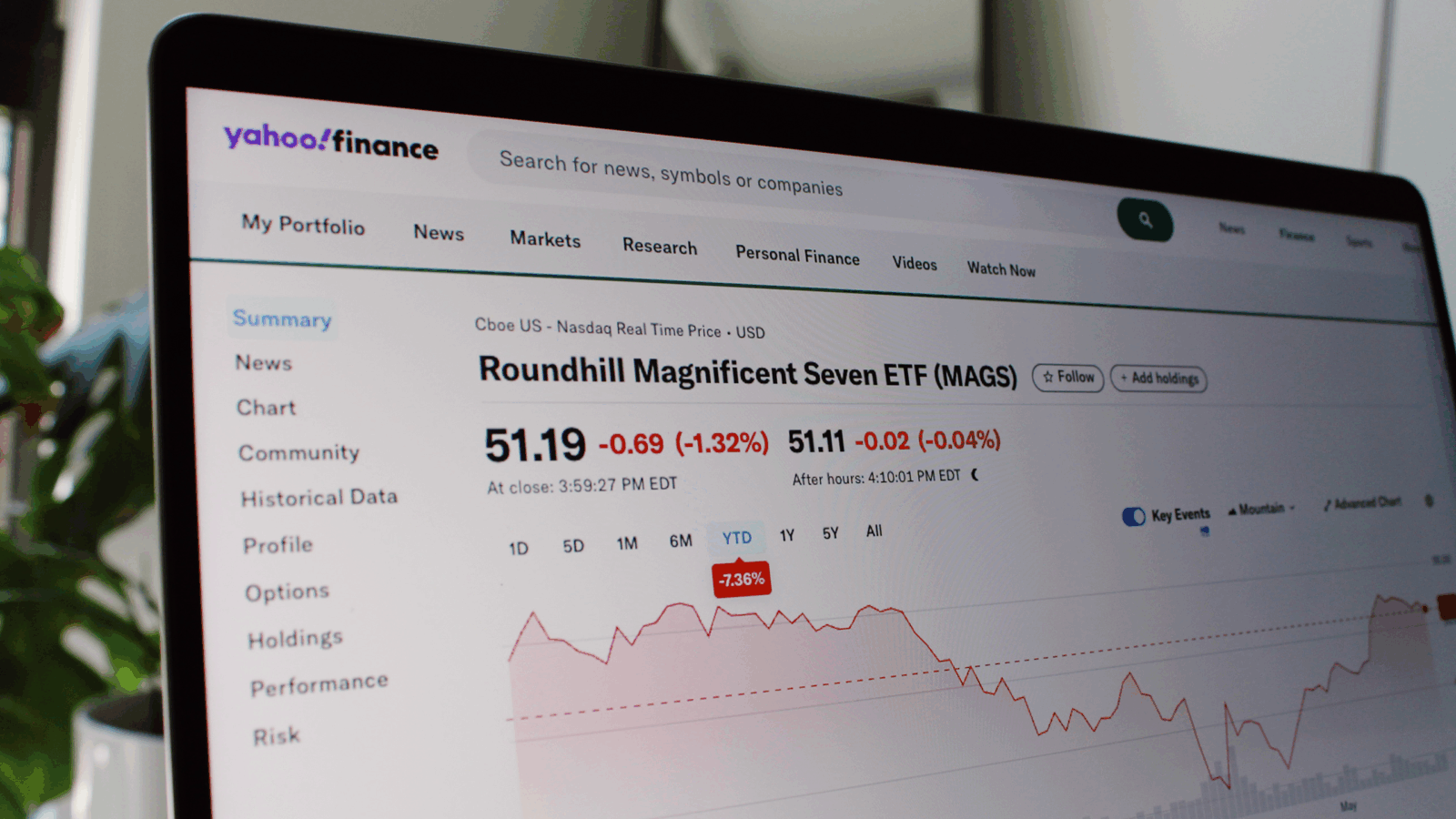

Overflowing Glass Half-Full: Integration into our economy might mean figuring out how to make money off the technology. Last year, investors gleefully poured billions into generative AI, but this year could see a major crunch as the tech doesn’t hold tons of promise for near-term return on investment, as reported by The Verge last week. “We’ve gotten very frothy very quickly,” Bernstein analyst Mark Shmulik told the news outlet. It’s the ultimate optimism-vs.-pessimism showdown.