Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

If you have an internet connection, you’ve probably read that the price of bitcoin has been soaring in recent weeks. Instead of quoting percentage moves, here are a few color anecdotes that help paint the picture:

- The owner of two popular NYC bars has listed the watering holes with an asking price of twenty-five bitcoin (roughly $1.4 million).

- Tesla has notched $1 billion of paper gains after disclosing a $1.5 billion stake just two weeks ago.

But it’s not just the coins themselves that are minting multi-millionaires. Coinbase, the largest digital currency exchange, has hit a $100 billion valuation in the secondary markets.

Riding Bitcoin’s Wave

Founded in 2012, Coinbase is the largest crypto exchange in the U.S. as measured by trading volume. In the first nine months of 2020, Coinbase notched $141 million in net income off $691 million revenue from trading fees and commissions and the company recently filed for a public listing.

Mirroring the hyperbolic moves in Bitcoin itself, the value of Coinbase shares trading on the secondary market have doubled in recent weeks, and on Friday eclipsed the $100 billion mark.

Expensive As Zuck: The mammoth valuation feels even larger when put into context:

- The last U.S. company to go public with a higher valuation was Facebook, at $104 billion.

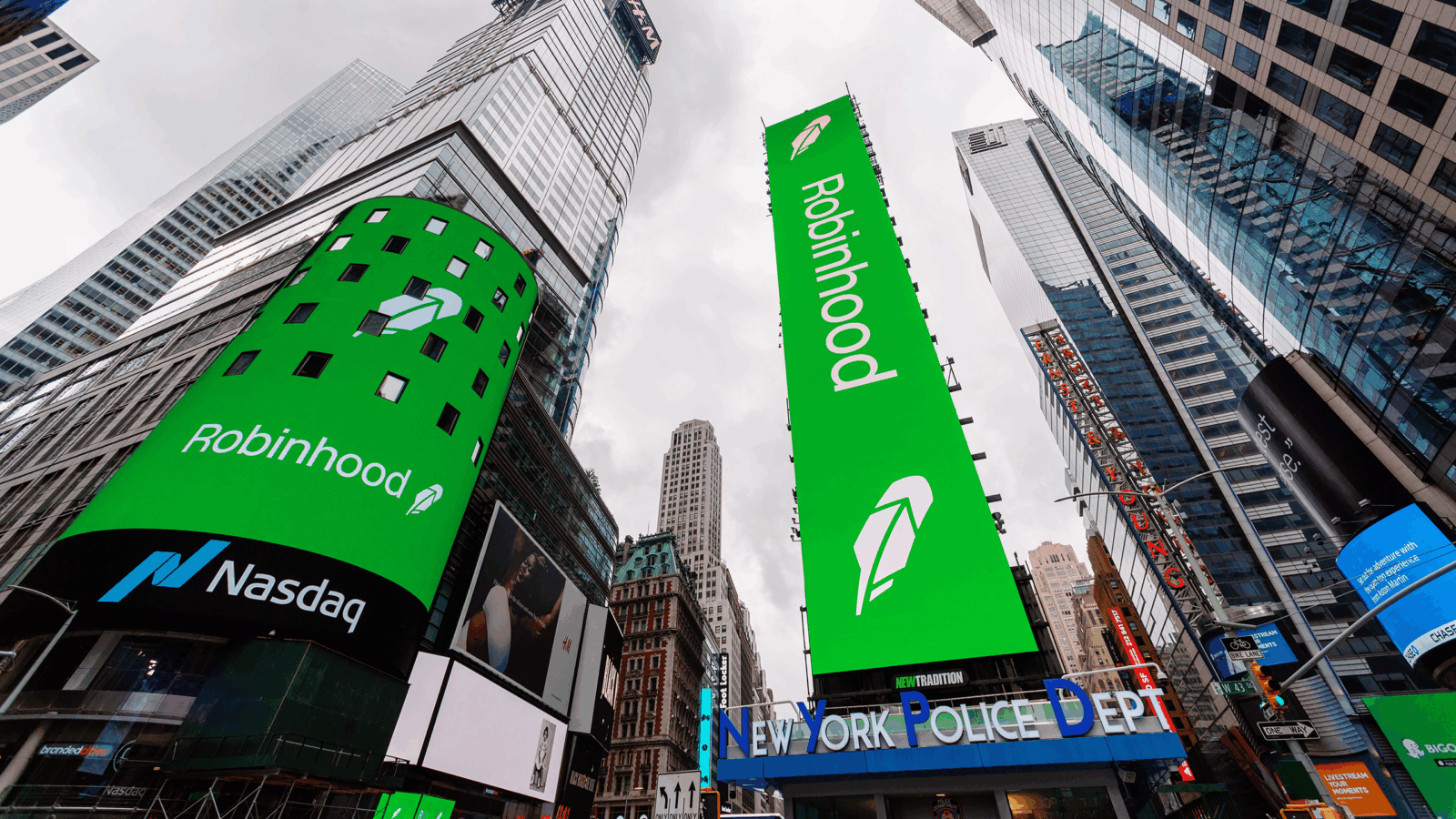

- Nasdaq Inc., the well-known exchange operator, has a market cap of roughly $25 billion. ICE, which owns the NYSE and a large many other prominent exchanges, is worth $64 billion.

the takeaway

No date has been announced for the IPO, but investors are, clearly, clamoring.