Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Yesterday the high-flying, Palo Alto-based auto company made all kinds of headlines.

For starters, Tesla was summoned by Chinese authorities which cited consumer complaints and quality issues with its cars. Filings also revealed that Tesla skipped its matching 401(K) contributions for the third consecutive year.

But Tesla was able to drown-out the negative press with a disclosure it bought $1.5 billion worth of bitcoin.

Pay With Your Other Wallet

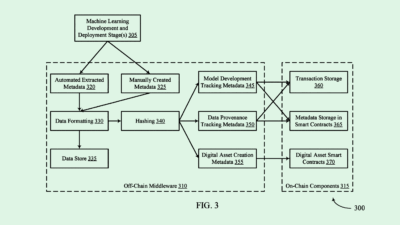

This was big news, but in no way a surprise. Last month the company’s famed CEO changed his Twitter bio to “#bitcoin” and two months ago he tweeted “Bitcoin is my safe word.” Last year Musk called money “Just an entry in a database.”

On top of the $1.5 billion bitcoin down payment, Tesla said it will begin to accept payment in the cryptocurrency.

The announcement did the expected – rocketing bitcoin’s price up 10% to over $43.5k.

The Other Side Of The Coin: Tesla prides itself on offering a smooth ride, but now the world’s most valuable carmaker has its own stable of instability:

- Bitcoin has one of the most volatile trading histories among all asset classes. Bitcoin’s price halved in 2012, 2016, and as recently as May 2020.

Tesla becomes the second-largest corporate holder of bitcoin, trailing only MicroStrategy, which has a $3.1 billion hoard. Well-known proponents include Stripe, which acquired $50 million worth in October, and Massachusetts Mutual Life Insurance, which bought $100 million worth in December.

Crime, Climate, and Uncertainty: While Bitcoin’s value quadrupled last year, Tesla warned that its exposure could add a layer of volatility to future disclosures.

Not to mention, Bitcoin now consumes as much power as a nation of 200 million, and its energy needs have alarmed some climate researchers. It’s also provided a safe haven for hundreds of millions in dirty money laundered through digital wallets, including a $280 million theft of crypto assets from exchange KuCoin in September.

The Takeaway:

There’s a reason Tesla, Square and others have only put a sliver of their assets into crypto.