Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Though cryptocurrency may be a central building block to the decentralized finance movement, its user base is now solidly more institutional than underground.

In 2021, Wall Street upped its crypto investments in a big way, trading $1.4 trillion worth of cryptocurrency on exchange Coinbase Global — a massive increase from just $120 billion in 2020.

Sales From The Crypt

While some critics may still dismiss the average bitcoin buyer as a (possibly basement-dwelling) retail trader, hedge funds, registered investment advisers, and other professional investors are increasingly powering the cryptocurrency market. In fact, a survey of 300 institutional investors conducted by State Street found that over 80% are now allowed to have exposure to the crypto market. (Retail traders are not too shabby, either: they still traded $535 billion worth of crypto in 2021, basement or not).

It’s reached a point where Wall Street is reshaping the crypto market just as much as the crypto market is reshaping Wall Street:

- The most crypto bullish firms also tend to be the largest: funds with assets under management of $500 billion or more have been the most active in the space, and nearly two-thirds have staff dedicated entirely to crypto.

- Gone are the days of crypto as a small, erratic market — institutional investors now largely treat crypto like other risk assets, trading it increasingly in lockstep with tech stocks. In January, bitcoin saw its highest correlation level to the tech-heavy Nasdaq 100 since April 2020, research firm IntoTheBlock told The Wall Street Journal.

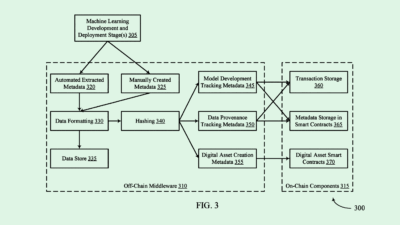

A Bit Derivative: You don’t get Wall Street without secondary and derivative markets. And, so far, crypto hobbyists and retailers have largely steered clear of the more advanced financial products. In Q4 2021, professional investors represented 99% of total trading volume in secondary crypto markets, according to IntoTheBlock.