As Nvidia Reports Earnings, Magnificent Seven Investors Rethink Their Bets

Hedge funds are still all in on the AI boom that drove the Magnificent Seven’s gains, they just think it’s creating value elsewhere now.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

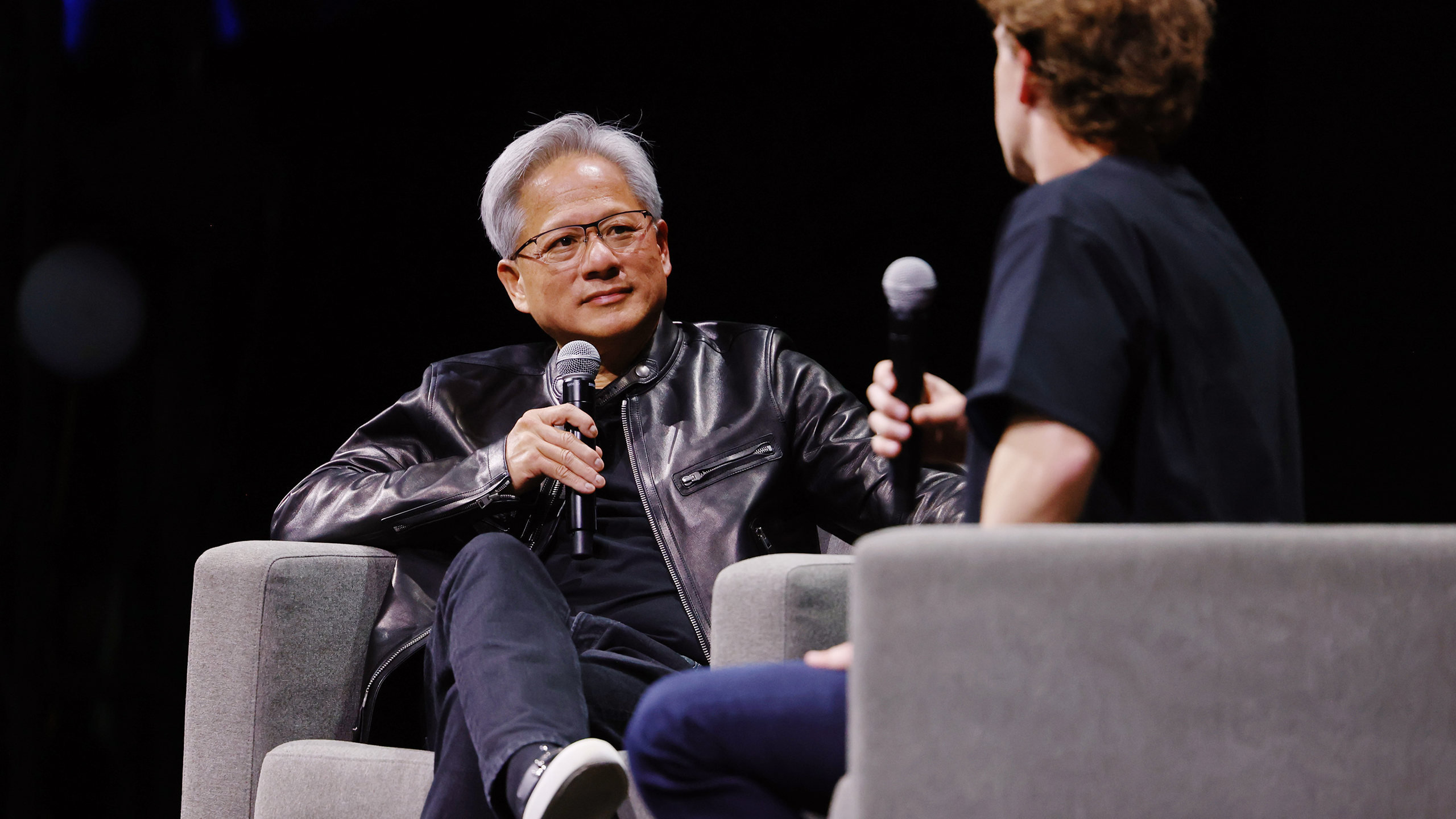

Nvidia’s chips are key drivers behind everything from AI applications at Google and Meta to IT infrastructure in the architecture, engineering, and construction sectors.

Nvidia’s shares, which gained 240% in 2023 and 170% in 2024, were key drivers behind the S&P 500’s strongest back-to-back annual runs since the late 1990s. When the company reports earnings after the bell today, analysts expect everything from “in line” with expectations and a side of “growing pains” (Mizuho) to “good news” (Wedbush). Whether pain or gain, recent Goldman Sachs research shows there’s a richer, longer-term conversation playing out among investors, including hedge funds, about investing after two years of megacap tech prosperity.

Risk Hedging

Nvidia is one of the so-called Magnificent Seven, along with Alphabet, Amazon, Apple, Meta, Microsoft, and Tesla. Together, they accounted for 50% of the S&P 500’s gains last year and hold a roughly 30% weighting in the benchmark index, in part because of the excitement around artificial intelligence breakthroughs.

But a Goldman Sachs analysis of 695 hedge funds with $3.1 trillion in equity positions released last week found that the funds trimmed their positions in all but Tesla in the fourth quarter of 2024. This isn’t a surprise. It’s no secret that a lot of smart people think US equities are overvalued: That’s what an overwhelming 89% of fund managers told Bank of America in its latest monthly Global Fund Manager Survey. That’s the highest since 2001. Indeed, the Magnificent Seven are down 2.9% this year, while the S&P 500 is up a modest 1.5%. That doesn’t mean hedge funds don’t see value to be had:

- Goldman found that hedge funds raised their exposure to health care and communications services companies in the fourth quarter — the former sector has offered a 5% return this year and the latter 9%. Health insurance provider Primerica and electronic trading firm Tradeweb were among the most popular companies for increased hedge fund positions in the fourth quarter.

- While comms services performed well last year — the Morningstar US Communication Services Index rose 39% in 2024 — healthcare stocks are seen as particularly undervalued. The S&P 500 healthcare sector gained only 2% last year, while the Centers for Medicare and Medicaid Service predicts that US health expenditures will hover around 18% to 19% of GDP through 2032.

Riding The Wave: Hedge funds are still all in on the AI boom that drove the Magnificent Seven’s gains, they just think it’s creating value in different places now. According to Goldman, fund managers raised their exposure to “Phase 3” companies, or businesses with AI-enabled revenues, in the fourth quarter. Their top two Phase 3 stocks were Salesforce and ServiceNow, companies that provide IT services and platforms to a wide range of sectors. “AI models are going to be commoditized at a really fast rate, which is a trend that is quite good for platform and application vendors like ServiceNow: The differentiation that AI is going to drive is going to be at the platform and application level, and not at the large language model level,” ServiceNow president and CFO Gina Mastantuono recently told The Daily Upside. “Agentic AI has quickly become part of every conversation. Companies and customers that we’re talking with certainly are realizing that this is a magic moment to shed the weight of their legacy technology and drive exponential efficiency.”