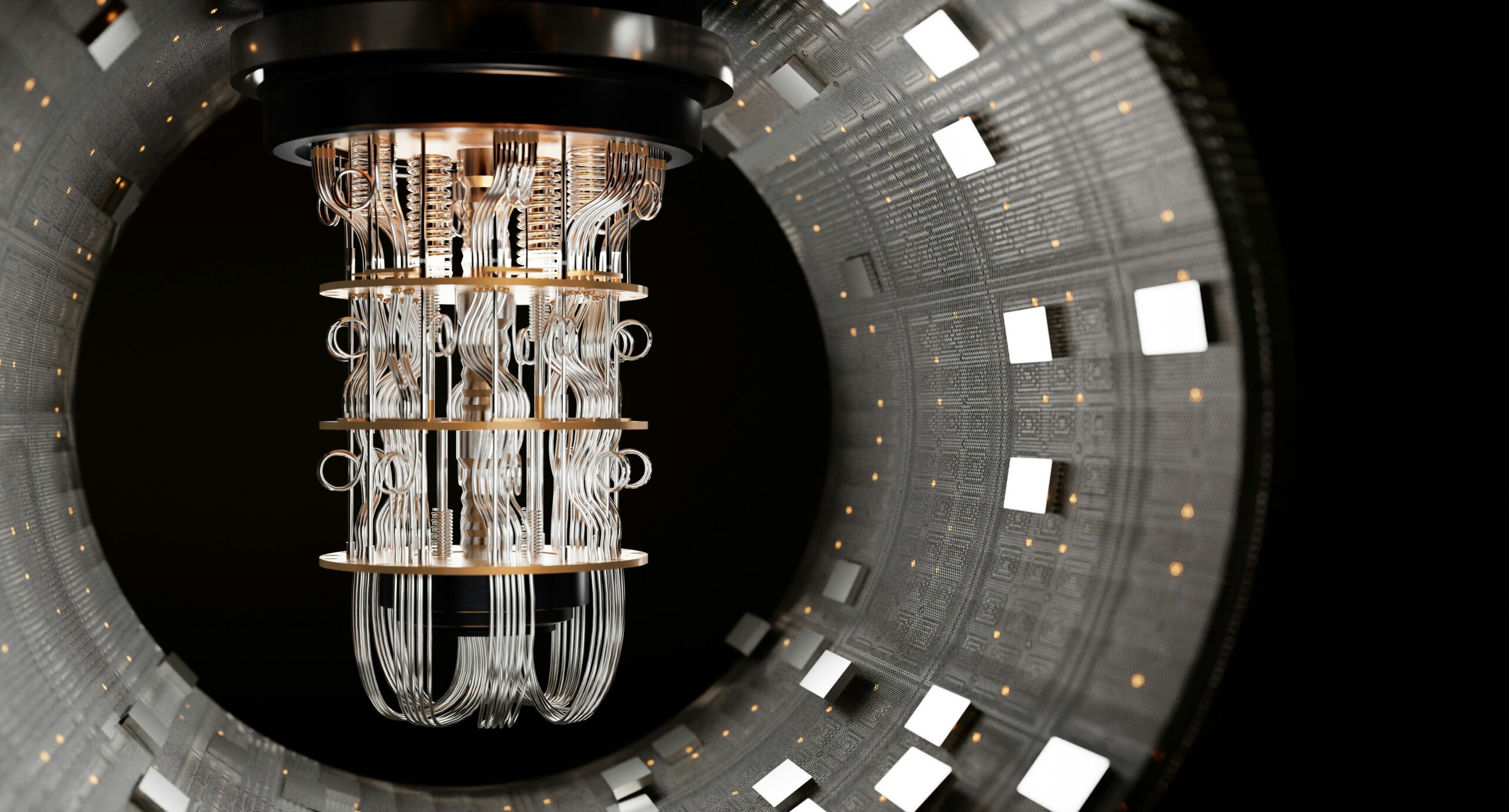

In Quantum Computing Investment, ‘The Race is On’

‘It will require a lot of R&D investment to unlock that potential.’

Sign up to get cutting-edge insights and deep dives into innovation and technology trends impacting CIOs and IT leaders.

The quantum computing market is catching the eyes of Big Tech and investors. Do enterprises need to prepare?

On Monday, quantum computing firm Infleqtion agreed to go public in a merger with Churchill Capital Corp. X, a special public acquisition company, in a deal worth $1.8 billion. Additionally, quantum startup IQM announced last week that it raised $320 million in a round led by Ten Eleven Ventures to ramp up commercializing the tech.

These announcements follow a banner year for the quantum industry, with tech giants like Google, Amazon and Microsoft debuting their own quantum computing chips, and IBM and AMD partnering to develop so-called “quantum-centric supercomputers.”

Despite the excitement, the tech faces a number of roadblocks before it’s ready for the big leagues. However, discussions around quantum development have largely moved from whether quantum is possible at all to how it can scale:

- A lot of the recent movement in the quantum space has likely been spurred by the mad dash toward AI, Scott Likens, global chief AI engineer at PwC, told CIO Upside.

- “Massive AI investments have caused people to look at their compute infrastructure in general,” said Likens. “Quantum has always been that promise of much more computability. AI investments have caused people to start to look outside of traditional compute.”

- Investors also likely recognize the challenge that quantum research and development presents, said Brian Jackson, principal research director at Info-Tech Research Group.

“People understand that it will require a lot of R&D investment to unlock that potential and to transform it into something that could be commercialized technology,” said Jackson. “I think there’s a bit of a sense that the race is on.”

Firms keeping their eye on quantum are playing the “long game,” said Likens. For example, scooping up quantum talent while the market is nascent and strategizing for when the tech is available at scale is “preparing for something that no one does today,” he said.

Some companies may view it as a “brand play,” Jackson noted. “It is about wanting to be the first leading-edge company to bring a quantum advantage to the industry that you’re competing in.”

But quantum’s impact may be felt sooner than later. For example, its potential ability to completely shatter modern encryption practices, also known as “Q-Day,” said Likens, is something that enterprises should be preparing for now.

For businesses looking to stay ahead of the curve, Likens said, now’s the time to brush up on “basic quantum literacy.” That means putting together “pilot projects” for how your enterprise may leverage quantum, especially in industries such as material sciences, logistics and pharmaceuticals that stand to benefit the most from the technology.

“Understand the opportunities for when quantum is available at scale,” he said. “And understand, at the executive level, that this is not something that’s 20 or 30 years away. Moving the timeframe in and knowing the limits of what we have today, we do recommend.”