Intel’s Bad Year Keeps Getting Worse and Worse

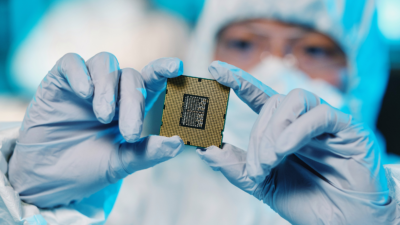

Intel’s contract chipmaking business suffered a major setback after it failed some major initial tests, sources said.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

These should be salad days for chipmakers, but once-dominant Intel is wilting faster than unrefrigerated lettuce.

On Wednesday, Reuters reported that the beleaguered tech giant’s contract chipmaking business suffered a major setback. It’s just the latest crisis facing Intel, whose ongoing struggles threaten not only itself, but also the Biden administration’s ambitious agenda to build a domestic chipmaking industry from the ground up.

Chip It and Rip It

Intel’s share price has plummeted nearly 60% through the first nine months of 2024, making it one of the worst-performing stocks on the S&P 500. Lip-Bu Tan, a high-profile semiconductor industry veteran, left Intel’s board recently over disagreements with CEO Pat Gelsinger and what Tan considered to be a bloated US workforce, weak AI strategy, and overall risk-averse culture, sources told Reuters in a separate report published last week. And SoftBank walked away from talks with Intel to develop an AI chip to rival Nvidia after growing disappointed with Intel’s capabilities, sources told the Financial Times in August.

On Wednesday, Reuters revealed another unhappy customer: chipmaker Broadcom, whose plan to outsource manufacturing to Intel is in jeopardy after Intel failed some major initial tests, sources said. The disappointment puts a spotlight on Intel’s new 18A manufacturing process, which was supposed to serve as the high-powered bedrock to the company’s contract chipmaking unit.

After posting a $1.6 billion net loss in its most recent quarter, Intel announced a $10 billion cost-cutting initiative that included layoffs of up to 15% of staff, or some 19,000 employees. And all this is taking place amid what could be a historic windfall courtesy of the Biden administration:

- Intel is set to be the recipient of up to $8.5 billion in government grants and another $11 billion in loans, making it the biggest beneficiary of the 2022 Chips and Science Act — though it has to clear key benchmarks and tests first.

- According to a Bloomberg report Wednesday, however, the firm has struggled to satisfy the government’s due diligence process, and has even resisted sharing requested pieces of information. Go ahead and count Joe Biden as yet another disappointed Intel partner.

Split Wise: Layoffs may be just the beginning of Intel’s make-good efforts. According to another Bloomberg report on Wednesday, the firm has engaged investment bankers for advice on various restructuring plans — including discussions to potentially spin off the very same contract foundry business that failed Broadcom. The idea has at least one fan: influential tech analyst Ben Thompson, who made the case for the spinoff in a lengthy edition of popular newsletter Stratechery on Tuesday.