TSMC Shrugs Off Shrinking Chinese Market Share

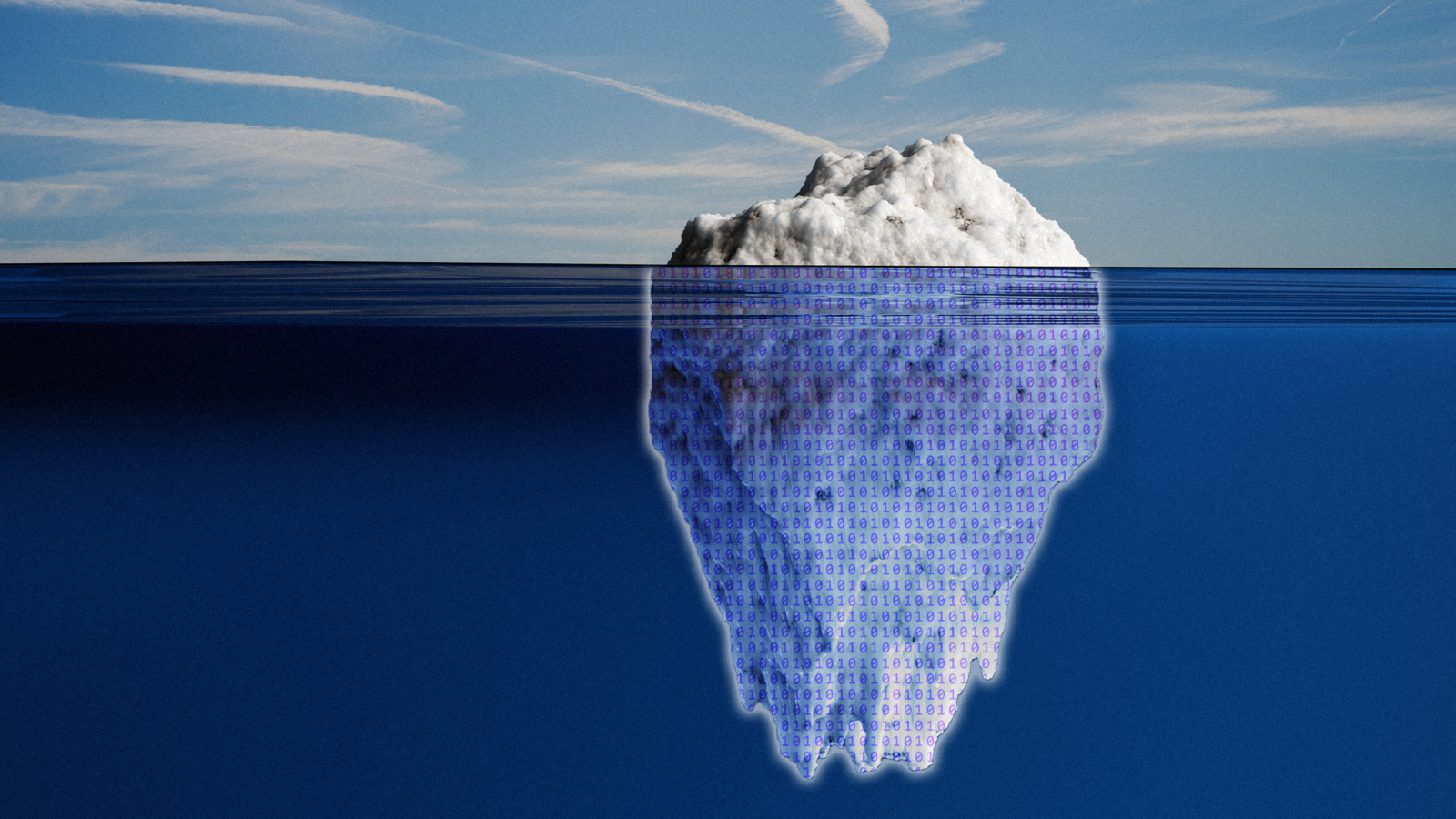

The company still makes more than 90% of the world’s most advanced AI chips and is a leading supplier for nearly every major tech firm.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Fears of an AI bubble may be pervasive, but TSMC’s “No China? No Problem” attitude provides a strong counterargument.

In its blockbuster earnings call on Thursday, the world’s premier chip fab argued that there’s more than enough demand for AI-powering chips around the world to offset the potential loss of clients in the increasingly cordoned-off Chinese market. In fact, demand for the company’s chip-making expertise has been so strong that it raised its 2025 outlook for the second quarter in a row.

Fab-ulous Results

Saying that the entire AI industry, sans China, is “more than enough” for TSMC is likely underselling it. The company still makes more than 90% of the world’s most advanced AI chips and is a leading supplier for nearly every major tech firm, which means it finds itself firmly at the center of the roughly $1 trillion spending boom planned for AI infrastructure around the globe in the coming years. In its third quarter, that spending boom manifested in revenue of $32.8 billion, a 30% year-over-year increase, and net income of $14.8 billion, an expectations-beating jump of 39% year over year.

The robust results come as US trade restrictions have effectively blocked TSMC from selling advanced chips to China all year, and those barriers are only increasing. In early September, the US government revoked TSMC’s authorization to ship to its chipmaking site in Nanjing, China. (One downstream effect: The Wall Street Journal reported in August that Alibaba has begun producing new AI chips by relying on a new and unnamed Chinese company whose tech is catching up to TSMC.) Still, TSMC stressed on Thursday that the trade tensions are hardly even registering as a headache:

- During the earnings call, the company projected revenue growth for 2025 to be in the middle range of 30% to 40%, up from its earlier projections of 30%. AI-related revenue is expected to double in 2025, and CEO C.C. Wei predicted it will grow at a rate exceeding 40% in the next few years, even with limited access to the Chinese market.

- TSMC has never been especially reliant on mainland sales, anyhow. China accounted for 8% of its net revenue in the most recent quarter, compared with a pre-trade war norm of around 11% per quarter; its Nanjing manufacturing base accounts for just 3% of its total manufacturing capacity.

Made in the USA: Still, the trade wars are reshaping the company in other ways. TSMC pledged some $100 billion earlier this year to increase manufacturing capacity in Arizona, and it’s also making investments in Japan and Germany. It plans to begin mass production of advanced chips in Arizona this year, though to what extent remains an open question. US Commerce Secretary Howard Lutnick posited last month that half of TSMC’s production could soon occur in the US — a suggestion that Taiwan government officials promptly shot down. In other words: Virtually all AI roads still lead to the Taiwan Semiconductor Manufacturing Company. Whether they will always lead to Taiwan itself is another question.