How Low Can You Go? Vanguard Slashes Fees on 87 Funds

The asset manager said the largest price reduction in its history could save investors more than $350 million this year alone.

Sign up for market insights, wealth management practice essentials and industry updates.

As prices rise on everything from housing to a hot cup of Joe, it’s refreshing to at least see investing fees getting slashed.

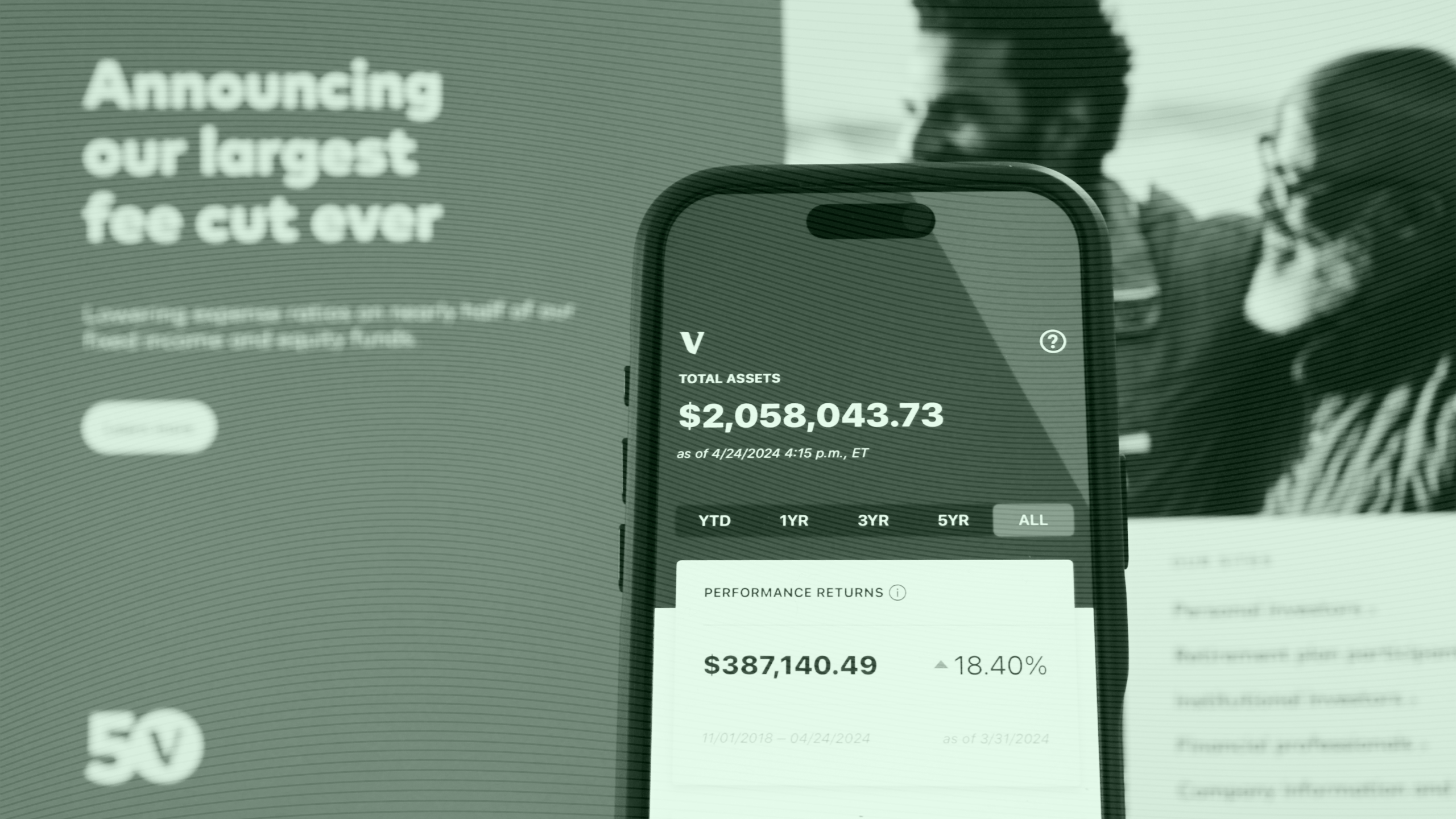

Vanguard, well known for its affordable products, has doubled down on cost by cutting expense ratios on dozens of its mutual fund and ETF share classes. The largest fee reduction in the asset manager’s 50-year history is expected to save investors more than $350 million this year alone, the company said. With Vanguard shaving prices, the pressure is on for competitors to do the same. “Lower costs enable investors to keep more of their returns, and those savings compound over time,” Vanguard CEO Salim Ramji said in a release.

Bond, James Bond

Vanguard will lower fees on 168 mutual fund and ETF share classes across 87 funds with an average reduction of about 20%. Prices for its fixed income products were also lowered. “Bonds are poised to play a crucial role in investors’ portfolios going forward,” company CIO Greg Davis said in the release. He expects bond yields to settle at levels higher than those seen over the past 15 years, meaning fixed income could play a larger role in client portfolios:

- Today, 86% of Vanguard mutual fund and ETF assets are in the lowest-cost decile of their Morningstar categories, the company said.

- Vanguard’s fixed-income ETFs now have an average expense ratio of just four basis points. The company’s equity index ETFs charge roughly five basis points.

Another notable fund getting a trim is Vanguard’s S&P 500 Growth ETF, which holds growth stocks in the Magnificent 7 and will see its expense ratio drop from 10 basis points to just seven.

Race to the Bottom? The price chopping is Vanguard’s latest move in an ever-raging fee war among asset managers. State Street cut fees on 10 of its core ETFs in 2023 and Fidelity trimmed prices on one of its high-yield ETFs in November.

Over the last two decades, the average fee paid by fund investors has more than halved — from 0.87% in 2004 to 0.36% in 2023, according to Morningstar. However, fees have begun to decline at slower rates starting in 2023. Looks like Vanguard is bucking trends yet again.