What Does the Fed’s Rate Cut Mean for Clients?

Many advisors say the move isn’t enough to significantly change strategies.

Sign up for market insights, wealth management practice essentials and industry updates.

It’s not a deep slice, more like a scratch.

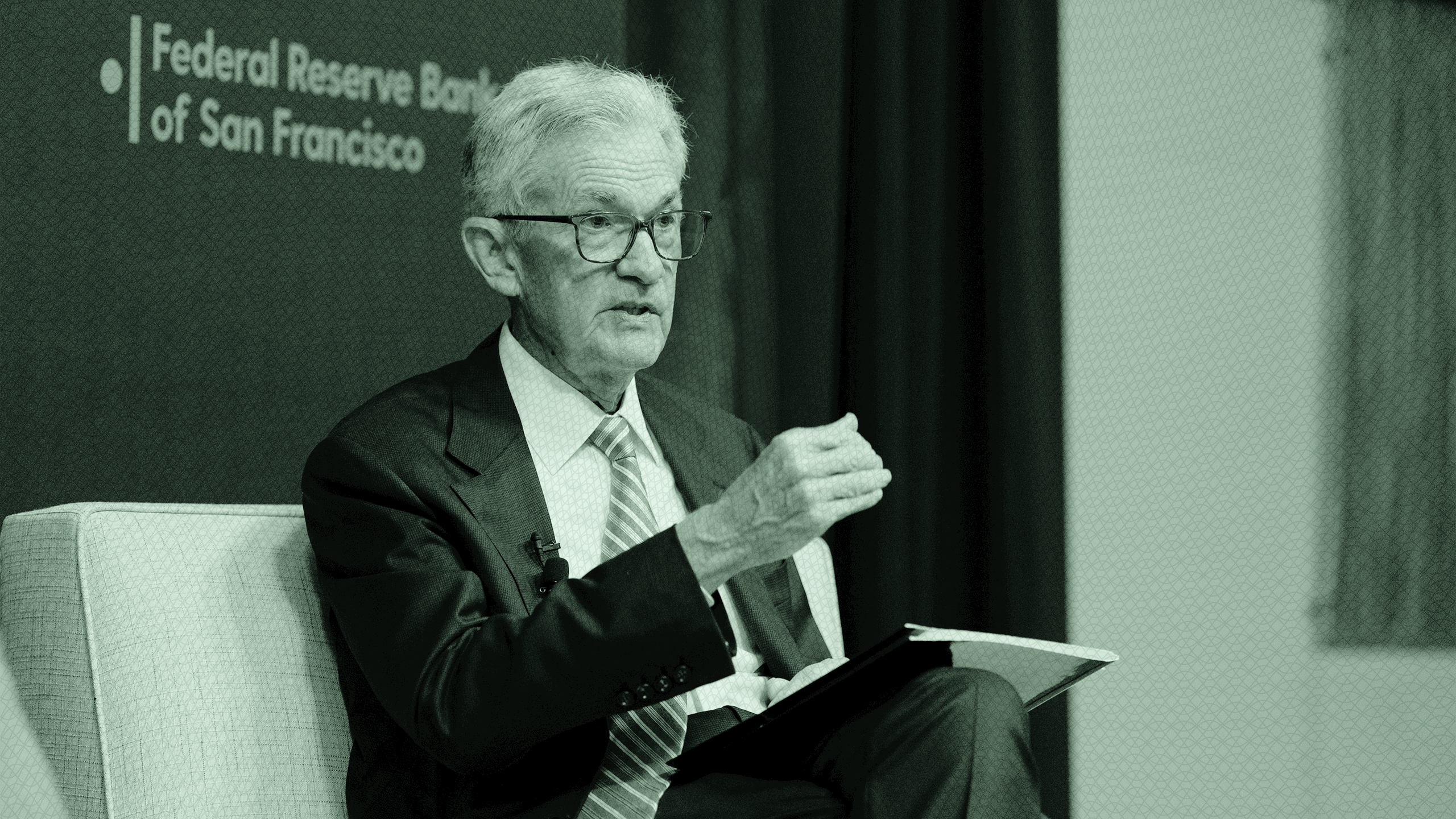

Interest rate cuts are something many Americans have long advocated for, especially President Donald Trump, and economists say they may open up new opportunities in the bond, housing and job markets. On Wednesday, nearly a year after the Federal Reserve last lowered rates, the central bank approved another 25 basis-point reduction, prompted partly by weak July and August jobs reports. The effective federal funds rate now sits between 4% and 4.25%, but advisors say it isn’t enough of a shift to warrant significant changes to portfolios or strategies.

“I caution against people treating things as black-and-white certainties, as well as over-connecting the dots between what the Fed does and how the market reacts,” said Peter Lazoroff, CIO at Plancorp Wealth Management.

Settle Down

Not everyone sees the Fed as infallible. Stabilizing the economy is complex, and the Fed relies on limited methods and backward-looking data, said Bill Mann, chief investment strategist at Motley Fool Asset Management. “We tend to think of the Fed as a heart surgeon,” he told Advisor Upside. “It’s not: They’ve got a hammer. They’re shoving money into the market or retracting it. When they go into the system, they need to be ahead of the curve.”

Advisors also stress that sound financial plans already account for countless what-ifs from downturns to career changes. A rate cut just isn’t enough to warrant major adjustments. “We aren’t making wholesale shifts in portfolio strategy but rather keeping the focus on long-term allocations, instead of trading around the Fed’s moves,” said Kate Feeney, VP at Summit Place Financial Advisors.

On Golden Bond

Lower rates often lift bond returns, but much depends on broader market forces, not just the Fed, Lazaroff said. “If you place too much of your fixed-income strategy on one input like Fed policy, you’re going to get burned,” he said. That’s why he favors actively managed, core bond strategies. “You’re not stuck playing in one corner of a huge market,” he said.

Home, Sweet Home. Rate cuts can also bring down mortgage costs. Presidio Advisors founder Josh Radman said many millennial clients see this as a chance to buy their first home. “These are huge decisions, but the rate cut could be the green light to take buying a house off the back burner,” he told Advisor Upside.

However, affordability remains a major question, and clients still need to consider deeply whether they have enough green for that lawn and white picket fence. “Over the past couple of years — especially in expensive cities like San Francisco, New York and Denver — the cost of renting has been dramatically lower than the cost of purchasing,” Radman said.

Additional reporting by Sean Allocca.