Think Equity Investing Can’t Be Risk Free? Think Again

It’s not impossible to get much of the upside of stocks without the downside. (Of course, there’s a caveat.)

Sign up for market insights, wealth management practice essentials and industry updates.

Want to earn much of the upside of the stock market without any risk?

Sounds impossible, but it isn’t, and we’re not talking about an equity-indexed annuity (rebranded as a fixed indexed annuity). It’s actually quite simple and can be done with ultra-low fees and high tax-efficiency. Here are two ways, and both involve buying a single Treasury Bond and investing in a stock index fund. Let’s take a $100,000 portfolio as an example, and a long investment horizon of 20 years.

Away we go.

Nominal Risk-Free Return

We start with a zero-coupon Treasury bond, which is hopefully risk-free. It pays no coupon income, and the entire return comes at maturity. The current yield of a 20-year, zero-coupon bond as of Dec. 31, 2025, is 5.09%. Buying about $37,049 of this bond will result in receiving $100,000 when the bond matures. That leaves about $62,951 to go into equities, such as a low-cost diversified stock index fund. This translates to about 63% equity and 37% fixed income allocation. Even if the stock market lost all of its value, the investor would get back the original $100,000.

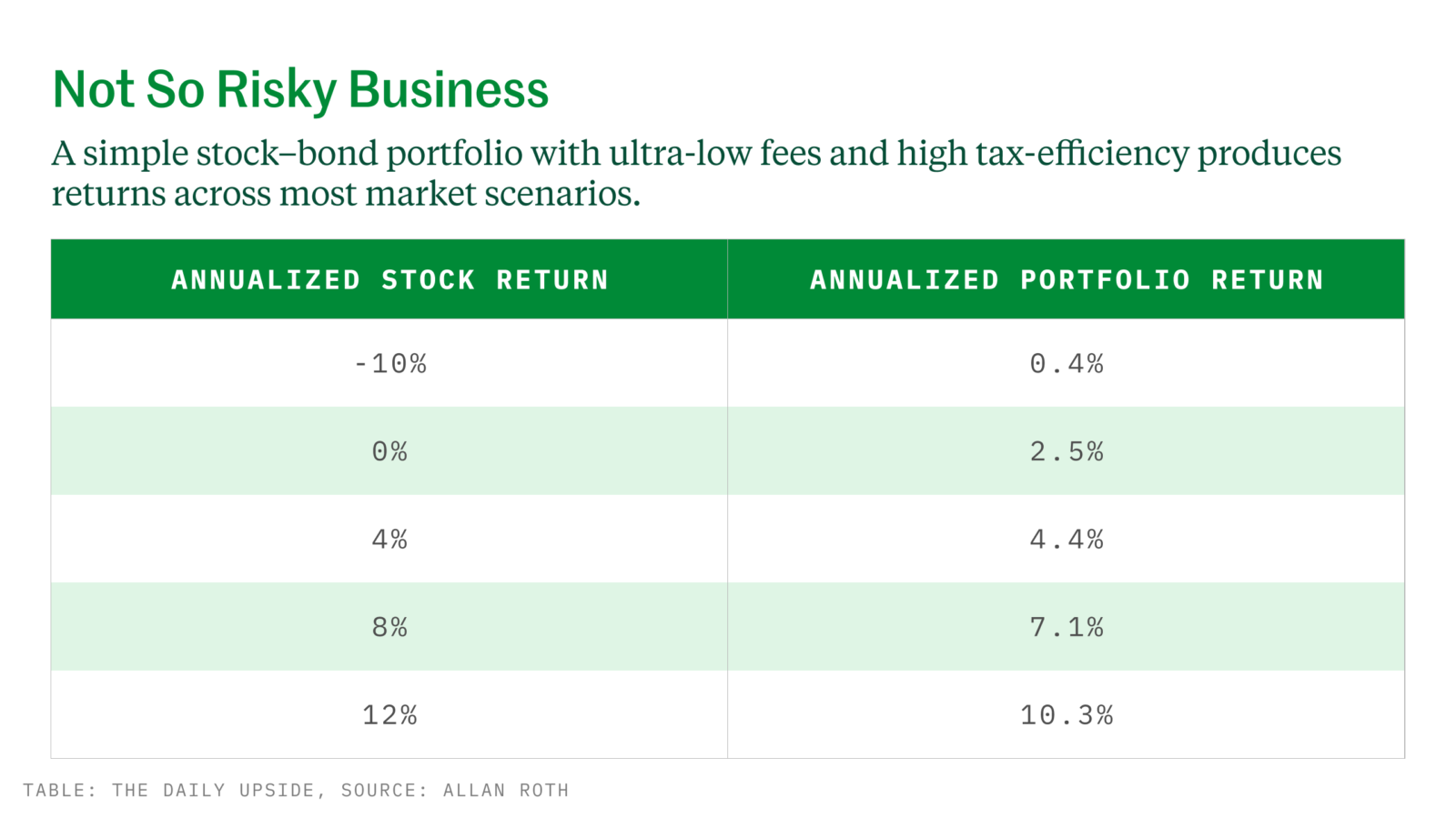

A 100% loss in a broad stock market index essentially means capitalism has failed (and I’m not sure the government would survive, either.) Even the so-called lost decade in the beginning of this century had about a 0% return. Below is a chart showing the return of this stock and bond portfolio, depending on how stocks perform. A catastrophic 10% annual loss still results in a positive return. Even an 8% annualized stock return results in a total portfolio return of 7.1% annually. And a 12% annual return gets a double-digit return, without risk. By comparison, Morningstar shows a 10-year annualized return on the Vanguard Total Stock Index Fund (VTI) of 14.36% as of Dec. 22, 2025, so it’s quite possible to get a double-digit return with this risk-free strategy.

Of course, this only guarantees a nominal risk-free return and not a real positive return after inflation. Should stocks have another lost decade with a zero return, the 2.5% nominal return of the portfolio would be negative if inflation is higher than the 2.5%. In other words, spending power would decrease.

Real Risk-Free Return

Nobody knows future inflation (and I must admit the government’s lack of financial discipline and the spiraling deficit and debt concern me.) An 8% annualized stock return is bad if inflation comes in at 10%. That’s where Treasury Inflation Protected Securities come into play. Using the same $100,000 portfolio and 20-year time period, one can buy a single 20-year TIPS yielding 2.57% plus inflation. An investment of $60,235 in the single TIPS will mature at an inflation-adjusted $100,000 in 20 years. That leaves $39,765 to go to the stock index fund. That’s almost a 40% stock portfolio.

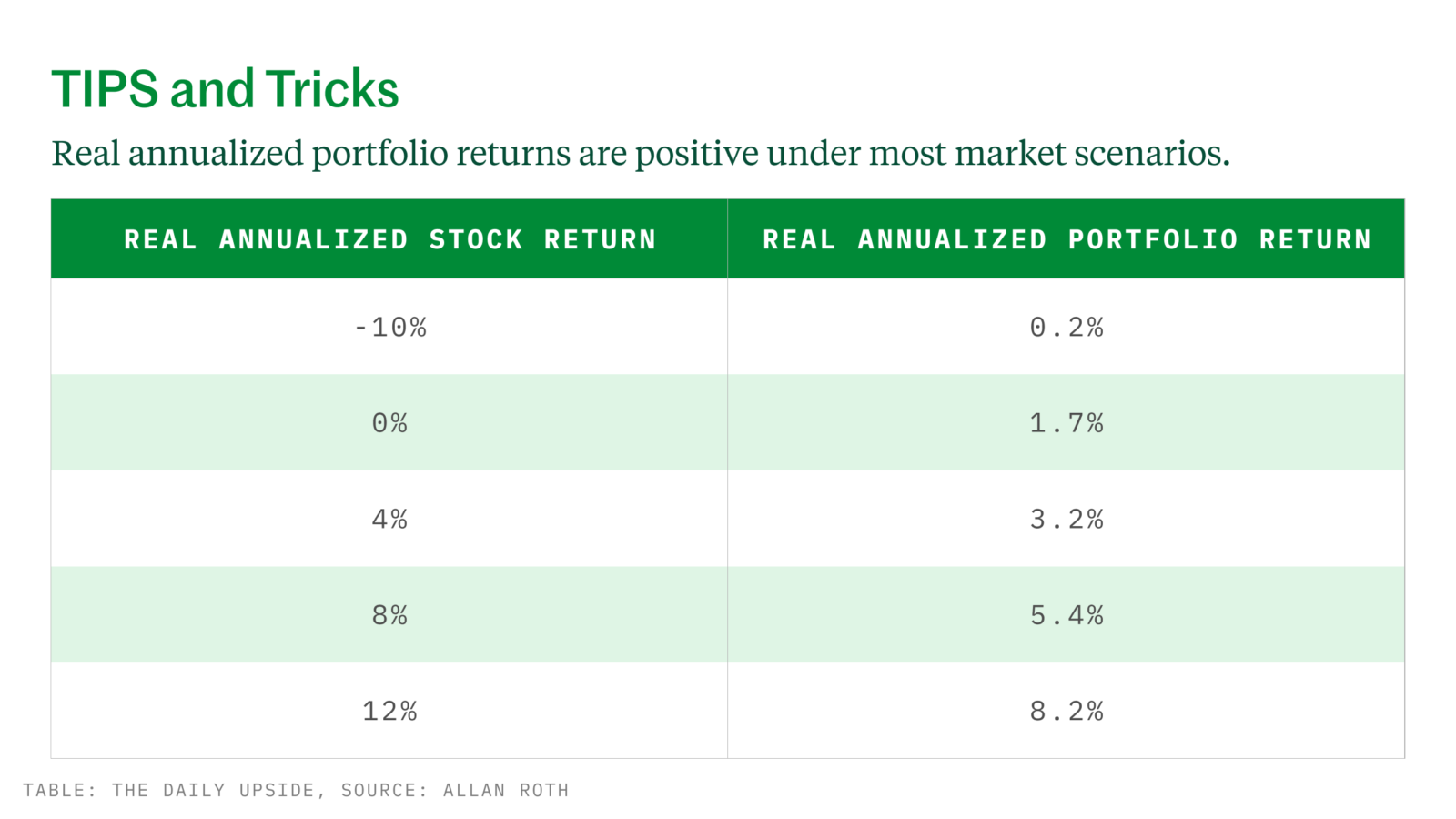

I ran the numbers in the chart below. This time, the stock returns are in real, inflation-adjusted dollars. If stocks only keep up with inflation, the portfolio still beats inflation by 1.7% annually. If stocks outpace inflation by the historic average of about 8% annually, the investor captures the majority at a 5.4% real annualized return.

Close to Risk Free

While these strategies are brilliantly simple, the claim that they are 100% risk-free isn’t true. There are two caveats: reinvestment risk and taxes. The nominal strategy has no reinvestment risk because the zero-coupon bond pays no dividends, and it’s easy to set up automatic reinvestment in the stock index fund. But the real strategy involving TIPS does pay a 1% coupon. That coupon would have to be reinvested at the same 2.57% real rate available now. Rates could change, though this is a relatively small amount and would likely not have a huge impact.

The larger issue is taxes. Since we are taxed based on nominal returns, high inflation could result in more taxes, resulting in the loss of spending power.

Fly In the Ointment

Tax risk can be mitigated as well, however. One could buy the bond (zero coupon or TIPS) in the tax-deferred account and the stock index fund in the taxable account. Unlike a fixed indexed annuity, much of the return from the stock index fund is taxed as a long-term capital gain and qualified dividends rate rather than ordinary income. While unlikely, one could still have a real inflation-adjusted loss after paying taxes.

While the math of buying a bond that will mature at a known rate is easy to understand, the real brilliance is emotions, namely the fact that the investor is more likely to stay the course if they know they will get their money back. That means they can’t lose, no matter how bleak market returns are and no matter how awful the news is. The higher bond interest rates are (both nominal and real) and the longer the investment horizon, the better this strategy works.

For many years, I’ve only dreamed of having wealth without risk. But now it’s a reality, at least before taxes.