Want to Attract Top Talent? Try These Comp Perks

Firms are offering extra incentives to advisor compensation plans like paid time off for volunteer work, and even free financial planning.

Sign up for market insights, wealth management practice essentials and industry updates.

How about two extra weeks of paid vacation time?

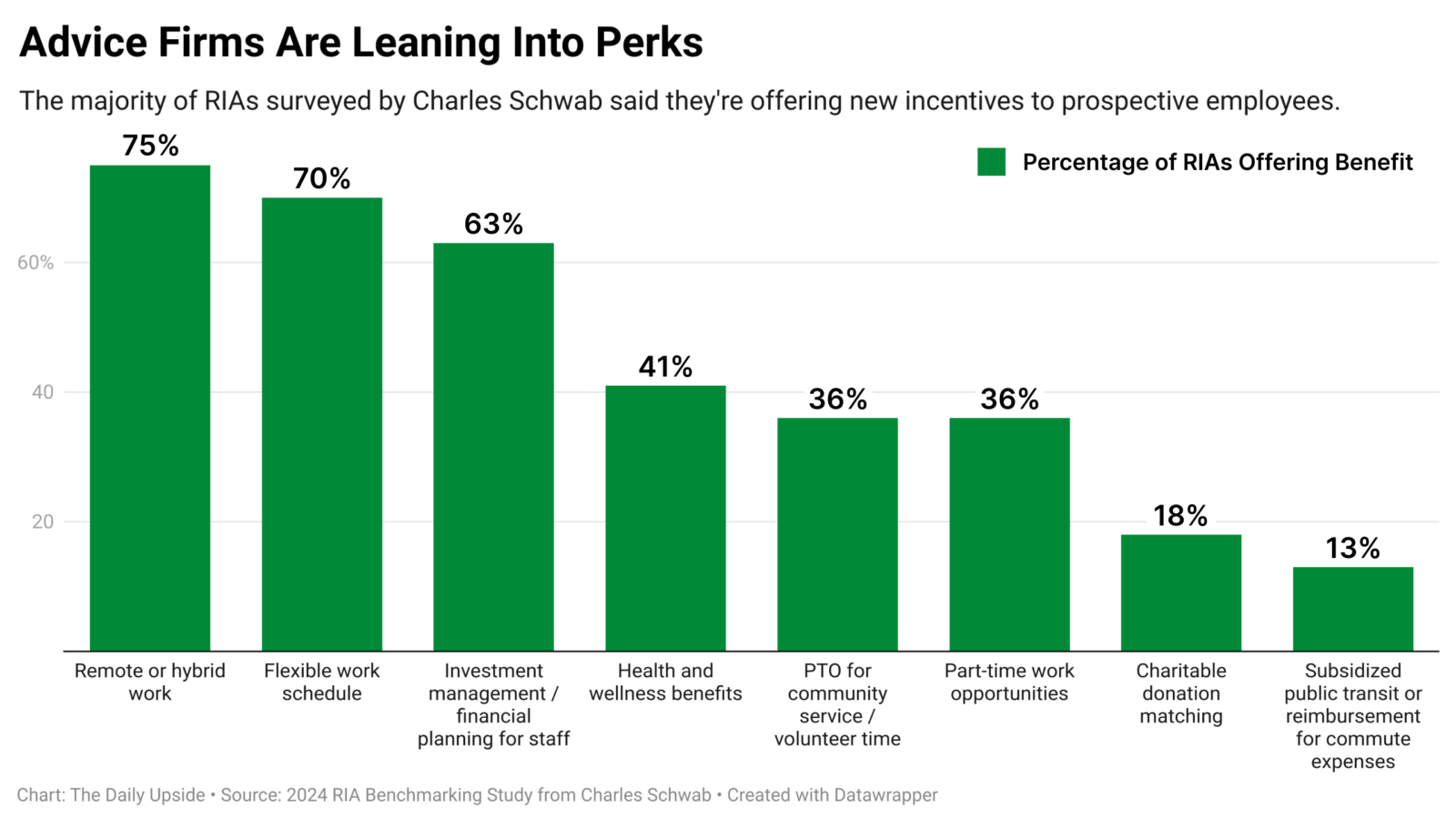

In a race to attract the best talent possible, advisory firms are offering extra perks like equity ownership, health and wellness programs, paid time off for volunteer work or charitable donation matches, and even free financial planning for employees. While three quarters of firms offered remote or hybrid options this year, some 68% of the best performing firms also offered nontraditional benefits, according to Schwab’s 2024 Compensation Report. It’s the latest tactic firms are rolling out to reel in the industry’s best talent.

“Non-traditional benefits can be a competitive advantage,” said Lisa Salvi, head of business consulting at Schwab Advisor Services. “Companies can foster employee engagement and ultimately position themselves as employers of choice in an increasingly competitive job market.”

Can I Get Some?

The new advisor compensation plans are addressing a problem for the RIA industry: a major talent shortage. Firms will have to hire more than 70,000 new employees over the next five years to keep up with demand for financial advice, according to an accompanying Schwab report. It’s driving firms to look beyond traditional comp packages. “Many [firms] are being more intentional,” Salvi told The Daily Upside.

Equity ownership is also emerging as a top strategy for talent retention. Now about 1 in 3 staff members surveyed own equity, according to Salvi. Other advisor compensation perks include access to a range of discounted services for physical wellness, like gym memberships, and mental health services. The report also found:

- Some 36% of advisory firms gave employees extra vacation days for community service and volunteer time.

- More than 4 in 10 firms offer a health and wellness benefits program.

- Just 13% offered subsidized public transit plans or reimbursement for commute expenses.

Family First. Alie Cowley, human resources manager at Bogart Wealth, says nontraditional incentives don’t just benefit employees. Bogart Wealth offers two weeks of family leave per year, in addition to standard vacation days, that employees generally use in case of children who become ill at the last minute or when caring for an elderly parent. It gives them extra cushion so they don’t have to miss out on a family vacation, because they used days on child care.

Since the company introduced the program, employee production has also ticked up. More production from top advisors definitely impacts the firm’s bottom line, she said. “Family leave has been an absolute game-changer,” she said.