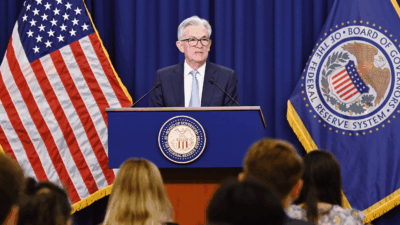

Fed Keeps Interest Rates Steady Amid Solid Job Growth

The central bank held the funds rate at 5.25% to 5.5%, citing a “lack of further progress toward the Committee’s 2% inflation objective.”

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

The US labor market continues to deliver better-than-expected job and wage growth, which is great for working stiffs but is keeping inflation elevated and interest rates at a 23-year high.

To practically nobody’s surprise on Wednesday, the Fed once again left rates alone.

The Cost of Inflation

When prices start accelerating, the Federal Reserve can increase the cost of borrowing, making it more expensive for consumers to acquire loans for a home or a car — or for businesses to borrow for investing in expansion. The idea is to weaken demand and purchasing power to make prices drop. The real trick is slowing the economy while just avoiding a recession — that oh-so-coveted “soft landing.”

So far, no such luck. Inflation reached an annual rate of 4.4% in the first three months of the year, well above the Fed’s target of 2%. And it’s harder to get prices to drop if the labor market continues to grow, wages increase, and the overall economy keeps expanding like it has been in the US:

- Private companies added 192,000 workers to their payrolls in April, according to ADP, beating the median estimate in a Bloomberg survey of economists. Additionally, the Employment Cost Index — a broad gauge of US labor costs — increased by 1.2% in the first quarter. The Labor Department will release its official jobs report for April on Friday.

- On Wednesday, the Fed maintained the funds rate at 5.25% to 5.5%, citing a “lack of further progress toward the Committee’s 2% inflation objective.”

Keep Waiting: In a column for Bloomberg, Jonathon Levine said that while higher wages can delay rate cuts, it’s still more money in people’s pockets. “First and foremost, they’re a clear positive for American workers trying to maintain their purchasing power,” he said. “For inflation, they’re probably a neutral development in the medium term. But in a world in which Fed policymakers were already on edge about stalling disinflation, they’re clearly not great for the near-term interest rate outlook.”

Wage gains and resilient consumer spending are good, but it’s also why financial markets and experts have pushed back their expectations of a Fed rate cut to September from June. And to think only a few months ago we really thought six cuts were coming this year.